Tesco 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements

Note 26 Post-employment benefits continued

The cumulative losses recognised through the Group Statement of Comprehensive Income since the date of transition to IFRS are £1,037m (2011: £539m).

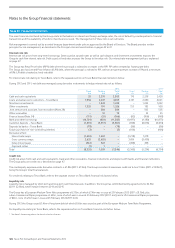

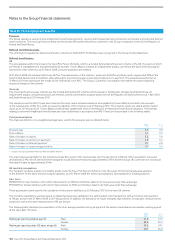

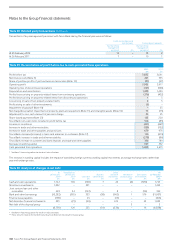

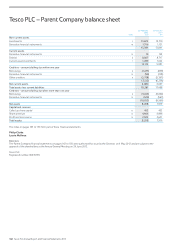

Summary of movements in deficit during the financial year

2012

£m

2011

£m

Deficit in schemes at beginning of the year (1,356) (1,840)

Current service cost (495) (499)

Past service gain/(cost) 3 (29)

Other finance income/(cost) 18 (18)

Contributions by employer 457 433

Foreign currency translation (1) 2

Actuarial (loss)/gain (498) 595

Deficit in schemes at end of the year (1,872) (1,356)

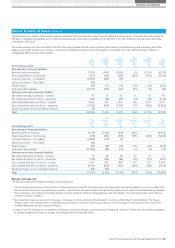

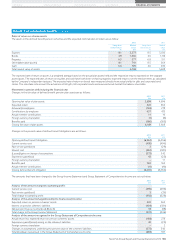

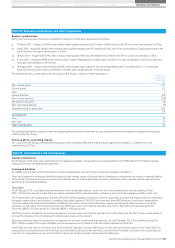

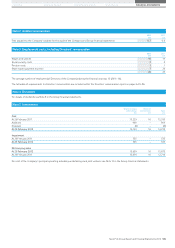

History of movements

The historical movement in defined benefit pension schemes’ assets and liabilities and history of experience gains and losses are as follows:

2012

£m

2011

£m

2010

£m

2009

£m

2008

£m

Total market value of assets 6,169 5,608 4,696 3,420 4,089

Present value of liabilities relating to unfunded schemes (60) (65) (54) (39) (34)

Present value of liabilities relating to partially funded schemes (7,981) (6,899) (6,482) (4,875) (4,893)

Pension deficit (1,872) (1,356) (1,840) (1,494) (838)

Experience (losses)/gains on scheme assets (168) 278 733 (1,270) (465)

Experience gains/(losses) on plan liabilities 43 (25) (1) (117) (20)

Post-employment benefits other than pensions

The Company operates a scheme offering post-employment healthcare benefits. The cost of providing these benefits has been accounted for on

a similar basis to that used for defined benefit pension schemes.

The liability as at 25 February 2012 of £11m (2011: £12m) was determined in accordance with the advice of independent actuaries. During the financial

year, £1m (2011: £1m) has been charged to the Group Income Statement and £1m (2011: £1m) of benefits were paid.

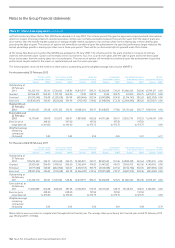

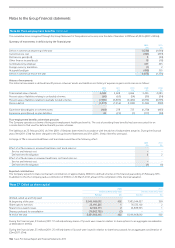

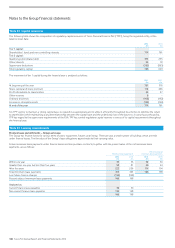

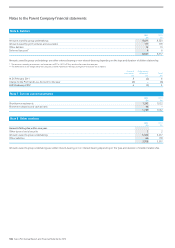

A change of 1% in assumed healthcare cost trend rates would have the following effect:

2012

£m

2011

£m

Effect of a 1% increase in assumed healthcare cost trend rates on:

Service and interest cost ––

Defined benefit obligation 22

Effect of a 1% decrease in assumed healthcare cost trend rates on:

Service and interest cost ––

Defined benefit obligation (1) (1)

Expected contributions

The Company expects to make normal cash contributions of approximately £486m to defined schemes in the financial year ending 23 February 2013.

Inaddition to this the Company paid a contribution of £180m on 30 March 2012, ahead of the completion of the triennial valuation.

