3M 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

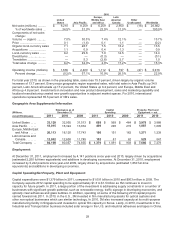

29

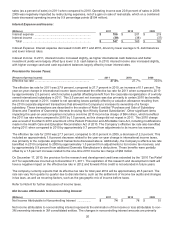

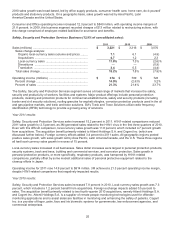

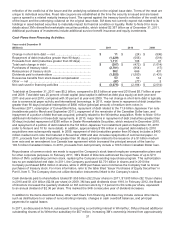

2010

United

States Asia Pacific

Europe,

Middle East

and Africa

Latin

America/

Canada

Other

Unallocated Worldwide

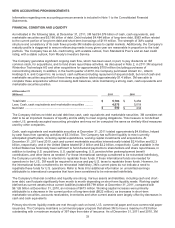

Net sales (millions) .......... $ 9,210 $ 8,259 $ 6,259 $ 2,950 $ (16) $ 26,662

% of worldwide sales ... 34.5% 31.0 % 23.5 % 11.0 %

—

100.0 %

Components of net sales

change:

Volume — organic ........... 7.0% 30.3 % 7.4 % 12.1 %

—

13.7 %

Price ................................ 0.1 (1.6 ) 0.1 1.1

—

(0.2 )

Organic local-currency sales 7.1 28.7 7.5 13.2

—

13.5

A

cquisitions ..................... 1.1 0.9 0.4 1.3

—

0.9

Local-currency sales ....... 8.2 29.6 7.9 14.5

—

14.4

Divestitures ......................

—

— (0.3 ) —

—

(0.1 )

Translation .......................

—

5.3 (2.8 ) 2.7

—

1.0

Total sales change .......... 8.2% 34.9 % 4.8 % 17.2 %

—

15.3 %

Operating income (millions) $ 1,636 $ 2,400 $ 1,112 $ 797 $ (27) $ 5,918

Percent change ............ (0.2)% 57.1 % 10.9 % 26.5 %

—

22.9 %

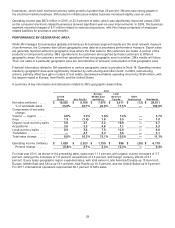

For total year 2010, as shown in the preceding table, sales rose 15.3 percent, driven largely by organic volume

increases of 13.7 percent. Every major geographic region expanded sales, with total sales in Asia Pacific up 34.9

percent, Latin America/Canada up 17.2 percent, the United States up 8.2 percent, and Europe, Middle East and

Africa up 4.8 percent. Investments in innovation and new product development, sales and marketing capability and

localized manufacturing created new growth opportunities in adjacent market spaces. For 2010, international

operations represented 65.5 percent of 3M’s sales.

Geographic Area Supplemental Information

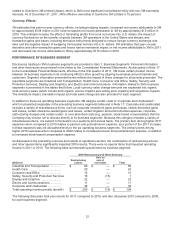

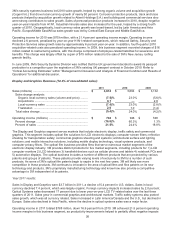

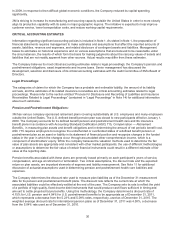

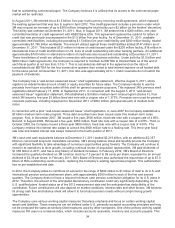

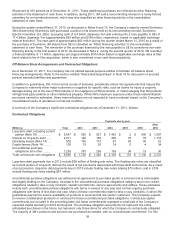

(Millions, Employees as of

December 31,

Capital

Spending

Property, Plant and

Equipment — net

except Employees) 2011 2010 2009 2011 2010 2009 2011 2010

United States .... 33,128

32,955 31,513

$ 688 $ 569 $ 464 $ 3,979

$ 3,888

A

sia Pacific ..... 18,015

16,324 13,834

409 290 215

1,887

1,605

Europe, Middle East

and Africa ..... 20,113

18,120 17,743

180 151 162

1,271

1,239

Latin America and

Canada ....... 12,942

12,658 11,745

102 81 62

529

547

Total Company . . 84,198

80,057 74,835

$ 1,379 $ 1,091 $ 903 $ 7,666

$ 7,279

Employment:

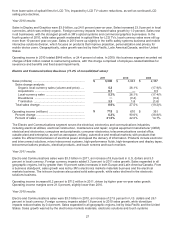

At December 31, 2011, employment increased by 4,141 positions since year-end 2010, largely driven by acquisitions

(estimated 2,250 full-time equivalents) and additions in developing economies. At December 31, 2010, employment

increased by 5,222 positions since year-end 2009, largely driven by acquisitions (estimated 1,850 full-time

equivalents) and additions in developing economies.

Capital Spending/Net Property, Plant and Equipment:

Capital expenditures were $1.379 billion in 2011, compared to $1.091 billion in 2010 and $903 million in 2009. The

Company expects 2012 capital spending to be approximately $1.3 to $1.5 billion as 3M continues to invest in

capacity for future growth. In 2011, a large portion of the investment is addressing supply constraints in a number of

businesses with significant growth potential, such as renewable energy, traffic signage in developing economies, and

optically clear adhesives and glass bubbles. In addition, spending on some of the following 2010 capital projects

carried forward into 2011. In 2010, in the U.S., 3M invested in film manufacturing assets for optical systems and

other non-optical businesses which use similar technology. In 2010, 3M also increased capacity at its multi-purpose

manufacturing facility in Singapore and invested in optical film capacity in Korea. Lastly, in 2010, investments in the

Industrial and Transportation business included solar energy in the U.S. and industrial adhesives and tapes in China.