3M 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

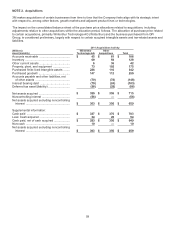

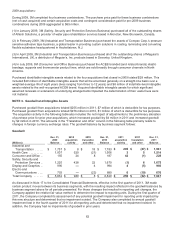

2011 acquisitions:

During 2011, 3M completed nine business combinations. The purchase price paid for these business combinations

(net of cash acquired) and the impact of other matters (net) during 2011 aggregated to $649 million.

(1) In January 2011, 3M (Industrial and Transportation Business) purchased certain assets of Nida-Core Corp., a

manufacturer of structural honeycomb core and fiber-reinforced foam core materials based in Port St. Lucie, Florida.

(2) In February 2011, 3M (Industrial and Transportation Business) announced that it completed its acquisition of all of

the outstanding shares of Alpha Beta Enterprise Co. Ltd., a manufacturer of box sealing tape and masking tape

headquartered in Taipei, Taiwan.

(3) In February 2011, 3M (Consumer and Office Business) purchased all of the outstanding shares of Hybrivet

Systems Inc., a provider of instant-read products to detect lead and other contaminants and toxins, which is based in

Natick, Massachusetts.

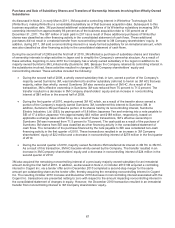

(4) In early March 2011, 3M (Industrial and Transportation Business) acquired a controlling interest in Winterthur via

completion of a public tender offer. Winterthur, based in Zug, Switzerland, is a leading global supplier of precision

grinding technology serving customers in the area of hard-to-grind precision applications in industrial, automotive,

aircraft and cutting tools. As of the settlement date of the tendered shares (the business acquisition date), 3M owned

approximately 86 percent of Winterthur shares via the tender and previous open market share purchases. The

purchase price paid in the preceding table includes non-cash consideration of $10 million representing the business

acquisition date fair value of shares previously owned by 3M as of December 31, 2010 and cash consideration paid,

net of cash acquired, of $293 million for subsequently tendered and open market purchased shares through the

business acquisition date. Following the business acquisition date, 3M purchased the remaining outstanding shares

of its consolidated Winterthur subsidiary, increasing 3M’s ownership interest to 100 percent as of December 31, 2011

as discussed in Note 6.

(5) In April 2011, 3M (Electro and Communications Business) purchased all of the outstanding shares of AP&T Co.

Ltd., based in Korea, which provides advanced sputtering and plating services, materials and manufacturing

capabilities for flexible circuits for the mobile hand-held, touch-screen panel and display markets.

(6) In April 2011, 3M (Display and Graphics Business) purchased all of the outstanding shares of Original Wraps Inc.,

a company specializing in the creative business development, technology and design of personalization platforms for

vehicles and vehicle accessories, which is based in Golden, Colorado.

(7) In July 2011, 3M (Industrial and Transportation Business) purchased all of the outstanding shares of Advanced

Chemistry & Technology Inc., a manufacturer of quick-cure, light-weight polysulfide sealants for aerospace

applications, which is based in Garden Grove, California.

(8) In July 2011, 3M (Industrial and Transportation Business) purchased certain assets of Piranha Plastics LLC,

based in Santa Clara, California, which provides plastic molding and paint solutions to the automotive aftermarket.

(9) In October 2011, 3M (Consumer and Office Business) acquired the do-it-yourself and professional business of

GPI Group. GPI, headquartered in France, is a manufacturer and marketer of home improvement products such as

tapes, hooks, insulation, and floor protection products and accessories.

In December 2011, 3M entered into a definitive agreement to acquire the Office and Consumer Products business of

Avery Dennison Corp. for a total purchase price of approximately $550 million, subject to certain adjustments. The

Office and Consumer Products business of Avery Dennison is a leading supplier of office and education products,

including labels, binders, presentation products, filing and indexing products, writing instruments, and other office and

home organization products. The transaction is expected to be completed in the second half of 2012, subject to

customary closing conditions including any necessary regulatory approvals.

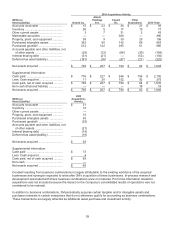

Purchased identifiable finite-lived intangible assets related to acquisitions which closed in 2011 totaled $342 million

and will be amortized generally on a straight-line basis over a weighted-average life of 14 years (lives ranging from 3

to 20 years). Acquired identifiable intangible assets for which significant assumed renewals or extensions of

underlying arrangements impacted the determination of their useful lives were not material.