Tesco 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

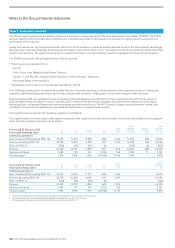

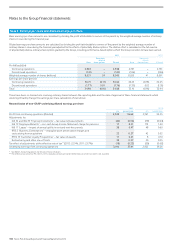

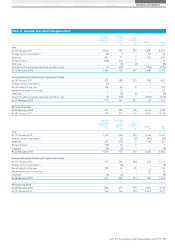

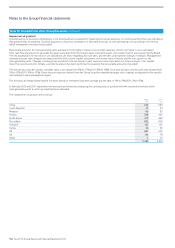

Notes to the Group financial statements

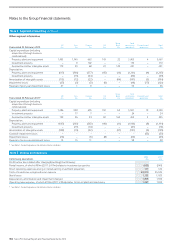

Note 2 Segmental reporting

The Group’s reporting segments are determined based on the Group’s internal reporting to the Chief Operating Decision Maker (‘CODM’). The CODM

has been determined to be the Executive Committee as it is primarily responsible for the allocation of resources to segments and the assessment of

performance of the segments.

During the financial year, the Group announced its decision to sell its operations in Japan (previously reported as part of the Asia segment). Accordingly,

these operations have been treated as discontinued as described in more detail in Notes 1 and 7. The segment results do not include any amounts for these

discontinued operations. The segment assets and other segment information sets out continuing operations separately from discontinued operations.

The CODM now considers the principal activities of the Group to be:

Retailing and associated activities in:

– the UK;

– Asia – China, India, Malaysia, South Korea, Thailand;

– Europe – Czech Republic, Hungary, Poland, Republic of Ireland, Slovakia, Turkey; and

– the United States of America (‘US’)

Retail banking and insurance services through Tesco Bank in the UK.

The CODM uses trading profit, as reviewed at monthly Executive Committee meetings, as the key measure of the segments’ results as it reflects the

segments’ underlying trading performance for the financial year under evaluation. Trading profit is a consistent measure within the Group.

Segment trading profit is an adjusted measure of operating profit and measures the performance of each segment before profits/losses arising on

property-related items, the impact on leases of annual uplifts in rent and rent-free periods, intangible asset amortisation charges and costs arising

from acquisitions, and goodwill impairment and restructuring and other one-off costs. The IAS 19 pension charge is replaced with the ‘normal’ cash

contributions for pensions. An adjustment is also made for the fair value of customer loyalty awards.

Inter-segment revenue between the operating segments is not material.

The segment results, the reconciliation of the segment measures to the respective statutory items included in the Group Income Statement, the segment

assets and other segment information are as follows:

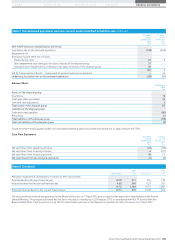

Year ended 25 February 2012

At constant exchange rates*UK

£m

Asia

£m

Europe

£m

US

£m

Tesco

Bank

£m

Total at

constant

exchange

£m

Foreign

exchange

£m

Total

at actual

exchange

£m

Continuing operations

Sales including VAT (excluding IFRIC 13) 47,355 11,615 11,380 660 1,044 72,054 (19) 72,035

Revenue (excluding IFRIC 13) 42,798 10,816 9,878 652 1,044 65,188 (22) 65,166

Effect of IFRIC 13 (550) (35) (39) (2) – (626) (1) (627)

Revenue 42,248 10,781 9,839 650 1,044 64,562 (23) 64,539

Trading profit/(loss) 2,480 735 525 (158) 168 3,750 11 3,761

Trading margin†5.8% 6.8% 5.3% (24.2%) 16.1% 5.8% 5.8%

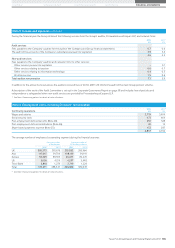

Year ended 25 February 2012

At actual exchange rates** UK

£m

Asia

£m

Europe

£m

US

£m

Tesco

Bank

£m

Total

at actual

exchange

£m

Continuing operations

Sales including VAT (excluding IFRIC 13) 47,355 11,627 11,371 638 1,044 72,035

Revenue (excluding IFRIC 13) 42,798 10,828 9,866 630 1,044 65,166

Effect of IFRIC 13 (550) (35) (40) (2) – (627)

Revenue 42,248 10,793 9,826 628 1,044 64,539

Trading profit/(loss) 2,480 737 529 (153) 168 3,761

Trading margin†5.8% 6.8% 5.4% (24.3%) 16.1% 5.8%

* Constant exchange rates are the average actual periodic exchange rates for the previous financial year.

** Actual exchange rates are the average actual periodic exchange rates for that financial year.

† Trading margin is based on revenue excluding the accounting impact of IFRIC 13.

102 Tesco PLC Annual Report and Financial Statements 2012