3M 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

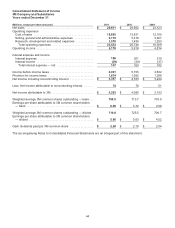

47

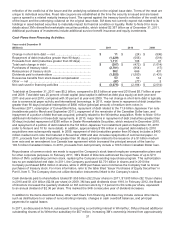

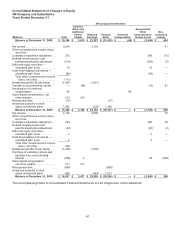

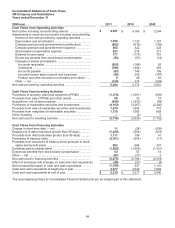

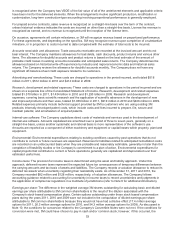

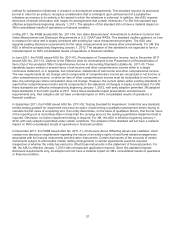

Consolidated Statement of Changes in Equity

3M Company and Subsidiaries

Years Ended December 31

3M Company Shareholders

(Millions) Total

Common

Stock and

Additional

Paid-in

Capital

Retained

Earnings

Treasury

Stock

Unearned

Compensation

Accumulated

Other

Comprehensive

Income (Loss)

Non-

controlling

Interest

Balance at December 31, 2008 .. $ 10,304 $ 3,015 $ 22,227 $ (11,676)

$

(40 ) $ (3,646 ) $ 424

Net income ...................... 3,244 3,193 51

Other comprehensive income (loss),

net of tax:

Cumulative translation adjustment . . . 273 286 (13 )

Defined benefit pension and

postretirement plans adjustment . . (314) (309 ) (5 )

Debt and equity securities —

unrealized gain (loss) ........... 10 10 —

Cash flow hedging instruments —

unrealized gain (loss) ........... (80) (80 ) —

Total other comprehensive income

(loss), net of tax .............. (111)

Dividends paid ($2.04 per share) . . . . (1,431) (1,431 )

Transfer to noncontrolling interest . . .

—

(66 ) (15 ) 81

A

mortization of unearned

compensation ................. 40 40

Stock-based compensation, net

of tax impacts .................. 213 213

Reacquired stock ................. (17) (17 )

Issuances pursuant to stock

option and benefit plans . . . . . . . . . 1,060 (236 ) 1,296

Balance at December 31, 2009 .. $ 13,302 $ 3,162 $ 23,753 $ (10,397)

$

—

$ (3,754 ) $ 538

Net income ...................... 4,163 4,085 78

Other comprehensive income (loss),

net of tax:

Cumulative translation adjustment . . . 244 205 39

Defined benefit pension and

postretirement plans adjustment . . (42) (40 ) (2 )

Debt and equity securities —

unrealized gain (loss) ........... 3 3 —

Cash flow hedging instruments —

unrealized gain (loss) ........... 4 4 —

Total other comprehensive income

(loss), net of tax .............. 209

Dividends paid ($2.10 per share) . . . . (1,500) (1,500 )

Purchase of subsidiary shares and

transfers from noncontrolling

interest ....................... (256) 4 39 (299 )

Stock-based compensation,

net of tax impacts .............. 311 311

Reacquired stock ................. (880) (880 )

Issuances pursuant to stock

option and benefit plans . . . . . . . . . 668 (343 ) 1,011

Balance at December 31, 2010 .. $ 16,017 $ 3,477 $ 25,995 $ (10,266)

$

—

$ (3,543 ) $ 354

The accompanying Notes to Consolidated Financial Statements are an integral part of this statement.