Tesco 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS

OVERVIEW

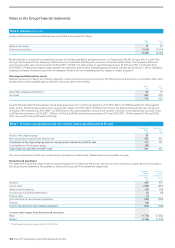

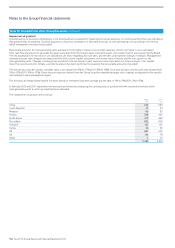

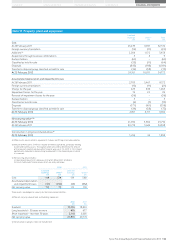

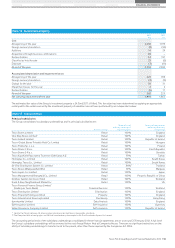

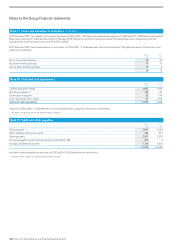

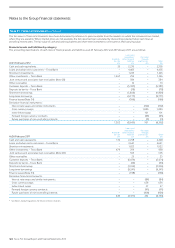

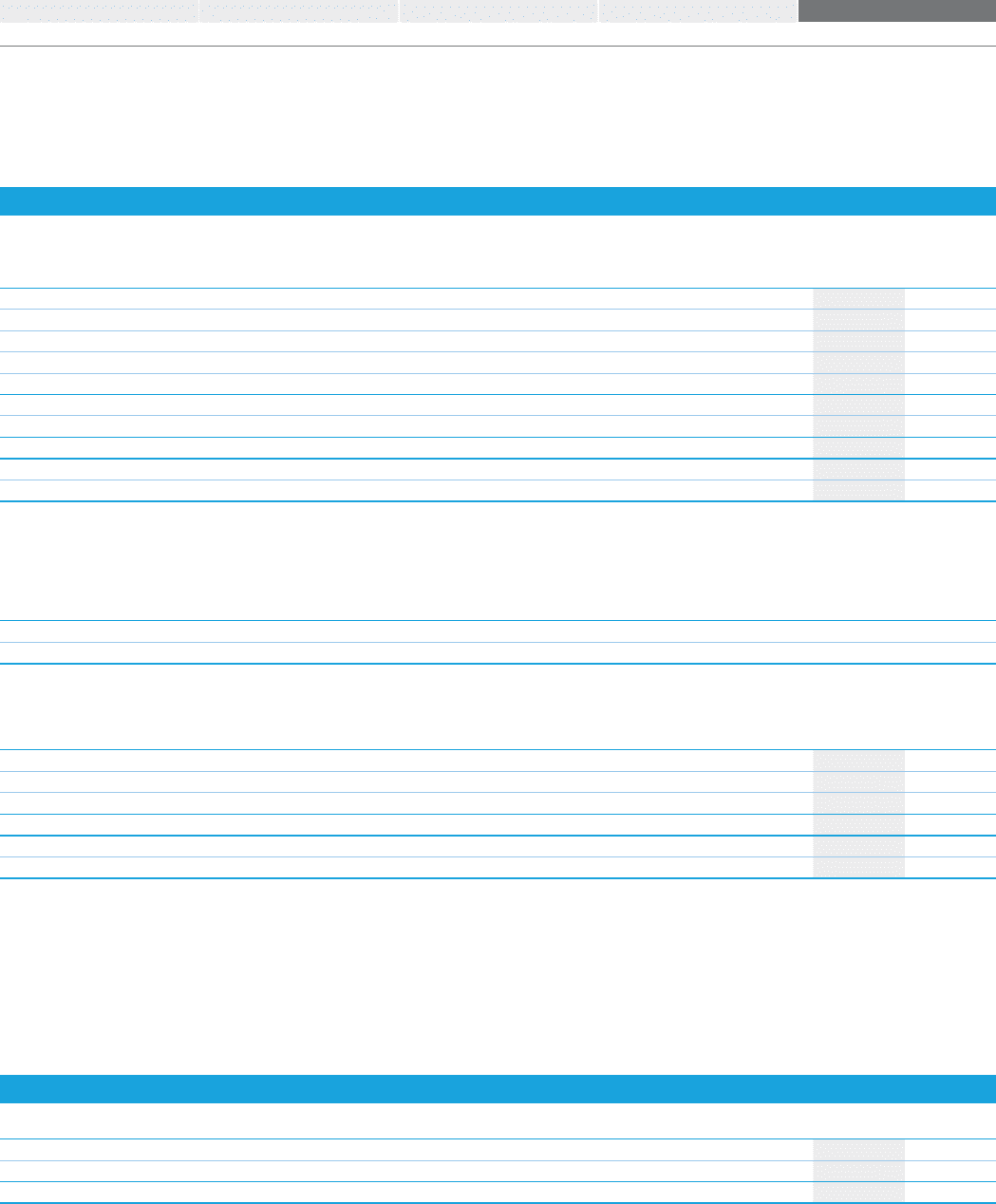

Note 13 Group entities continued

The share of the assets, liabilities, revenue and profit of the joint ventures, which are included in the Group financial statements, are as follows:

2012

£m

2011

£m

Non-current assets 3,173 2,720

Current assets 868 577

Current liabilities (2,180) (1,957)*

Non-current liabilities (1,678) (1,123)

Goodwill 7 7

Net assets 190 224

Cumulative unrecognised losses 118 –

Interests in joint ventures 308 224

Revenue 492 369

Profit for the year 71 65

Associates

The Group’s principal associates are:

Business activity

Share of issued share capital,

loan capital and debt

securities

Country of incorporation

and principal country

of operation

Greenergy International Limited** Fuel Supplier 34.4% England

Tesco Underwriting Limited** Insurance 49.9% England

The share of the assets, liabilities, revenue and profit of the Group’s associates, which are included in the Group financial statements, are as follows:

2012

£m

2011

£m

Assets 782 535

Liabilities (673) (452)

Goodwill 6 9

Interests in associates 115 92

Revenue 3,791 1,551

