Tesco 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

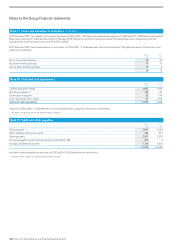

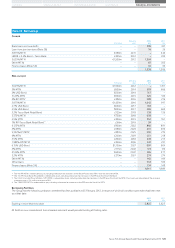

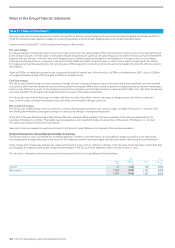

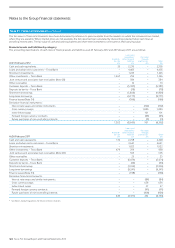

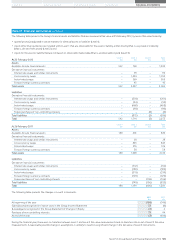

Notes to the Group financial statements

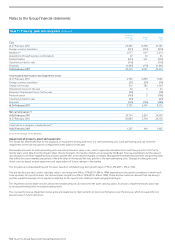

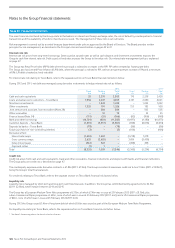

Note 21 Financial instruments continued

The fair values of financial instruments have been determined by reference to prices available from the markets on which the instruments are traded,

where they are available. Where market prices are not available, the fair value has been calculated by discounting expected future cash flows at

prevailing interest rates. The fair value of cash and cash equivalents and short-term investments is the same as their carrying value.

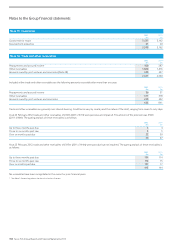

Financial assets and liabilities by category

The accounting classifications of each class of financial assets and liabilities as at 25 February 2012 and 26 February 2011 are as follows:

