3M 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

Shareholders Agreement, 3M marketed the firm’s flat flexible wiring systems for automotive interior applications to

the global automotive market. I&T filed a petition for bankruptcy protection in August 2006. As part of its agreement

to purchase the shares of TI&M, the Company was granted a put option, which gave the Company the right to sell

back its entire ownership interest in TI&M to the other investors from whom 3M acquired its 19 percent interest. The

put option became exercisable January 1, 2007. The Company exercised the put option and recovered

approximately $25 million of its investment from one of the investors based in Belgium in February 2007. The other

two TI&M investors from whom 3M purchased its shares have filed a bankruptcy petition in Austria. The Company

has recovered approximately 6.7 million Euros through this bankruptcy process, which in addition to prior recoveries,

results in a remaining investment balance of approximately 12 million Euros (approximately $15 million) as of

December 31, 2011. The Company is pursuing recovery of the balance of its investment, first, from the bank that

held the 3M purchase price paid to the two bankrupt investors and, to the extent not made whole, pursuant to the

terms of the Share Purchase Agreement. The Company believes collection of its remaining investment is probable

and, as a result, no impairment reserve has been recorded.

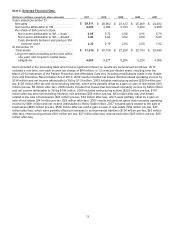

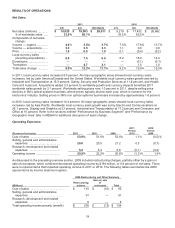

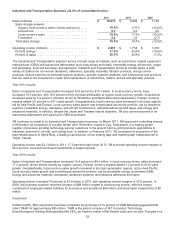

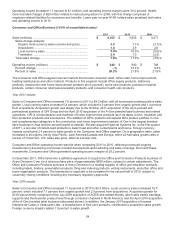

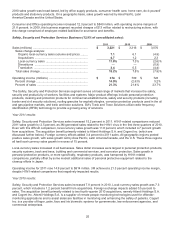

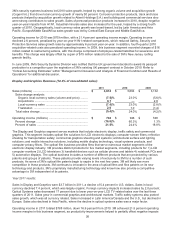

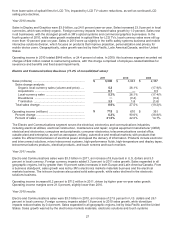

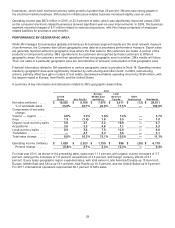

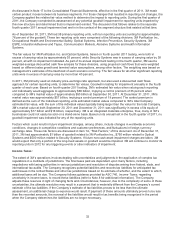

Health Care Business (17.0% of consolidated sales):

2011 2010 2009

Sales (millions) .................................................................... $ 5,031

$ 4,513 $ 4,282

Sales change analysis:

Organic local-currency sales (volume and price) ......... 4.6 % 4.1% 2.7 %

Acquisitions .................................................................. 3.8

1.2 0.9

Local-currency sales .................................................... 8.4 % 5.3% 3.6 %

Divestitures .................................................................. — (0.2) —

Translation ................................................................... 3.1

0.3 (3.9 )

Total sales change ........................................................... 11.5 % 5.4% (0.3 )%

Operating income (millions) ................................................ $ 1,489

$ 1,362 $ 1,347

Percent change ................................................................ 9.3 % 1.1% 14.9 %

Percent of sales ............................................................... 29.6 % 30.2% 31.4 %

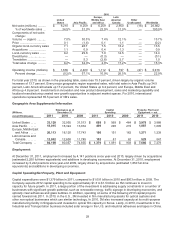

The Health Care segment serves markets that include medical clinics and hospitals, pharmaceuticals, dental and

orthodontic practitioners, and health information systems. Products and services provided to these and other markets

include medical and surgical supplies, skin health and infection prevention products, inhalation and transdermal drug

delivery systems, dental and orthodontic products (oral care), health information systems, and food safety products.

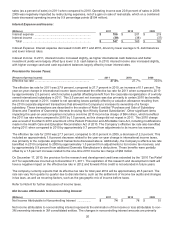

Year 2011 results:

Health Care sales increased 11.5 percent to $5.0 billion. Local-currency sales increased 8.4 percent, including 3.8

percent from acquisitions. Acquisition growth primarily related to Arizant Inc., a leading manufacturer of patient

warming solutions designed to prevent hypothermia in surgical settings. Currency impacts increased sales by 3.1

percent in Health Care. On a geographic basis, all regions posted positive sales growth. Asia Pacific, Latin

America/Canada, and Europe all reported sales growth of 10 percent or more, while the U.S. grew at 9 percent.

Local currency sales growth was led by the infection prevention, health information systems, food safety, skin and

wound care, and oral care businesses. Sales in the drug-delivery systems business increased in the fourth quarter of

2011 compared to the same period in 2010, but were down slightly for total-year 2011 when compared to 2010.

Operating income in Health Care increased 9.3 percent in 2011 to $1.5 billion. Operating income margins were 29.6

percent, compared to 30.2 percent in 2010, with this decrease due in part to growth investments in the health

information systems and infection prevention businesses. 3M has also been investing in emerging markets over the

past couple of years to improve market penetration levels. The year-on-year decline in operating income margins

was also due in part to sales declines in drug delivery systems. 3M’s long-term expectation is that Health Care

operating income margins will be in the high 20’s, as 3M continues to invest to grow this business.

Year 2010 results:

Health Care local-currency sales increased 5.3 percent, including a benefit of 1.2 percent from acquisitions, primarily

related to the Arizant Inc. acquisition in the fourth quarter (discussed above). Currency impacts increased sales by

0.3 percent. On a geographic basis, all regions posted positive local-currency sales growth, led by Asia Pacific and

Latin America/Canada. Local currency sales growth was broad-based, led by skin and wound care, drug delivery

systems, health information systems, infection prevention and oral care.