3M 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

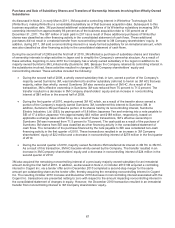

Under the terms of the floating rate notes due in 2027, 2040, and 2041, holders have put options that commence ten

years after the date of issuance and each third anniversary thereafter until final maturity. 3M would be required to

repurchase these securities at various prices, ranging from 99 percent to 100 percent of par value according to the

redemption schedules for each security. In 2011, 2010, 2009 and 2008, 3M was required to repurchase an

immaterial amount of principal on the aforementioned floating rate notes.

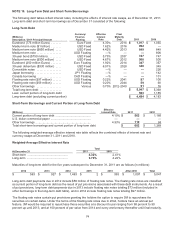

Significant borrowings that were partially or fully repaid in 2011 included the $800 million medium-term note, the final

redemption of Convertible Notes, the remaining portion of the 17.4 billion Japanese Yen loan, and the remaining

portion of the $201 million Canadian Dollar loan. The primary borrowing in 2011 related to the five-year $1 billion

fixed rate note debt issuance in September 2011. Additional details on the Japanese Yen loan, Canadian loan,

Convertible Notes redemption, and $1 billion debt issuance follow.

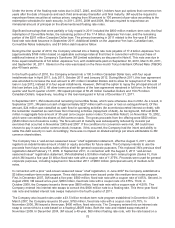

During the first quarter of 2010, the Company entered into a floating rate note payable of 17.4 billion Japanese Yen

(approximately $188 million based on applicable exchange rates at that time) in connection with the purchase of

additional interest in the Company’s Sumitomo 3M Limited subsidiary as discussed in Note 6. This note was due in

three equal installments of 5.8 billion Japanese Yen, with installments paid on September 30, 2010, March 30, 2011,

and September 30, 2011. Interest on the note was based on the three-month Tokyo Interbank Offered Rate (TIBOR)

plus 40 basis points.

In the fourth quarter of 2010, the Company entered into a 100.5 million Canadian Dollar loan, with four equal

installments due in April 2011, July 2011, October 2011 and January 2012. During March 2011, this loan agreement

was amended to increase the loan amount to 201 million Canadian Dollars and to allow for repayment of the total

loan in July 2012, instead of in four equal installments. However, 3M had the option to repay the principal amount of

this loan before July 2012. All other terms and conditions of the loan agreement remained in full force. In the third

quarter and fourth quarter of 2011, 3M repaid principal of 50.25 million Canadian Dollars and 150.75 million

Canadian Dollars, respectively, resulting in this loan being paid in full as of December 31, 2011.

In September 2011, 3M redeemed all remaining Convertible Notes, which were otherwise due in 2032. As a result, in

September 2011, 3M paid out cash of approximately $227 million (with no gain or loss on extinguishment). Of this

amount, $24 million was classified as cash flow for operating activities (for accretion/accreted interest on debt), with

the remainder classified as cash flows from financing activities (repayment of debt). As background, 3M sold $639

million in aggregate face amount of 30-year zero-coupon senior notes (“Convertible Notes”) on November 15, 2002,

which were convertible into shares of 3M common stock. The gross proceeds from the offering were $550 million

($540 million net of issuance costs). The face amount at maturity was subsequently reduced by investor put

exercises that occurred in November 2005 and 2007. If the conditions for conversion were met, 3M could have

chosen to pay in cash and/or common stock; however, if this occurred, the Company had the intent and ability to

settle this debt security in cash. Accordingly, there was no impact on diluted earnings per share attributable to 3M

common shareholders.

The Company has a “well-known seasoned issuer” shelf registration statement, effective August 5, 2011, which

registers an indeterminate amount of debt or equity securities for future sales. The Company intends to use the

proceeds from future securities sales off this shelf for general corporate purposes. This replaced 3M’s previous shelf

registration dated February 17, 2009. In September 2011, in connection with the August 5, 2011 “well-known

seasoned issuer” registration statement, 3M established a $3 billion medium-term notes program (Series F), from

which 3M issued a five-year $1 billion fixed rate note with a coupon rate of 1.375%. Proceeds were used for general

corporate purposes, including repayment in November 2011 of $800 million (principal amount) of medium-term

notes.

In connection with a prior “well-known seasoned issuer” shelf registration, in June 2007 the Company established a

$3 billion medium-term notes program. Three debt securities were issued under this medium-term notes program.

First, in December 2007, 3M issued a five-year, $500 million, fixed rate note with a coupon rate of 4.65%. Second, in

August 2008, 3M issued a five-year, $850 million, fixed rate note with a coupon rate of 4.375%. Third, in

October 2008, the Company issued a three-year $800 million, fixed rate note with a coupon rate of 4.50%. The

Company entered into interest rate swaps to convert this $800 million note to a floating rate. This three-year fixed

rate note and related interest rate swaps matured in the fourth quarter of 2011.

The Company also issued notes under a $1.5 billion medium-term note program established in December 2003. In

March 2007, the Company issued a 30-year, $750 million, fixed rate note with a coupon rate of 5.70%. In

November 2006, 3M issued a three-year, $400 million, fixed rate note. The Company entered into an interest rate

swap to convert this to a rate based on a floating LIBOR index. Both the note and related swap matured in

November 2009. In December 2004, 3M issued a 40-year, $60 million floating rate note, with the rate based on a