Tesco 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share ownership guidelines

Guidelines

Four times base salary for

theCEO

Three times base salary for

other Executive Directors

J^[fkhfei[_ijeYh[Wj[Wb_]dc[dj

with interests of shareholders

J^_ih[gk_h[c[dj_iWjj^[kff[h

end of typical market practice for

similar sized companies

The Remuneration Committee believes that a significant shareholding

by Executive Directors aligns their interests with shareholders and

demonstrates their ongoing commitment to the business.

Policy for calculating shareholding

Shares included – Shares held in plans which are not subject

to forfeiture will be included (on a net basis) for the purposes of

calculating Executive Directors’ shareholdings, as will shares held

by an executive’s spouse. Vested but unexercised market value

share options are not included in the calculation.

Five years for new appointees to build shareholdings – New

appointees will typically be expected to achieve this minimum level

ofshareholding within five years of appointment.

PSP participation may be subject to maintaining holding – Full

participation in the long-term Performance Share Plan will generally

be conditional upon maintaining the minimum shareholding.

Holding of 50% of vesting awards until requirement met – Most

executives already meet the shareholding requirement but those who

do not will generally be required to hold, and not dispose of, at least

50% of the net number of shares which vest under incentive

arrangements until they meet this requirement.

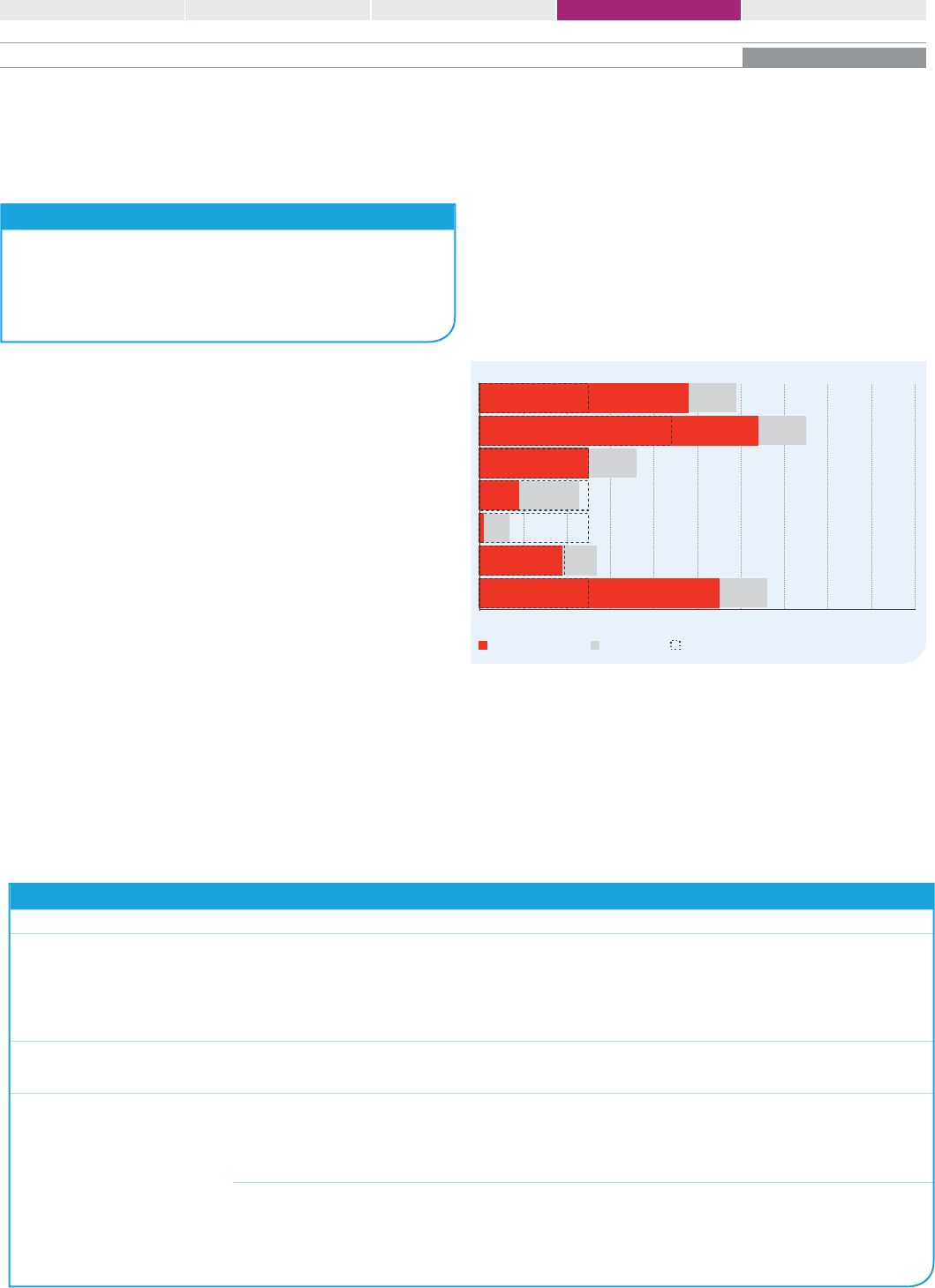

Shares held by Executive Directors at 25 February 2012

The chart below illustrates the value of Executive Directors’

shareholdings, based on the three-month average share price to

25February 2012 of 359p per share compared to the shareholding

guideline. The shareholding guideline has been shown based on the full

requirement of four times salary for the CEO and three times salary for

other directors. When the shareholding guidelines were increased last

year, Executives were given a period of five years to meet this enhanced

requirement and therefore should meet the requirement by June 2016.

£ million

Ordinary shares

EIP shares

Richard Brasher

Philip Clarke

Andrew Higginson

Tim Mason

Laurie Mcllwee

Lucy Neville-Rolfe

David Potts

Shareholding requirement

012345678910

012345678

Share dealing policy

