3M 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

NOTE 14. Commitments and Contingencies

Capital and Operating Leases:

Rental expense under operating leases was $279 million in 2011, $262 million in 2010 and $244 million in 2009. It is

3M’s practice to secure renewal rights for leases, thereby giving 3M the right, but not the obligation, to maintain a

presence in a leased facility. 3M has two primary capital leases. First, 3M has a capital lease, which became

effective in April 2003, that involves a building in the United Kingdom (with a lease term of 22 years). During the

second quarter of 2003, 3M recorded a capital lease asset and obligation of approximately 33.5 million United

Kingdom pounds (approximately $52 million at December 31, 2011 exchange rates). Second, during the fourth

quarter of 2009, 3M recorded a capital lease asset and obligation of approximately $50 million related to an IT

investment with an amortization period of seven years.

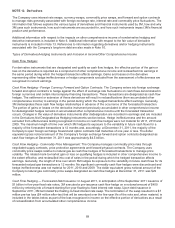

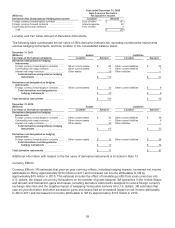

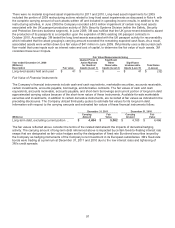

Minimum lease payments under capital and operating leases with non-cancelable terms in excess of one year as of

December 31, 2011, were as follows:

(Millions)

Capital

Leases

Operating

Leases

2012 .................................................................................................................. $ 19 $ 155

2013 .................................................................................................................. 20 113

2014 .................................................................................................................. 18 87

2015 .................................................................................................................. 5 55

2016 .................................................................................................................. 4 40

A

fter 2016 .......................................................................................................... 34 52

Total ............................................................................................................... $ 100 $ 502

Less: Amounts representing interest ................................................................. 8

Present value of future minimum lease payments ............................................ 92

Less: Current obligations under capital leases ................................................. 13

Long-term obligations under capital leases ...................................................... $ 79

Warranties/Guarantees:

3M’s accrued product warranty liabilities, recorded on the Consolidated Balance Sheet as part of current and long-

term liabilities, are estimated at approximately $28 million as of December 31, 2011 and approximately $27 million as

of December 31, 2010. 3M does not consider this amount to be material. The fair value of 3M guarantees of loans

with third parties and other guarantee arrangements are not material.

Related Party Activity:

3M does not have any material related party activity that is not in the ordinary course of business.

Legal Proceedings:

The Company and some of its subsidiaries are involved in numerous claims and lawsuits, principally in the United

States, and regulatory proceedings worldwide. These include various products liability (involving products that the

Company now or formerly manufactured and sold), intellectual property, and commercial claims and lawsuits,

including those brought under the antitrust laws, and environmental proceedings. Unless otherwise stated, the

Company is vigorously defending all such litigation.

Process for Disclosure and Recording of Liabilities and Insurance Receivables Related to Legal Proceedings

Many lawsuits and claims involve highly complex issues relating to causation, scientific evidence, and whether there

are actual damages and are otherwise subject to substantial uncertainties. Assessments of lawsuits and claims can

involve a series of complex judgments about future events and can rely heavily on estimates and assumptions. The

Company complies with the requirements of ASC Topic 450, Contingencies, and related guidance, and records

liabilities for legal proceedings in those instances where it can reasonably estimate the amount of the loss and where

liability is probable. Where the reasonable estimate of the probable loss is a range, the Company records the most

likely estimate of the loss, or the low end of the range if there is no one best estimate. The Company either discloses

the amount of a possible loss or range of loss in excess of established reserves if estimable, or states that such an

estimate cannot be made. The Company discloses significant legal proceedings even where liability is not probable