Tesco 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

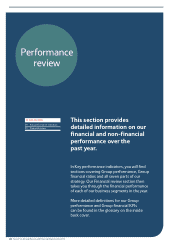

08/09

£(142)m £(165)m £(153)m

09/10 11/12

US trading loss

£(186)m

10/11

An increasing number of stores are reaching shop-door profitability,

which means that they are operating profitably, before taking account

of central costs. Thirty stores are already making a positive contribution

to cashflow, and 118 more are very close to doing so. We intend to

focus on delivering this store-level profitability, before pushing on

faster with expansion in the number of stores. As a result of this more

measured approach to new capital expenditure, we now anticipate

crossing into break-even in the US during 2013/14.

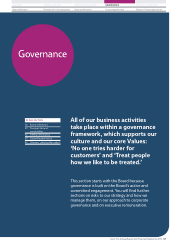

Tesco Bank

Tesco Bank results 2011/12

2011/12 Growth

Tesco Bank revenue (exc. VAT, exc. impact of IFRIC 13) £1,044m 13.6%

Tesco Bank trading profit £168m (36.4)%

Tesco Bank trading margin 16.09% (1,264)bp

Tesco Bank baseline profit £203m 29.3%

Tesco Bank increased its baseline profitability very strongly by 29%.

This measures business growth, before key non-trading provisioning

movements. This performance was particularly pleasing given the need

to take a conservative approach on new savings and loans business

during the final stages of systems migration. As we put more than three

years of transition behind us, the Bank is well placed to deliver good

growth, starting in the coming year.

Trading profit was impacted by a number of factors. The unwind of

the fair value provision, dating from the time of acquisition in 2008,

reduced by £133 million in the year, to £22 million, and will be

immaterial going forward. We increased our provision against possible

claims arising from the sale of PPI by £57 million in the first half of the

year. With no further adjustments in the second half, we ended the year

with a net provision of £75 million. Our decision to slow down the final

stages of migration also impacted profit by around £40 million which

will now begin to reverse.

Bad debts reduced by 5.2% in the year due to the application of our

robust credit policy. The Bank’s overall capital position improved, from

an already good position. Liquidity has also improved, with the retail

bond issues giving us greater diversity in the Bank’s funding position.

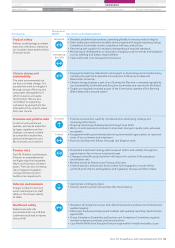

08/09*

£221m

£250m

£168m

09/10 11/12

Tesco Bank trading profit

£264m

10/11

* On a 2008/09 pro-forma basis.

Group balance sheet

Net debt remained stable for the year at £6.8 billion. This is a little

behind our expectations at the half-year, due to the impact of the

Christmas trading result on cash flow and to lower working capital

inflow, linked to higher stock levels than planned. Group capital

expenditure was slightly below our half-year expectation, at £3.8 billion,

due to tight control of spending. Operating cash flow from retail

operations was down slightly year-on-year, at £3.8 billion, again

affected by lower working capital inflow.

Our strategy to release value from our property portfolio has had

another successful year, generating £376 million of property profits

from around £1 billion of disposals. The launch of our first property

fund in Asia completed successfully after the year end, raising over

£379 million from 17 mature stores and malls in Thailand. With the

fund seeing strong demand on launch, and since trading above its

listing price, this is a strong indication of the overall value of our

operations in Thailand and elsewhere in Asia. The market value

of our global property currently exceeds £37 billion.

Finally, our IAS 19, or accounting, pension deficit increased to

£1.4billion after tax, largely as a consequence of market conditions.

We announced proposed changes to the terms of our defined benefits

scheme in March, in order to make it more sustainable over the long

term. We also made a one-off cash contribution of £180 million to the

scheme after the year end, in anticipation of the forthcoming outcome

of the triennial actuarial valuation, which we believe gives a more

accurate indication of the likely costs of future funding of the scheme.

Group financial metrics

A year ago I set out four key financial metrics or measures to help

investors monitor our capital returns performance, debt and overall

balance sheet. Taking each in turn, we have improved return on capital

employed (‘ROCE’) from 12.9% last year to 13.3%. This improvement

benefits from Japan now being classified as discontinued as a result

of our decision to exit the market.