Profit/(loss) for the year 20 (8)

The accounting period ends of the associates consolidated in these financial statements range from 31 December 2011 to 29 February 2012. The

accounting period end dates of the associates are different from those of the Group as they depend upon the requirements of the parent companies

of those entities.

There are no significant restrictions on the ability of associated undertakings to transfer funds to the parent, other than those imposed by the

Companies Act 2006.

* Includes £59m relating to cumulative unrecognised losses.

** Held by an intermediate subsidiary.

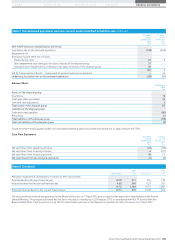

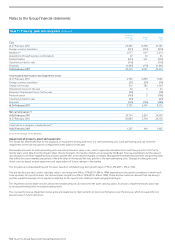

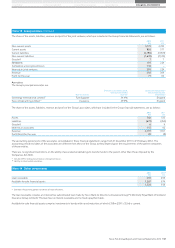

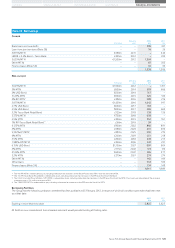

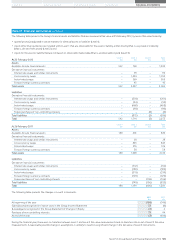

Note 14 Other investments

2012

£m

2011*

£m

Loan receivable 259 259

Available-for-sale financial assets 1,267 679

1,526 938

* See Note 1 Accounting policies for details of reclassifications.

The loan receivable includes an interest-free subordinated loan made by Tesco Bank to Direct Line Insurance Group Plc (formerly Royal Bank of Scotland

Insurance Group Limited). This loan has no interest receivable and no fixed repayment date.

Available-for-sale financial assets comprise investments in bonds with varied maturities of which £158m (2011: £32m) is current.

Tesco PLC Annual Report and Financial Statements 2012 117