Tesco 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS

OVERVIEW

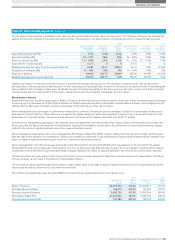

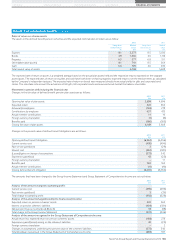

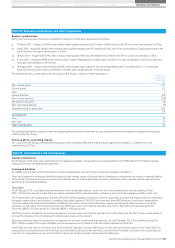

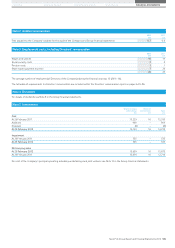

Note 27 Called up share capital continued

During the financial year, the Group purchased and cancelled 70.8 million (2011: nil) shares of 5p each representing 1% (2011: 0%) of the called up capital

as at 25 February 2012 at an average price of £4.07 (2011: n/a) per share. The total consideration including expenses was £290m (2011: £nil). The excess of

the consideration over the aggregate nominal value of the shares purchased has been charged to retained earnings.

Between 26 February 2012 and 13 April 2012 options over 2,779,741 ordinary shares have been exercised under the terms of the Savings-related Share Option

Scheme (1981) and the Irish Savings-related Share Option Scheme (2000). Between 26 February 2012 and 13 April 2012, options over 937,548 ordinary

shares have been exercised under the terms of the Executive Share Option Schemes (1994 and 1996) and the Discretionary Share Option Plan (2004).

As at 25 February 2012, the Directors were authorised to purchase up to a maximum in aggregate of 803.6 million (2011: 802.1 million) ordinary shares.

The owners of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share at general meetings

of the Company.

Capital redemption reserve

Upon cancellation of the shares purchased as part of the share buy-back, a capital redemption reserve is created representing the nominal value

of the shares cancelled. This is a non-distributable reserve.

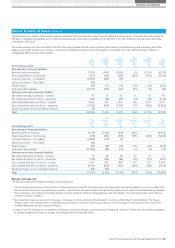

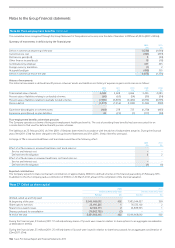

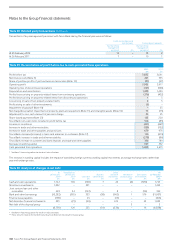

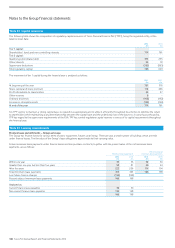

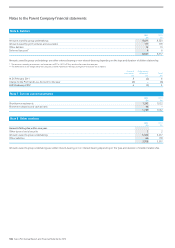

Note 28 Related party transactions

Transactions between the Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are not disclosed in this

note. Transactions between the Group and its joint ventures and associates are disclosed below:

Trading transactions

Sales to

related parties

Purchases from

related parties

Amounts owed

by related parties

Amounts owed

to related parties

2012

£m

2011

£m

2012

£m

2011

£m

2012

£m

2011

£m

2012

£m

2011

£m

Joint ventures 263 281 480 449 518 36 4

Associates 231,691 1,104 –6368 264

Sales to related parties consists of services/management fees and loan interest.

Purchases from related parties include £351m (2011: £306m) of rentals payable to the Group’s joint ventures (including those joint ventures formed as

part of the sale and leaseback programme) and £1,691m (2011: £1,104m) of fuel purchased from Greenergy International Limited. In addition, duty on

the fuel purchases paid by the Group to Greenergy International Limited was £1,950m (2011: £1,877m).

Non-trading transactions

Sale and leaseback

of assets

Loans to

related parties

Loans from

related parties

Injection of

equity funding

2012

£m

2011

£m

2012

£m

2011

£m

2012

£m

2011

£m

2012

£m

2011

£m

Joint ventures 450 1,652 380 502 16 26 49 94

Associates ––41–––69

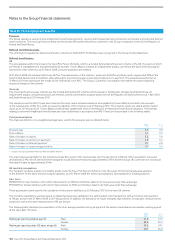

Transactions between the Group and the Group’s pension plans are disclosed in Note 26.

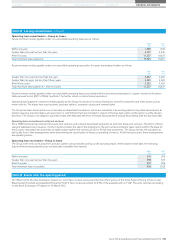

A number of the Group’s subsidiaries are members of one or more partnerships to whom the provisions of the Partnerships (Accounts) Regulations 2008

(‘Regulations’) apply. The accounts for those partnerships have been consolidated into these accounts pursuant to Regulation 7 of the Regulations.

On 31 January 2012, the Group completed a new sale and leaseback transaction involving UK property assets, structured as a joint venture with a UK

investor. Ten trading stores and one store under development were sold for proceeds of £450m at an average net yield of 4.9%.

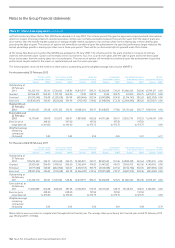

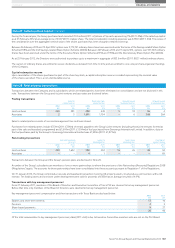

Transactions with key management personnel

From 27 Feburary 2011, members of the Board of Directors and Executive Committee of Tesco PLC are deemed to be key management personnel.

Before that time only members of the Board of Directors were deemed to be key management personnel.

Key management personnel compensation and their transactions with Tesco Bank are disclosed below:

2012

£m

2011

£m

Salaries and short-term benefits 13 10

Pensions 43

Share-based payments 927

26 40

Of the total remuneration to key management personnel, £6m (2011: £nil) is due to Executive Committee members who are not on the PLC Board.

Tesco PLC Annual Report and Financial Statements 2012 137