3M 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

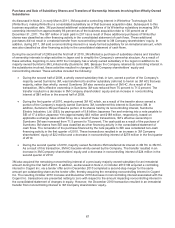

NOTE 11. Pension and Postretirement Benefit Plans

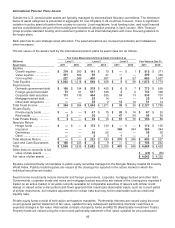

3M has company-sponsored retirement plans covering substantially all U.S. employees and many employees outside

the United States. In total, 3M has over 65 plans in 25 countries. Pension benefits associated with these plans

generally are based on each participant’s years of service, compensation, and age at retirement or termination. The

U.S. defined-benefit pension plan was closed to new participants effective January 1, 2009. The Company also

provides certain postretirement health care and life insurance benefits for substantially all of its U.S. employees who

reach retirement age while employed by the Company. Most international employees and retirees are covered by

government health care programs. The cost of company-provided postretirement health care plans for international

employees is not material and is combined with U.S. amounts in the tables that follow.

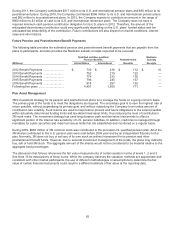

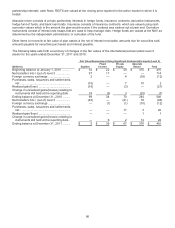

The Company’s pension funding policy is to deposit with independent trustees amounts allowable by law. Trust funds

and deposits with insurance companies are maintained to provide pension benefits to plan participants and their

beneficiaries. There are no plan assets in the non-qualified plan due to its nature. For its U.S. postretirement health

care and life insurance benefit plans, the Company has set aside amounts at least equal to annual benefit payments

with an independent trustee.

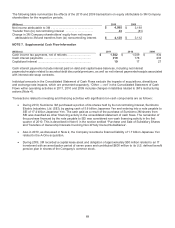

In August 2006, the Pension Protection Act (PPA) was signed into law in the U.S. The PPA transition rules increased

the funding target for defined benefit pension plans to 100% of the target liability by 2011. 3M’s U.S. qualified defined

benefit plan does not have a mandatory cash contribution because the Company has a significant credit balance

from previous discretionary contributions that can be applied to any PPA funding requirements.

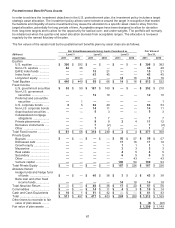

In 2008, the Company made modifications to its U.S. postretirement benefits plan. The changes were effective

beginning January 1, 2009, and allow current retired employees and employees who retire before January 1, 2013

the option to continue on the existing postretirement plans or elect the new plans. Current employees who retire after

December 31, 2012, will receive a savings account benefits-based plan. In 2009, the Company made further

modifications to its U.S. postretirement benefit plan. The changes were effective beginning January 1, 2010, and limit

the amount of medical inflation absorbed by the Company to three percent a year. As a result, as of the

December 31, 2009 measurement date, the Accumulated Postretirement Benefit Obligation (APBO) was reduced by

$168 million.

In the fourth quarter of 2010, the Company made further changes to its U.S. postretirement benefit plans. As a result

of these changes, the Company will transition all current and future retirees to the savings account benefits-based

plan announced in 2008. These changes become effective beginning January 1, 2013, for all Medicare eligible

retirees and their Medicare eligible dependents and January 1, 2015, for all non-Medicare eligible retirees and their

eligible dependents. As a result, as of the December 31, 2010 measurement date, the APBO increased by $69

million.

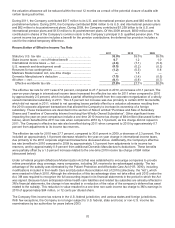

In the second quarter 2010, 3M’s Brazilian subsidiary received approval from the government in Brazil to freeze its

defined benefit pension plan. Effective March 31, 2010, participants in this subsidiary’s pension plan no longer

accrue additional pension benefits. As a result, the Company recorded a $22 million curtailment gain in the second

quarter of 2010.

During the second quarter of 2009, the Company offered a voluntary early retirement incentive program to certain

eligible participants of its U.S. pension plans who met age and years of pension service requirements. The eligible

participants who accepted the offer and retired by June 1, 2009, received an enhanced pension benefit. Pension

benefits were enhanced by adding one additional year of pension service and one additional year of age for certain

benefit calculations. Approximately 700 participants accepted the offer and retired by June 1, 2009. As a result, the

Company incurred a $21 million charge related to these special termination benefits.

During 2009, 3M Sumitomo (Japan) experienced a higher number of retirements than normal, largely due to early

retirement incentive programs, which required eligible employees who elected to leave the Company to retire by

September 2009. Participants in the Japan pension plan had the option of receiving cash lump sum payments when

exiting the plan, which a number of participants exiting the pension plan elected to receive. In accordance with ASC

715, Compensation ² Retirement Benefits, settlement accounting is required when the lump sum distributions in a

year are greater than the sum of the annual service and interest costs. Due to the large number of lump sum

payment elections in 2009, the Company incurred $17 million of settlement charges.

3M was informed during the first quarter of 2009 that the general partners of WG Trading Company, in which 3M’s

benefit plans hold limited partnership interests, are the subject of a criminal investigation as well as civil proceedings

by the SEC and CFTC (Commodity Futures Trading Commission). In March 2011, over the objections of 3M and six