Tesco 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

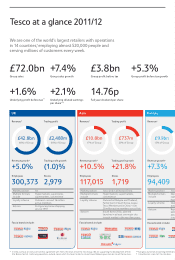

Tesco at a glance 2011/12

We are one of the world’s largest retailers with operations

in 14 countries*

, employing almost 520,000 people and

serving millions of customers every week.

£72.0bn

Group sales

+5.3%

Group profit before tax growth

£3.8bn

Group profit before tax

+7.4%

Group sales growth

+2.1%

Underlying diluted earnings

per share**†

14.76p

Full year dividend per share

+1.6%

Underlying profit before tax**

* In India, we have an exclusive franchise agreement with Trent, the retail arm of the Tata Group. We are supporting the development of their

Star Bazaar format. Continuing operations exclude Japan which has been treated as discontinued following our decision to sell the business.

** See glossary for full accounting definitions.

† Calculated on a constant tax rate basis.

Asia

Revenue growth±

+10.5%

Employees

117,015

Stores

1,719

Trading profit growth

+21.8%

Revenue±Trading profit

Market position 1st or 2nd in all except China

Multiple formats

include

Hypermarkets, supermarkets,

convenience

Loyalty scheme Clubcard in Malaysia and Thailand,

Family Card in South Korea, Legou

Tesco Membercard in China – over

20 million active members across Asia

dotcom South Korea 2002, planned

launches in at least one major city

in each market in the next few years

Fascia brands include:

£10.8bn

17% of Group

£737m

20% of Group

Europe

Revenue growth±

+7. 3%

Employees

94,409

Revenue±

Market position 1st o

Multiple formats

include

Dep

supe

hype

Loyalty scheme Club

activ

dotcom Repu

2011

2012

in ea

Fascia brands include:

£9.9bn

15% of Group

UK

Revenue growth±

+5.0%

Employees

300,373

Stores

2,979

Trading profit growth

(1.0)%

Revenue±Trading profit

Market position 1st

Multiple formats

include

Hypermarkets, superstores,

supermarkets, convenience

Loyalty scheme Clubcard – around 16 million

active members

dotcom First grocery home shopping

service1997

Fascia brands include:

£42.8bn

66% of Group

£2,480m

66% of Group