3M 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

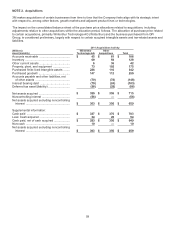

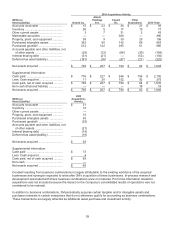

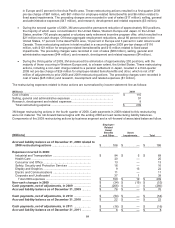

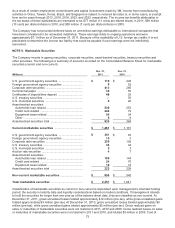

NOTE 5. Supplemental Balance Sheet Information

Accounts payable (included as a separate line item in the Consolidated Balance Sheet) includes drafts payable on

demand of $82 million at both December 31, 2011, and 2010. Accumulated depreciation for capital leases totaled

$60 million and $50 million as of December 31, 2011, and 2010, respectively. Additional supplemental balance sheet

information is provided in the table that follows.

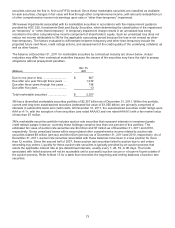

(Millions) 2011 2010

Other current assets

Prepaid expenses and other .............................................................................. $ 676 $ 555

Deferred income taxes ....................................................................................... 385 282

Derivative assets-current ................................................................................... 107 38

Product and other insurance receivables ........................................................... 109 92

Total other current assets ............................................................................... $ 1,277 $ 967

Investments

Equity method .................................................................................................... $ 98 $ 84

Cost method ....................................................................................................... 47 36

Other investments .............................................................................................. 10 26

Total investments ............................................................................................ $ 155 $ 146

Property, plant and equipment — at cost

Land.................................................................................................................... $ 377 $ 358

Buildings and leasehold improvements .............................................................. 6,587 6,321

Machinery and equipment .................................................................................. 13,240 12,769

Construction in progress .................................................................................... 814 656

Capital leases ..................................................................................................... 148 149

Gross property, plant and equipment ................................................................. 21,166 20,253

A

ccumulated depreciation .................................................................................. (13,500) (12,974 )

Property, plant and equipment — net ............................................................. $ 7,666 $ 7,279

Other assets

Deferred income taxes ....................................................................................... $ 1,018 $ 648

Product and other insurance receivables ........................................................... 151 143

Cash surrender value of life insurance policies ................................................. 223 213

Other................................................................................................................... 264 258

Total other assets ........................................................................................... $ 1,656 $ 1,262

Other current liabilities

A

ccrued trade payables ..................................................................................... $ 516 $ 476

Deferred income ................................................................................................. 389 369

Derivative liabilities ............................................................................................. 49 87

Restructuring actions.......................................................................................... 6

22

Employee benefits and withholdings .................................................................. 160 167

Product and other claims ................................................................................... 159 132

Property and other taxes .................................................................................... 94 196

Pension and postretirement benefits .................................................................. 53 41

Deferred income taxes ....................................................................................... 23 26

Other................................................................................................................... 636 506

Total other current liabilities ............................................................................ $ 2,085 $ 2,022

Other liabilities

Long term income taxes payable ....................................................................... $ 595 $ 627

Employee benefits .............................................................................................. 577 524

Product and other claims ................................................................................... 329 324

Capital lease obligations .................................................................................... 79 94

Deferred income ................................................................................................. 19 18

Deferred income taxes ....................................................................................... 251 198

Other................................................................................................................... 7

69

Total other liabilities ........................................................................................ $ 1,857 $ 1,854