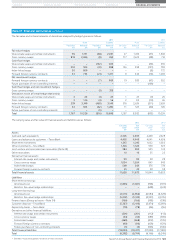

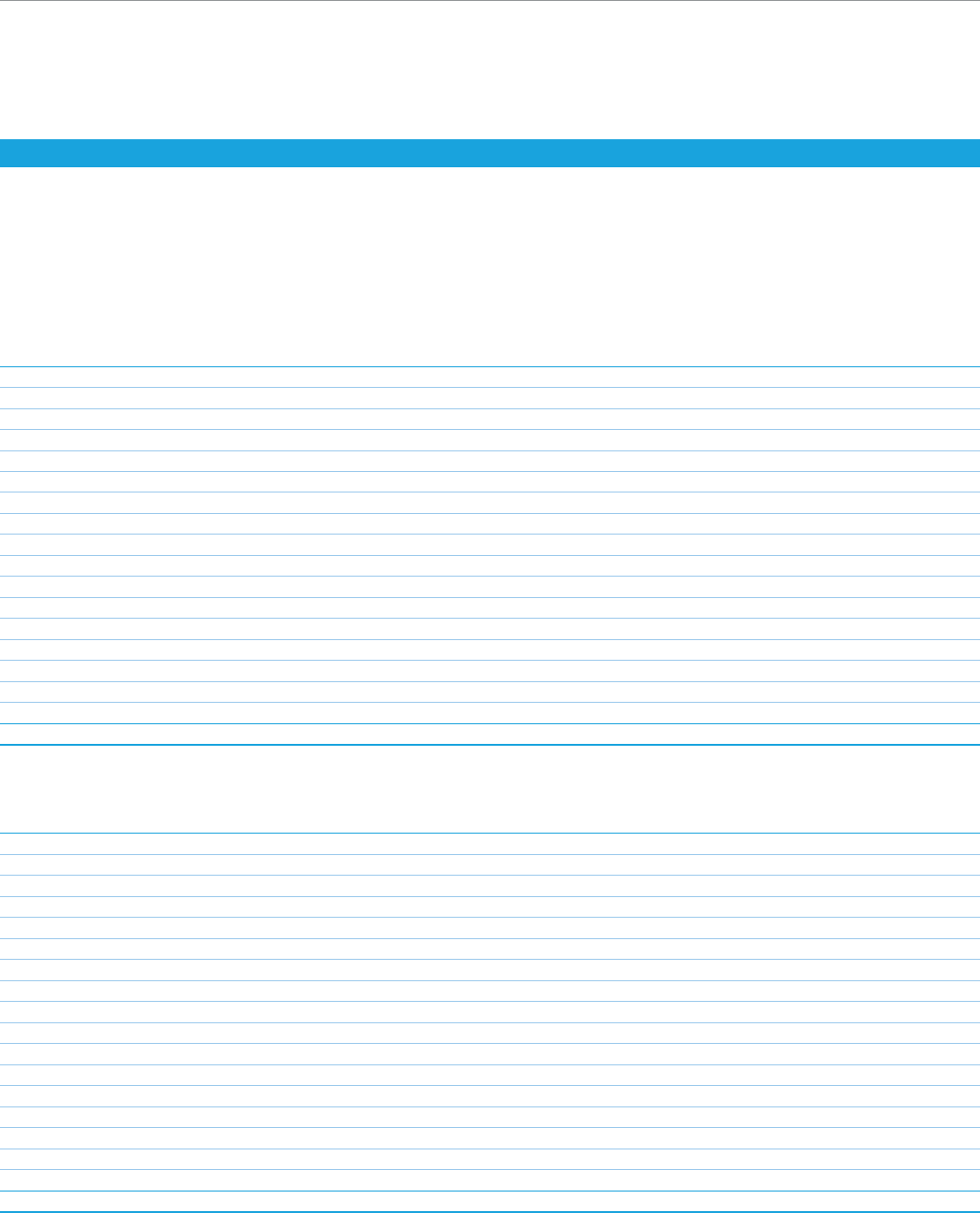

At 25 February 2012

Available-

for-sale

£m

Loans and

receivables/

other financial

liabilities

£m

Fair value

through

profit or loss

£m

Total

£m

Cash and cash equivalents 35 2,270 – 2,305

Loans and advances to customers – Tesco Bank – 4,403 – 4,403

Short-term investments – 1,243 – 1,243

Other investments – Tesco Bank 1,267 259 – 1,526

Joint venture and associates loan receivables (Note 28) – 384 – 384

Other receivables – 10 – 10

Customer deposits – Tesco Bank – (5,387) – (5,387)

Deposits by banks – Tesco Bank – (78) – (78)

Short-term borrowings – (1,806) – (1,806)

Long-term borrowings – (9,777) – (9,777)

Finance leases (Note 34) – (166) – (166)

Derivative financial instruments:

Interest rate swaps and similar instruments – – (102) (102)

Cross currency swaps – – 1,000 1,000

Index-linked swaps – – 101 101

Forward foreign currency contracts – – (45) (45)

Future purchases of non-controlling interests – – (3) (3)

1,302 (8,645) 951 (6,392)

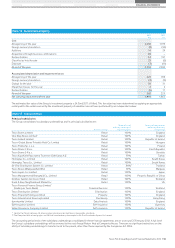

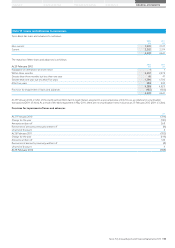

At 26 February 2011

Available-

for-sale

£m

Loans and

receivables/

other financial

liabilities

£m

Fair value

through

profit or loss

£m

Total*

£m

Cash and cash equivalents 170 2,258 – 2,428

Loans and advances to customers – Tesco Bank – 4,641 – 4,641

Short-term investments – 1,022 – 1,022

Other investments – Tesco Bank 679 259 – 938

Joint venture and associates loan receivables (Note 28) – 503 – 503

Other receivables –25 –25

Customer deposits – Tesco Bank – (5,074) – (5,074)

Deposits by banks – Tesco Bank – (36) – (36)

Short-term borrowings –(1,336) –(1,336)

Long-term borrowings – (9,541) – (9,541)

Finance leases (Note 34) –(198) –(198)

Derivative financial instruments:

Interest rate swaps and similar instruments – – (84) (84)

Cross currency swaps ––656656

Index-linked swaps – – 57 57

Forward foreign currency contracts – – (91) (91)

Future purchases of non-controlling interests – – (106) (106)

849 (7,477) 432 (6,196)

* See Note 1 Accounting policies for details of reclassifications.

124 Tesco PLC Annual Report and Financial Statements 2012