Tesco 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

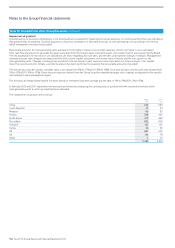

Notes to the Group financial statements

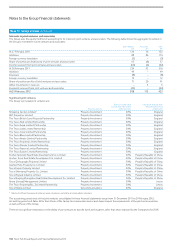

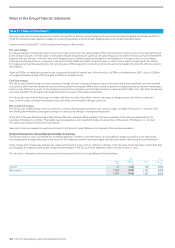

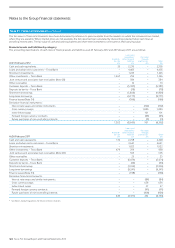

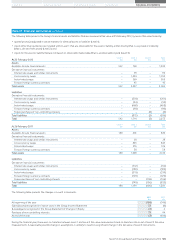

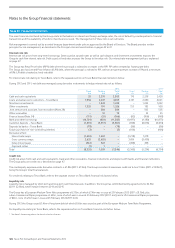

Note 21 Financial instruments

Derivatives are used to hedge exposure to market risks and those that are held as hedging instruments are formally designated as hedges as defined

in IAS 39. Derivatives may qualify as hedges for accounting purposes and the Group’s hedging policies are further described below.

Finance income of £3m (2011: £27m) resulted from hedge ineffectiveness.

Fair value hedges

The Group maintains interest rate and cross currency swap contracts as fair value hedges of the interest rate and currency risk on fixed rate debt issued

by the Group. Changes in the fair value of derivatives that are designated and qualify as fair value hedges are recorded in the Group Income Statement,

together with any changes in the fair value of the hedged asset or liability that are attributable to the hedged risk. The gain or loss on the hedging

instrument and hedged item is recognised in the Group Income Statement within finance income or costs. If the hedge no longer meets the criteria

forhedge accounting, the adjustment to the carrying value of the hedged item is amortised to the Group Income Statement under the effective interest

rate method.

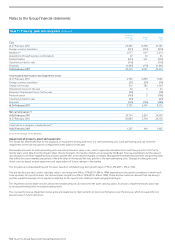

A gain of £263m on hedging instruments was recognised during the financial year, offset by a loss of £260m on hedged items (2011: a loss of £369m

on hedging instruments was offset by a gain of £396m on hedged items).

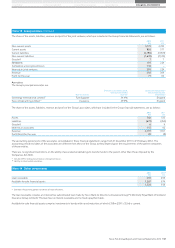

Cash flow hedges

The Group uses forward foreign currency contracts to hedge the cost of future purchases of goods for resale where those purchases are denominated

in a currency other than the functional currency of the purchasing company. Where these contracts qualify for hedge accounting, mark-to-market gains

and losses are deferred in equity. These hedging instruments are primarily used to hedge purchases in Euros and US Dollars. The cash flows hedged will

occur and will affect the Group Income Statement within one year of the balance sheet date.

The Group also uses index-linked swaps to hedge cash flows on index-linked debt, interest rate swaps to hedge interest cash flows on debt and

cross currency swaps to hedge intercompany loan cash flows denominated in foreign currencies.

Net investment hedges

The Group uses forward foreign currency contracts, currency denominated borrowings and currency swaps to hedge the exposure of a portion of its

non-Sterling denominated assets against changes in value due to changes in foreign exchange rates.

At the start of the year the Group had a South Korean Won denominated liability relating to the future purchase of the minority shareholding of its

subsidiary, Homeplus Co., Limited. This liability was designated as a net investment hedge of a proportion of the assets of Homeplus Co., Limited.

Thisoption was exercised during the financial year.

Gains and losses accumulated in equity are included in the Group Income Statement on disposal of the overseas operations.

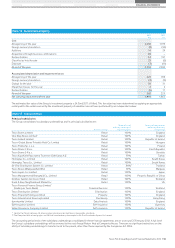

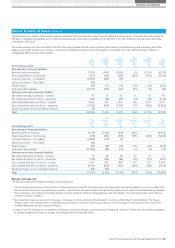

Financial instruments not qualifying for hedge accounting

The Group’s policy is not to use derivatives for trading purposes. However, some derivatives do not qualify for hedge accounting or are specifically

not designated as a hedge where gains and losses on the hedging instrument and the hedged item naturally offset in the Group Income Statement.

These instruments include caps, interest rate swaps and forward foreign currency contracts. Changes in the fair value of any derivative instruments that

do not qualify for hedge accounting are recognised immediately in the Group Income Statement within finance income or costs.

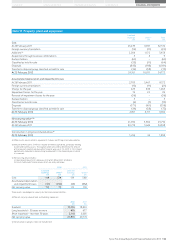

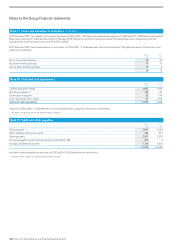

The fair value of derivative financial instruments have been disclosed in the Group Balance Sheet as follows:

2012 2011

Asset

£m

Liability

£m

Asset

£m

Liability

£m

Current 41 (128) 148 (255)

Non-current 1,726 (688) 1,139 (600)

1,767 (816) 1,287 (855)

122 Tesco PLC Annual Report and Financial Statements 2012