3M 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

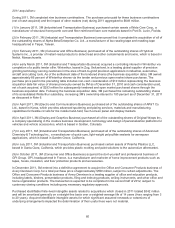

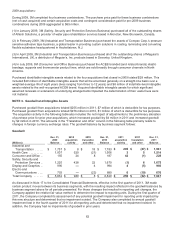

in Europe and 5 percent in the Asia Pacific area. These restructuring actions resulted in a first-quarter 2009

pre-tax charge of $67 million, with $61 million for employee-related items/benefits and $6 million related to

fixed asset impairments. The preceding charges were recorded in cost of sales ($17 million), selling, general

and administrative expenses ($47 million), and research, development and related expenses ($3 million).

x During the second quarter of 2009, 3M announced the permanent reduction of approximately 900 positions,

the majority of which were concentrated in the United States, Western Europe and Japan. In the United

States, another 700 people accepted a voluntary early retirement incentive program offer, which resulted in a

$21 million non-cash charge. Of these aggregate employment reductions, about 66 percent were in the

United States, 17 percent in the Asia Pacific area, 14 percent in Europe and 3 percent in Latin America and

Canada. These restructuring actions in total resulted in a second-quarter 2009 pre-tax charge of $116

million, with $103 million for employee-related items/benefits and $13 million related to fixed asset

impairments. The preceding charges were recorded in cost of sales ($68 million), selling, general and

administrative expenses ($44 million), and research, development and related expenses ($4 million).

x During the third quarter of 2009, 3M announced the elimination of approximately 200 positions, with the

majority of those occurring in Western Europe and, to a lesser extent, the United States. These restructuring

actions, including a non-cash charge related to a pension settlement in Japan, resulted in a third-quarter

2009 net pre-tax charge of $26 million for employee-related items/benefits and other, which is net of $7

million of adjustments to prior 2008 and 2009 restructuring actions. The preceding charges were recorded in

cost of sales ($25 million) and research, development and related expenses ($1 million).

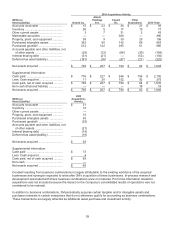

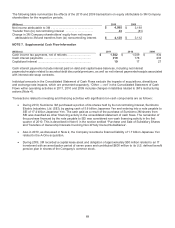

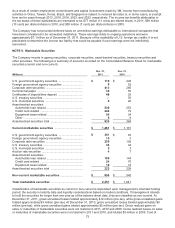

The restructuring expenses related to these actions are summarized by income statement line as follows:

(Millions) 2009

Cost of sales ........................................................................................................ $ 110

Selling, general and administrative expenses ..................................................... 91

Research, development and related expenses ................................................... 8

Total restructuring expense ............................................................................. $ 209

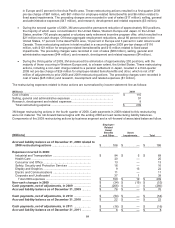

3M began restructuring actions in the fourth quarter of 2008. Cash payments in 2008 related to this restructuring

were not material. The roll-forward below begins with the ending 2008 accrued restructuring liability balances.

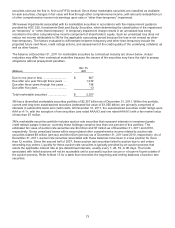

Components of the 2009 restructuring actions by business segment and a roll-forward of associated balances follow.

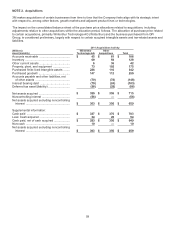

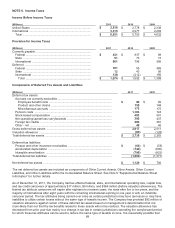

(Millions)

Employee-

Related

Items/

Benefits

and Other

Asset

Impairments Total

Accrued liability balance as of December 31, 2008 related to

2008 restructuring actions ................................ ................ $ 186 $

—

$ 186

Expenses incurred in 2009:

Industrial and Transportation ............................................... $ 84 $ 5 $ 89

Health Care .......................................................................... 20

—

20

Consumer and Office ........................................................... 13

—

13

Safety, Security and Protection Services ............................ 16

—

16

Display and Graphics ........................................................... 9 13 22

Electro and Communications ............................................... 11

—

11

Corporate and Unallocated .................................................. 37 1 38

Total 2009 expenses ........................................................ $ 190 $ 19 $ 209

Non-cash changes in 2009 ................................................... $ (34 ) $ (19) $ (53 )

Cash payments, net of adjustments, in 2009 ..................... $ (266 ) $

—

$ (266 )

Accrued liability balance as of December 31, 2009 ........... $ 76 $

—

$ 76

Cash payments, net of adjustments, in 2010 ..................... $ (54 ) $

—

$ (54 )

Accrued liability balance as of December 31, 2010 ........... $ 22 $

—

$ 22

Cash payments, net of adjustments, in 2011 ..................... $ (16 ) $

—

$ (16 )

Accrued liability balance as of December 31, 2011 ........... $ 6 $

—

$ 6