Tesco 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance in 2011/12

We delivered modest profit growth in a challenging economic

environment, with a strong international performance largely offset

by a reduction in UK profits. Whilst the year gave us many things to be

proud of, overall it was not the most pleasing performance. My team

and I are resolved to get Tesco back to winning, particularly at home.

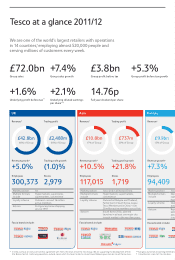

Group sales increased by 7.4% to £72 billion, while Group trading

profit was up 1.3% on last year and underlying profit before tax rose

to £3.9 billion, an increase of 1.6%. Group capital expenditure in the

year was £3.8 billion. Group return on capital employed (‘ROCE’)

increased – to 13.3% (last year 12.9%).

The Board has proposed a final dividend of 10.13p per share, taking the

full year dividend to 14.76p, which is an increase of 2.1% on last year.

The decisions we have taken during the year have had an impact on

our financial performance. We decided to forego some short-term

profit to re-invest in the long-term health of the business, with a clear

focus on improving the shopping trip for customers.

The UK business clearly did not meet our own expectations in the

year and, partly as a result of this, we decided to accelerate our

plan to make improvements which has meant a necessary reset to

expectations for our growth in 2012/13 as well. This acceleration and

reset were announced with our Christmas trading update in January.

Despite this significant re-investment programme, we remain

committed to driving higher returns for shareholders. Although

our investment plans in the UK make achieving our ROCE target

more challenging in the short term, we still expect to deliver a

ROCE of 14.6% by 2014/15, with broadly based growth from

around the Group.

Strategic update

In last year’s Annual Report, I set out an evolution of our strategy

into seven parts:

To grow the UK core;

To be an outstanding international retailer in stores

and online;

To be as strong in everything we sell as we are in food;

To grow retail services in all our markets;

To put our responsibilities to the communities we serve

at the heart of what we do;

To be a creator of highly valued brands; and

To build our team so that we create more value.

This strategy remains as relevant now as it did a year ago and

I’m pleased to be able to update you on the progress we have

made on each of these strategic objectives. I also set out immediate

management priorities for the business last year – keeping the UK

strong and growing; becoming outstanding internationally, not just

successful; becoming a multi-channel retailer wherever we trade;

delivering on the potential of retail services; applying Group

skill and scale; and delivering higher returns. You will see how

these priorities have shaped our actions through the year.

To grow the UK core

The deli counter in our Hertford Superstore has a flat glass front, bright

lighting and warmer, more engaging signage

In the UK, high petrol prices and falling real incomes affected customers’

discretionary spending in the year. The combination of disappointing

sales in the second half of the year and our decision to increase investment

into the shopping trip meant that our UK performance was weaker

than planned. Sales grew by 6.2%, supported by excellent new store

performance, but trading profit declined by (1.0)%.

The issue we are addressing is that the shopping trip just hasn’t been

improving fast enough and our standards haven’t been as consistent as

our customers have come to expect. As a result, we are taking action to

improve each aspect of the customer offer. This will involve significant

revenue and capital investment in a comprehensive plan encompassing

six key areas.

The UK Plan – Building a Better Tesco

Our Plan for the UK business has six elements:

Service & Staff: helping our people deliver great service by investment

in recruitment, training and equipment, dedicated to particular

departments such as produce so that our customers notice the change.

Stores & Formats: making our stores better places in which to shop

and work, with the pace of new store development moderating, and

the pace of refreshing our existing stores stepping up.

Price & Value: delivering great value for money through the right

blend of price, promotions, couponing and loyalty.

Range & Quality: building the right ranges of quality products,

reviewing and refreshing our entire range of Tesco brand products,

making our ranging more store and format-specific, and bringing

dunnhumby, our marketing insight business, back into the heart

of Tesco.

Brand & Marketing: making sure that we get back to having the right

conversation with our customers about Tesco.

Clicks & Bricks: making this a potent combination for our customers,

with the roll-out of Click & Collect and the transformation of our range

and online presence.

Chief Executive’s review

4 Tesco PLC Annual Report and Financial Statements 2012