Tesco has a share dealing policy in place for Executive Directors and for

members of the Executive Committee. This policy prevents Executive

Directors and Executive Committee members and their connected

persons dealing in shares at times when this would be prohibited by

theModel Code. At all other times, Executive Directors and Executive

Committee members must seek advance clearance from the Chairman

before dealing in shares on their own behalf or in respect of their

connected persons.

Service agreements

Key provisions

Provision Current service contracts Policy for new appointments

Notice period '(cedj^iÊdej_Y[Xoj^[9ecfWdoWdZi_ncedj^iÊdej_Y[Xoj^[;n[Ykj_l[$

<ehd[mWffe_djc[djij^[9ecc_jj[[h[i[hl[ij^[h_]^jjelWhoj^_i

period to 24 months for the initial period of appointment and for the

notice period to then revert to 12 months. No Executive currently has

anotice period of greater than 12 months.

Expiry date Hebb_d]i[hl_Y[YedjhWYj$

De\_n[Z[nf_hoZWj[$

Termination payments

(Does not apply if notice as

per the service agreement is

provided or for termination

by reason of resignation or

unacceptable performance

or conduct)

J[hc_dWj_edfWoc[dji_db_[ke\dej_Y[YWbYkbWj[ZXWi[ZedXWi_YiWbWho

and the average annual bonus paid for the last two years.

Termination payments

inlieu of notice based on

basic salary and

benefitsonly.

DeWYYekdjm_bbX[jWa[de\f[di_ed$

J[hc_dWj_edfWoc[djim_bbX[ikX`[Yjjec_j_]Wj_edWdZdehcWbbofW_Z

ininstalments to facilitate this (other than for long serving Executives).

?\j^[j[hc_dWj_edeYYkhim_j^_ded[o[Whe\h[j_h[c[dj"j^[j[hc_dWj_ed

payment will be reduced accordingly.

The Committee has taken into account the feedback received from shareholders and shareholder representative bodies regarding best practice in

relation to the inclusion of bonuses in Directors’ termination arrangements. To ensure full alignment with best practice, the Committee has decided

that the policy for new executives joining the Board will be to restrict termination payments in lieu of notice to a sum based on salary and benefits

only. This was reflected in the new service contract for Philip Clarke on his appointment to CEO.

The service agreements are available to shareholders to view on request from the Company Secretary.

Tesco PLC Annual Report and Financial Statements 2012 69

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTSOVERVIEW

General information Directors’ remuneration reportBoard of Directors Principal risks and uncertainties Corporate governance