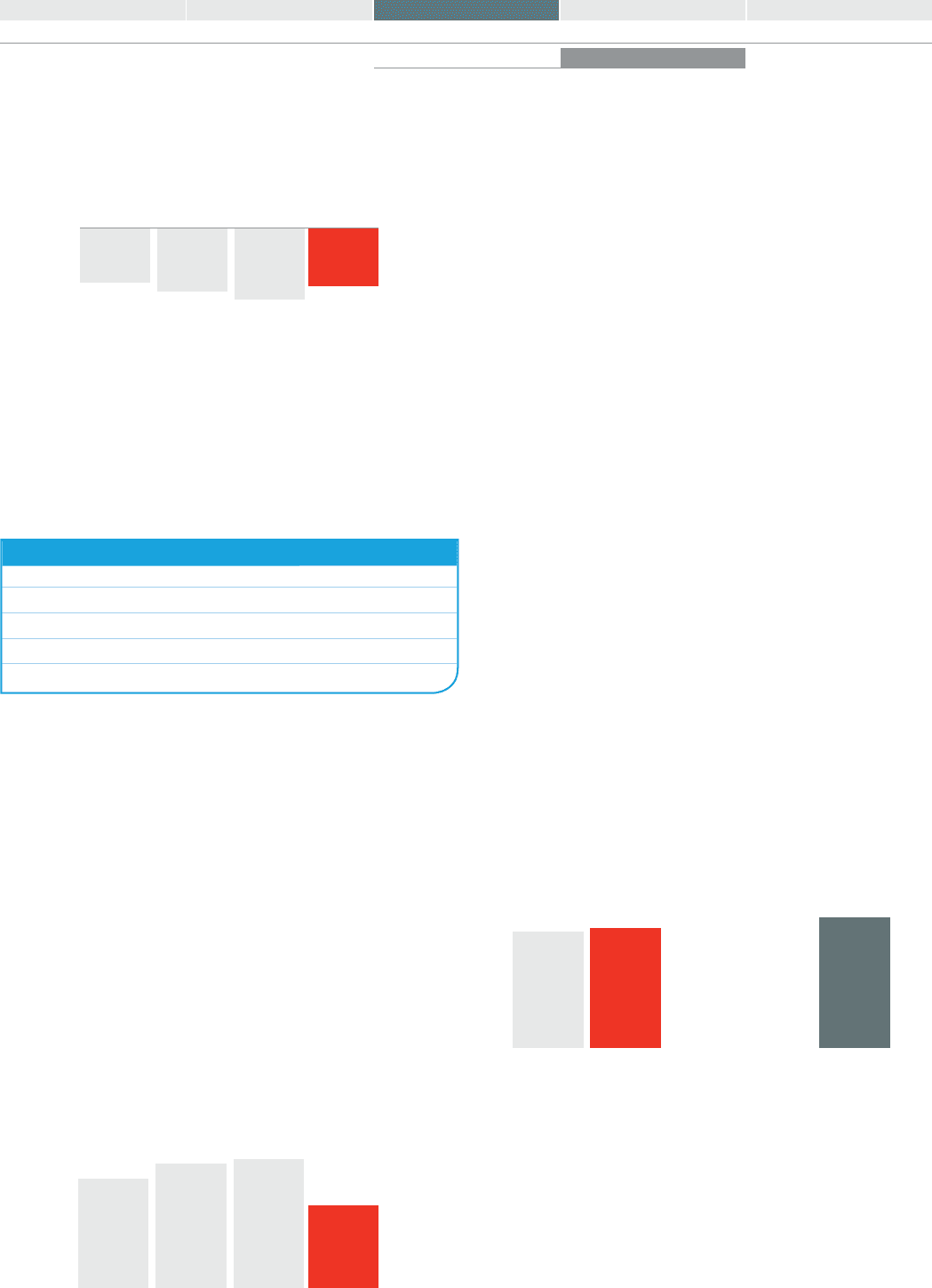

10/11

12.9% 13.3%

11/12

13.3% 14.6%

14/15

TARGET

Target return on capital employed

We held our two debt metrics, fixed charge cover and net indebtedness,

broadly flat this year. Both measures will of course be directly affected

by the UK investment plan we have announced for the coming year.

Our target for fixed charge cover is between 4 and 4.5 times and, for

net indebtedness, is 2.5 times.

On our fourth key metric, capital expenditure as a proportion of sales,

we were exactly in the middle of our target range of 5 to 5.5%.

Tesco PLC Annual Report and Financial Statements 2012 35

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTSOVERVIEW

Key performance indicators Financial review