3M 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

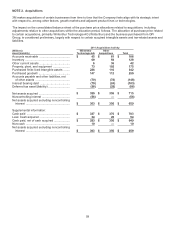

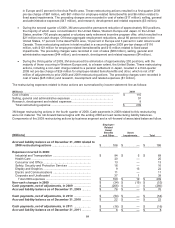

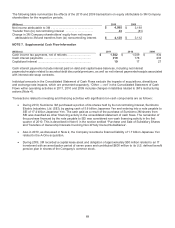

2009 acquisitions:

During 2009, 3M completed four business combinations. The purchase price paid for these business combinations

(net of cash acquired) and certain acquisition costs and contingent consideration paid for pre-2009 business

combinations during 2009 aggregated to $69 million.

(1) In January 2009, 3M (Safety, Security and Protection Services Business) purchased all of the outstanding shares

of Alltech Solutions, a provider of water pipe rehabilitation services based in Moncton, New Brunswick, Canada.

(2) In February 2009, 3M (Industrial and Transportation Business) purchased the assets of Compac Corp.’s pressure

sensitive adhesive tape business, a global leader in providing custom solutions in coating, laminating and converting

flexible substrates headquartered in Hackettstown, N.J.

(3) In April 2009, 3M (Industrial and Transportation Business) purchased all of the outstanding shares of Meguiar’s

International, UK, a distributor of Meguiar’s, Inc. products based in Daventry, United Kingdom.

(4) In July 2009, 3M (Consumer and Office Business) purchased the ACE® branded (and related brands) elastic

bandage, supports and thermometer product lines, which are sold broadly through consumer channels in North

America.

Purchased identifiable intangible assets related to the four acquisitions that closed in 2009 totaled $28 million. This

included $20 million of identifiable intangible assets that will be amortized generally on a straight-line basis over a

weighted-average life of eight years (lives ranging from three to 12 years) and $8 million of indefinite-lived intangible

assets related to the well-recognized ACE® brand. Acquired identifiable intangible assets for which significant

assumed renewals or extensions of underlying arrangements impacted the determination of their useful lives were

not material.

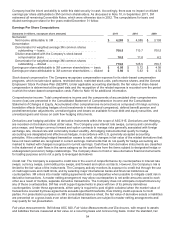

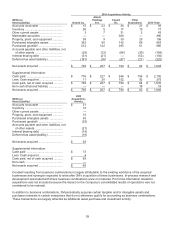

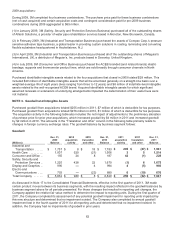

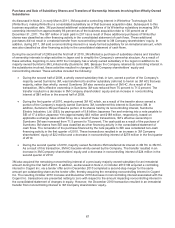

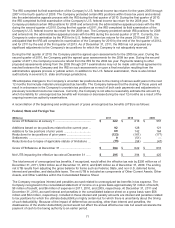

NOTE 3. Goodwill and Intangible Assets

Purchased goodwill from acquisitions totaled $255 million in 2011, $7 million of which is deductible for tax purposes.

Purchased goodwill from acquisitions totaled $978 million in 2010, $1 million of which is deductible for tax purposes.

The acquisition activity in the following table also includes the net impact of adjustments to the preliminary allocation

of purchase price for prior year acquisitions, which increased goodwill by $4 million in 2011 and increased goodwill

by $2 million in 2010. The amounts in the “Translation and other” column in the following table primarily relate to

changes in foreign currency exchange rates. The goodwill balance by business segment follows:

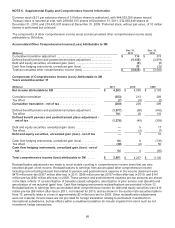

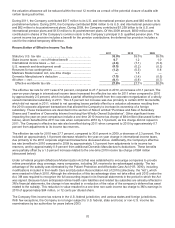

Goodwill

(Millions)

Dec. 31,

2009

Balance

2010

acquisition

activity

2010

translation

and other

Dec. 31,

2010

Balance

2011

acquisition

activity

2011

translation

and other

Dec. 31,

2011

Balance

Industrial and

Transportation ...... $ 1,757 $ 8 $ 18 $ 1,783

$ 205 $ (27) $ 1,961

Health Care .......... 1,007 520 (21 ) 1,506 3 5 1,514

Consumer and Office . . 155 24 8 187 42 (1) 228

Safety, Security and

Protection Services . . 1,220 428 22 1,670 (1) 6 1,675

Display and Graphics . . 990 —

4 994 4 (5) 993

Electro and

Communications .... 703 —

(23 ) 680 6 (10) 676

Total Company ....... $ 5,832 $ 980 $ 8 $ 6,820

$ 259 $ (32) $ 7,047

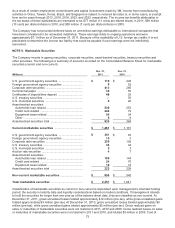

As discussed in Note 17 to the Consolidated Financial Statements, effective in the first quarter of 2011, 3M made

certain product moves between its business segments, with the resulting impact reflected in the goodwill balances by

business segment above for all periods presented. For those changes that resulted in reporting unit changes, the

Company applied the relative fair value method to determine the impact to reporting units. During the first quarter of

2011, the Company completed its assessment of any potential goodwill impairment for reporting units impacted by

this new structure and determined that no impairment existed. The Company also completed its annual goodwill

impairment test in the fourth quarter of 2011 for all reporting units and determined that no impairment existed. In

addition, the Company had no impairments of goodwill in prior years.