3M 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

combined index (defined as quarterly net sales — fourth quarter at year-end — multiplied by four, divided by ending

net accounts receivable plus inventory less accounts payable) was 5.0 at December 31, 2011, a decline from 5.3 at

December 31, 2010. Receivables increased $252 million, or 7.0 percent, compared with December 31, 2010, with

higher December 2011 sales compared to December 2010 sales contributing to this increase. In addition,

acquisitions increased accounts receivable by $106 million and currency translation decreased accounts receivable

by $59 million. Inventories increased $261 million, or 8.3 percent, compared with December 31, 2010. The inventory

increases are partially attributable to the increase in demand in 2011. In addition, acquisitions increased inventories

by $128 million year-on-year, while currency translation decreased inventories by $18 million. Accounts payable

decreased $19 million compared with December 31, 2010. Acquisitions increased the accounts payable balance by

$68 million, while currency translation decreased accounts payable by $5 million.

Cash flows from operating, investing and financing activities are provided in the tables that follow. Individual amounts

in the Consolidated Statement of Cash Flows exclude the effects of acquisitions, divestitures and exchange rate

impacts on cash and cash equivalents, which are presented separately in the cash flows. Thus, the amounts

presented in the following operating, investing and financing activities tables reflect changes in balances from period

to period adjusted for these effects.

The Company revised the amounts previously presented for cash used in investing activities and cash used in

financing activities during 2010 by $63 million. This revision related to purchases of additional shares (noncontrolling

interest) of non-wholly owned consolidated subsidiaries. These immaterial revisions increased cash used in financing

activities and decreased cash used in investing activities.

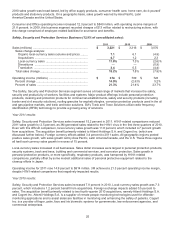

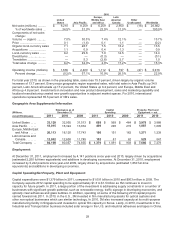

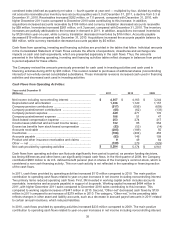

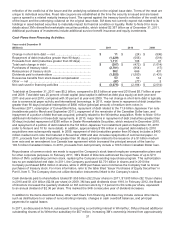

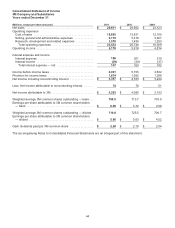

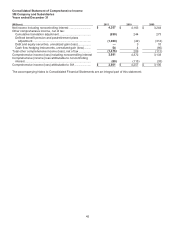

Cash Flows from Operating Activities:

Y

ears ended December 31

(Millions) 2011 2010 2009

Net income including noncontrolling interest .......................... $ 4,357

$ 4,163 $ 3,244

Depreciation and amortization ................................................ 1,236

1,120 1,157

Company pension contributions .............................................. (517 ) (556) (659 )

Company postretirement contributions ................................... (65 ) (62) (133 )

Company pension expense ..................................................... 449

271 176

Company postretirement expense .......................................... 106

51 47

Stock-based compensation expense ...................................... 253

274 217

Income taxes (deferred and accrued income taxes) ............... 132

85 554

Excess tax benefits from stock-based compensation ............. (53 ) (53) (14 )

A

ccounts receivable ................................................................ (205 ) (189) 55

Inventories ............................................................................... (196 ) (404) 453

A

ccounts payable .................................................................... (83 ) 146 109

Product and other insurance receivables and claims ............. 9

49 64

Other — net ............................................................................. (139 ) 279 (329 )

Net cash provided by operating activities ................................ $ 5,284

$ 5,174 $ 4,941

Cash flows from operating activities can fluctuate significantly from period to period, as pension funding decisions,

tax timing differences and other items can significantly impact cash flows. In the third quarter of 2009, the Company

contributed $600 million to its U.S. defined benefit pension plan in shares of the Company’s common stock, which is

considered a non-cash financing activity. This non-cash activity is not reflected in the operating or financing section

of the cash flows.

In 2011, cash flows provided by operating activities increased $110 million compared to 2010. The main positive

contribution to operating cash flows related to year-on-year increases in net income including noncontrolling interest.

Two primary items reduced operating cash flows. First, 3M invested in working capital (which includes accounts

receivable, inventories and accounts payable) in support of its growth. Working capital increased $484 million in

2011, with higher December 2011 sales compared to December 2010 sales contributing to this increase. This

compared to working capital increases of $447 million in 2010. Second, “Other-net” decreased cash flows by $139

million in 2011 compared to an increase of $279 million in 2010. The category, “Other-net,” in the preceding table

reflects changes in other asset and liability accounts, such as a decrease in accrued payroll amounts in 2011 related

to certain annual incentives, which reduced liabilities.

In 2010, cash flows provided by operating activities increased $233 million compared to 2009. The main positive

contribution to operating cash flows related to year-on-year increases in net income including noncontrolling interest.