Tesco 2012 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS

OVERVIEW

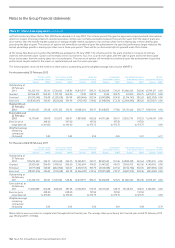

Note 31 Business combinations and other acquisitions

Business combinations

During the financial year, the Group completed five business combination transactions as follows:

i) 18 March 2011 – Acquired 100% of the ordinary share capital relating to the 77 stores of Mills Group in the UK for a cash consideration of £10m;

ii) 1 April 2011 – Acquired 100% of the ordinary share capital relating to the 87 franchised kiosks and 47 stores branded as Zabka and Koruna in the

Czech Republic for a cash consideration of £36m;

iii) 18 April 2011 – Acquired 80.25% of the ordinary share capital of Blinkbox Entertainment Limited in the UK for a cash consideration of £3m;

iv) 8 June 2011 – Acquired 100% of the ordinary share capital of BzzAgent Inc and BzzAgent Limited for a cash consideration of £9m and deferred

contingent consideration of £15m; and

v) 18 August 2011 – Acquired the remaining 50% of the ordinary share capital of its joint venture Multi Veste Czech Republic 9, s.r.o not already

owned by the Group for a total consideration of £24m, split equally between cash and equity.

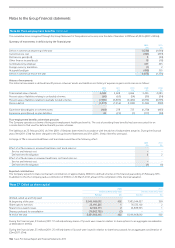

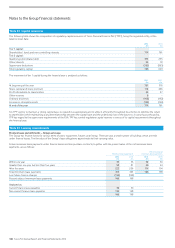

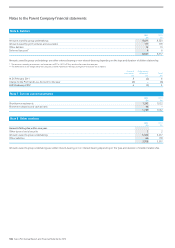

The table below sets out the provisional fair values to the Group in respect of these acquisitions.

Provisional

fair values on

acquisition

£m

Non-current assets 107

Current assets 25

Cash 5

Current liabilities (41)

Non-current liabilities (98)

Net liabilities acquired (2)

Non-controlling interests (1)

Goodwill arising on acquisition 100

97

Consideration:

Cash 70

Non-cash 27

Total consideration 97

The goodwill represents synergies within the operating models and the economies of scale expected from incorporating the operations of acquired

entities within the Group.

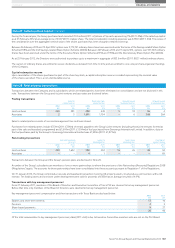

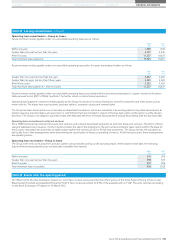

Purchase of non-controlling interest

On 1 July 2011, the Group completed the acquisition of the remaining 6% of the ordinary share capital of Homeplus Co., Limited for a cash

consideration of £73m.

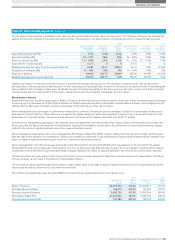

Note 32 Commitments and contingencies

Capital commitments

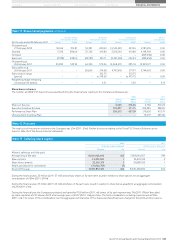

At 25 February 2012, there were commitments for capital expenditure contracted for, but not provided for of £1,599m (2011: £1,719m), principally

relating to the store development programme.

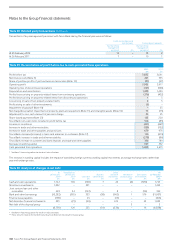

Contingent liabilities

For details of assets held under finance leases, which are pledged as security for the finance lease liabilities, see Note 11.

There are a number of contingent liabilities that arise in the normal course of business which if realised are not expected to result in a material liability

to the Group. The Group recognises provisions for liabilities when it is more likely than not that a settlement will be required and the value of such a

payment can be reliably estimated.

Tesco Bank

At 25 February 2012, Tesco Bank had commitments of formal standby facilities, credit lines and other commitments to lend, totalling £7.4bn

(2011: £7.1bn). The amount is intended to provide an indication of the potential volume of business and not of the underlying credit or other risks.

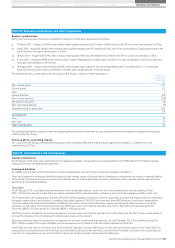

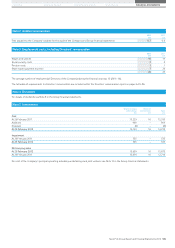

The Financial Services Compensation Scheme (‘FSCS’) is the UK statutory fund of last resort for customers of authorised financial services institutions

and pays compensation if an institution is unable to pay claims against it. The FSCS has borrowed from HM Treasury to fund these compensation

costs associated with institutions that failed in 2008 and will receive receipts from asset sales, surplus cash flow and other recoveries from these

institutions in the future. The initial borrowings from HM Treasury are on an interest-only basis and, from 1 April 2012, this has increased from

12month LIBOR + 30 basis points to 12 month LIBOR + 100 basis points.

The FSCS meets its obligations by raising management expense levies which will be kept based on limits advised by the FSA. These include amounts

to cover the interest on its borrowings and compensation levies on the industry.

Each deposit-taking institution contributes in proportion to its share of total protected deposits. As at 25 February 2012, Tesco Bank accrued £5m

(2011: £3m) in respect of its current obligation to meet expenses levies, based on indicative costs published by the FSCS.

If the FSCS does not receive sufficient funds from the failed institutions to repay HM Treasury in full it will raise compensation levies. At this time it is

not possible to estimate the amount or timing of any shortfall resulting from the cash flows received from the failed institutions and, accordingly, no

provision for compensation levies, which could be significant, has been made in these financial statements.

Tesco PLC Annual Report and Financial Statements 2012 139