3M 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Notes to Consolidated Financial Statements

NOTE 1. Significant Accounting Policies

Consolidation: 3M is a diversified global manufacturer, technology innovator and marketer of a wide variety of

products. All subsidiaries are consolidated. All significant intercompany transactions are eliminated. As used herein,

the term “3M” or “Company” refers to 3M Company and subsidiaries unless the context indicates otherwise.

Foreign currency translation: Local currencies generally are considered the functional currencies outside the United

States. Assets and liabilities for operations in local-currency environments are translated at year-end exchange rates.

Income and expense items are translated at average rates of exchange prevailing during the year. Cumulative

translation adjustments are recorded as a component of accumulated other comprehensive income (loss) in

shareholders’ equity.

Although local currencies are typically considered as the functional currencies outside the United States, under

Accounting Standards Codification (ASC) 830, Foreign Currency Matters, the reporting currency of a foreign entity’s

parent is assumed to be that entity’s functional currency when the economic environment of a foreign entity is highly

inflationary—generally when its cumulative inflation is approximately 100 percent or more for the three years that

precede the beginning of a reporting period. 3M has a subsidiary in Venezuela with operating income representing

less than 1.0 percent of 3M’s consolidated operating income for 2011. 3M determined that the cumulative inflation

rate of Venezuela in November 2009 and since has exceeded 100 percent. Accordingly, the financial statements of

the Venezuelan subsidiary were remeasured as if its functional currency were that of its parent beginning January 1,

2010.

Regulations in Venezuela require the purchase and sale of foreign currency to be made at official rates of exchange

that are fixed from time to time by the Venezuelan government. Certain laws in the country, however, provided an

exemption for the purchase and sale of certain securities and resulted in an indirect “parallel” market through which

companies obtained foreign currency without having to purchase it from Venezuela’s Commission for the

Administration of Foreign Exchange (CADIVI). In May 2010, the Venezuelan government took control of the

previously freely-traded parallel market. The government-controlled rate that emerged under the new Transaction

System for Foreign Currency Denominated Securities (SITME) is not as unfavorable as the previous parallel rate in

comparison to the official rates. As previously disclosed, as of December 31, 2009 (prior to the change in functional

currency of 3M’s Venezuelan subsidiary in January 2010), 3M changed to use of the parallel exchange rate for

translation of the financial statements of its Venezuelan subsidiary. Beginning January 1, 2010, as discussed above,

the financial statements of the Venezuelan subsidiary are remeasured as if its functional currency were that of its

parent. This remeasurement utilized the parallel rate through May 2010 and the SITME rate thereafter.

The Company continues to monitor circumstances relative to its Venezuelan subsidiary. Other factors

notwithstanding, the change in functional currency of this subsidiary and associated remeasurement beginning

January 1, 2010 as a result of Venezuela’s economic environment decreased net sales of the Venezuelan subsidiary

by approximately two-thirds in 2010 in comparison to 2009 (based on exchange rates at 2009 year-end), but did not

otherwise have a material impact on operating income and 3M’s consolidated results of operations.

Reclassifications: Certain amounts in the prior years’ consolidated financial statements have been reclassified to

conform to the current year presentation.

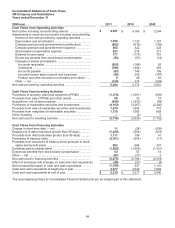

Revisions: The Company revised the amounts previously presented for cash used in investing activities and cash

used in financing activities for the year ended December 31, 2010 by $63 million. This revision related to purchases

of additional shares (noncontrolling interest) of non-wholly owned consolidated subsidiaries. These immaterial

revisions increased cash used in financing activities and decreased cash used in investing activities.

Use of estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from these

estimates.

Cash and cash equivalents: Cash and cash equivalents consist of cash and temporary investments with maturities of

three months or less when acquired.