3M 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

had no outstanding commercial paper. The Company believes it is unlikely that its access to the commercial paper

market will be restricted.

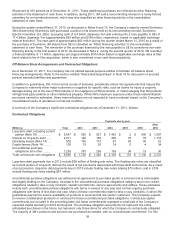

In August 2011, 3M entered into a $1.5 billion, five-year multi-currency revolving credit agreement, which replaced

the existing agreement that was due to expire in April 2012. This credit agreement includes a provision under which

3M may request an increase of up to $500 million, bringing the total facility up to $2 billion (at the lenders’ discretion).

This facility was undrawn at December 31, 2011. Also, in August 2011, 3M entered into a $200 million, one-year

committed line/letter of credit agreement with HSBC Bank USA. This agreement replaced the sublimit for letters of

credit that was previously encompassed in the $1.5 billion five-year facility. As of December 31, 2011, available

committed credit facilities, including the preceding $1.5 billion five-year credit facility and $200 million facility, totaled

approximately $1.785 billion worldwide. The amount utilized against these credit facilities totaled $147 million as of

December 31, 2011. This included $121 million in letters of credit issued under the $200 million facility, $18 million in

international lines of credit and $8 million in U.S. lines of credit outstanding with other banking partners. An additional

approximately $100 million in stand-alone letters of credit was also issued and outstanding at December 31, 2011.

These lines/letters of credit are utilized in connection with normal business activities. Under both the $1.5 billion and

$200 million credit agreements, the Company is required to maintain its EBITDA to Interest Ratio as of the end of

each fiscal quarter at not less than 3.0 to 1. This is calculated (as defined in the agreement) as the ratio of

consolidated total EBITDA for the four consecutive quarters then ended to total interest expense on all funded debt

for the same period. At December 31, 2011, this ratio was approximately 40 to 1. Debt covenants do not restrict the

payment of dividends.

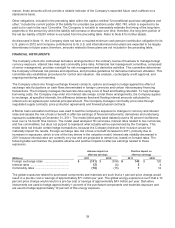

The Company has a “well-known seasoned issuer” shelf registration statement, effective August 5, 2011, which

registers an indeterminate amount of debt or equity securities for future sales. The Company intends to use the

proceeds from future securities sales off this shelf for general corporate purposes. This replaced 3M’s previous shelf

registration dated February 17, 2009. In September 2011, in connection with the August 5, 2011 “well-known

seasoned issuer” registration statement, 3M established a $3 billion medium-term notes program (Series F), from

which 3M issued a five-year $1 billion fixed rate note with a coupon rate of 1.375%. Proceeds were used for general

corporate purposes, including repayment in November 2011 of $800 million (principal amount) of medium-term

notes.

In connection with a prior “well-known seasoned issuer” shelf registration, in June 2007 the Company established a

$3 billion medium-term notes program. Three debt securities have been issued under this medium-term notes

program. First, in December 2007, 3M issued a five-year, $500 million, fixed rate note with a coupon rate of 4.65%.

Second, in August 2008, 3M issued a five-year, $850 million, fixed rate note with a coupon rate of 4.375%. Third, in

October 2008, the Company issued a three-year $800 million, fixed rate note with a coupon rate of 4.50%. The

Company entered into interest rate swaps to convert this $800 million note to a floating rate. This three-year fixed

rate note and related interest rate swaps matured in the fourth quarter of 2011.

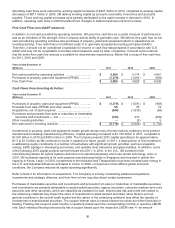

3M’s cash and cash equivalents balance at December 31, 2011 totaled $2.219 billion, with an additional $2.357

billion in current and long-term marketable securities. 3M’s strong balance sheet and liquidity provide the Company

with significant flexibility to take advantage of numerous opportunities going forward. The Company will continue to

invest in its operations to drive growth, including continual review of acquisition opportunities. 3M paid dividends of

$1.555 billion in 2011, and has a long history of dividend increases. In February 2012, 3M’s Board of Directors

increased the quarterly dividend on 3M common stock by 7.3 percent to 59 cents per share, equivalent to an annual

dividend of $2.36 per share. In February 2011, 3M’s Board of Directors also authorized the repurchase of up to $7.0

billion of 3M’s outstanding common stock, replacing the Company’s existing repurchase program. This authorization

has no pre-established end date.

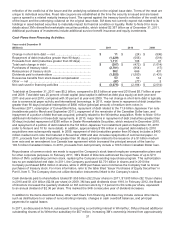

In 2012, the Company plans to contribute an amount in the range of $800 million to $1 billion of cash to its U.S. and

international pension and postretirement plans, with approximately $300 million in each of the first and second

quarters. The Company does not have a required minimum cash pension contribution obligation for its U.S. plans in

2012. Therefore, the amount of the anticipated discretionary contribution could vary significantly depending on the

U.S. qualified plans’ funded status as of the 2012 measurement date and the anticipated tax deductibility of the

contribution. Future contributions will also depend on market conditions, interest rates and other factors. 3M believes

its strong cash flow and balance sheet will allow it to fund future pension needs without compromising growth

opportunities.

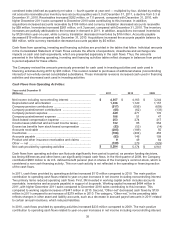

The Company uses various working capital measures that place emphasis and focus on certain working capital

assets and liabilities. These measures are not defined under U.S. generally accepted accounting principles and may

not be computed the same as similarly titled measures used by other companies. One of the primary working capital

measures 3M uses is a combined index, which includes accounts receivable, inventory and accounts payable. This