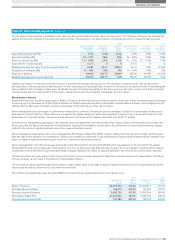

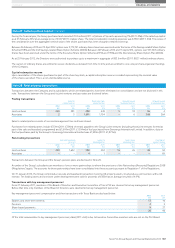

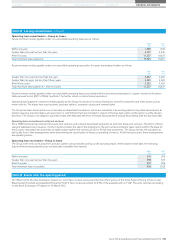

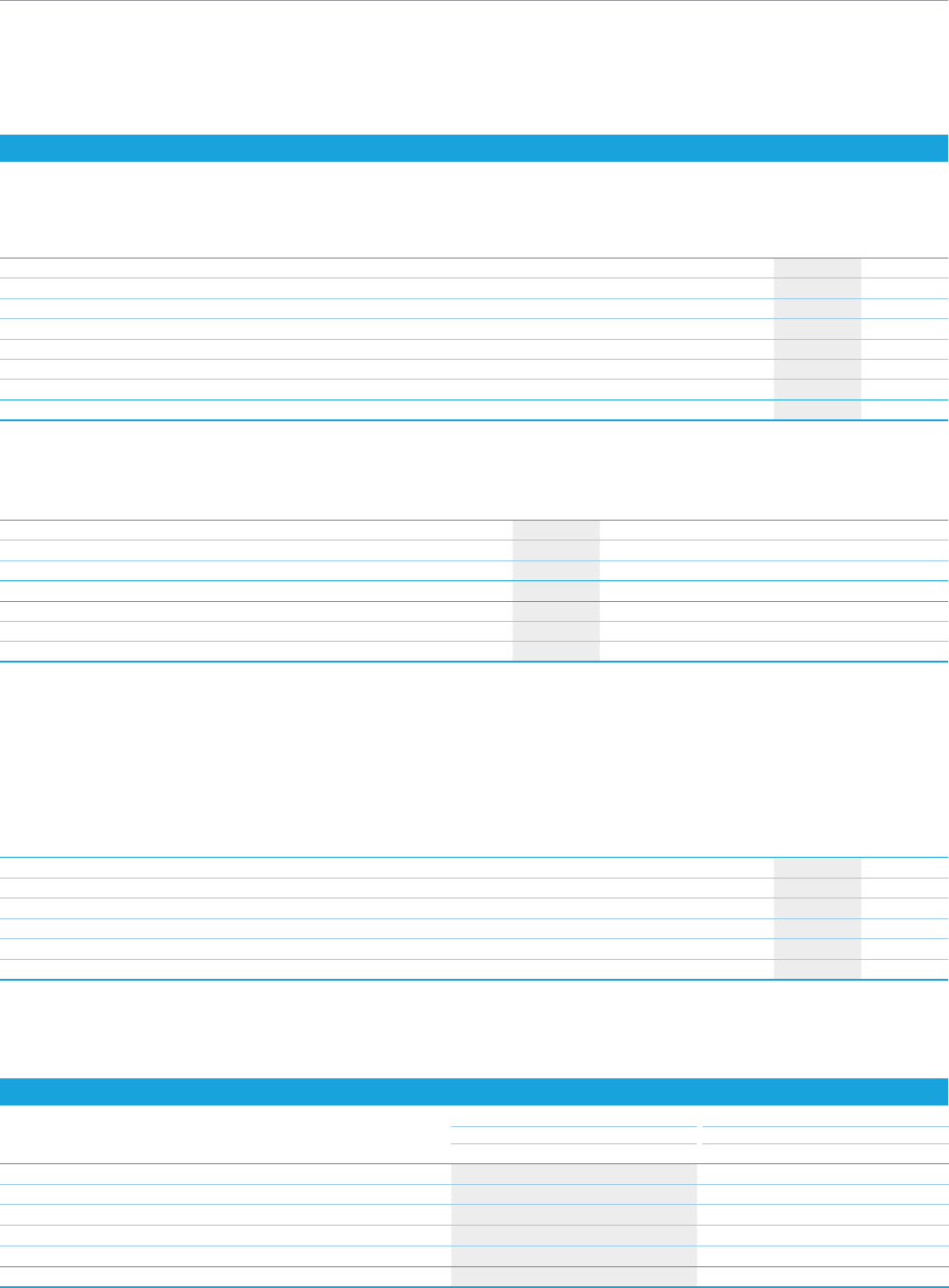

Note 27 Called up share capital

2012 2011

Ordinary shares of 5p each Ordinary shares of 5p each

Number £m Number £m

Allotted, called up and fully paid:

At beginning of the year 8,046,468,092 402 7,985,044,057 399

Share options exercises 23,490,825 1 36,535,102 2

Share bonus awards issues 32,656,313 2 24,888,933 1

Shares purchased for cancellation (70,802,785) (3) ––

At end of the year 8,031,812,445 402 8,046,468,092 402

During the financial year, 23 million (2011: 37 million) ordinary shares of 5p each were issued in relation to share options for an aggregate consideration

of £69m (2011: £97m).

During the financial year, 33 million (2011: 25 million) shares of 5p each were issued in relation to share bonus awards for an aggregate consideration of

£2m (2011: £1m).

136 Tesco PLC Annual Report and Financial Statements 2012