Supercuts 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

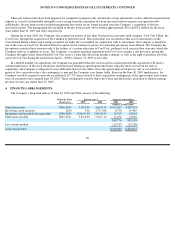

Fiscal Year 2005

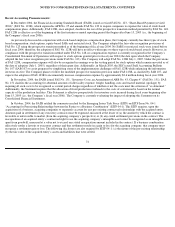

On April 7, 2005 the Company entered into an amendment and restatement of its existing revolving credit facility with a syndicate of eight

banks. Among other changes, this amendment and restatement increased the borrowing capacity under the facility from $250.0 million to

$350.0 million, extended the facility’s expiration date to April of 2010, reduced the spread charged for certain borrowings under the facility,

and modified certain financial covenants.

As so amended, the credit agreement includes financial covenants and other customary terms and conditions for credit facilities of this

type. The maturity date for the facility may be accelerated upon the occurrence of various events of default, including breaches of the credit

agreement, certain cross-default situations, certain bankruptcy-related situations, and other customary events of default for a facility of this

type. The interest rates under the facility vary and are based on a bank’s reference rate, the federal funds rate and/or LIBOR, as applicable, and

a leverage ratio for the Company determined by a formula tied to the Company’s debt and its adjusted income.

In addition, on April 7, 2005, the Company issued $200.0 million of senior unsecured debt to approximately twenty purchasers via a

private placement transaction pursuant to a Master Note Purchase Agreement. The placement was split into four tranches, with $100 million

maturing March 31, 2013 and $100.0 million maturing March 31, 2015. Of the debt maturing in 2013, $30.0 million was issued as fixed rate

debt with a rate of 4.97 percent. The remaining $70.0 million was issued as variable rate debt and is priced at 0.52 percent over LIBOR. As for

the $100 million maturing in 2015, $70.0 million was issued at a fixed rate of 5.20 percent, with the remaining $30.0 million issued as variable

rate debt, priced at 0.55 percent over LIBOR. All four tranches are non-amortizing and no principle payments are due until maturity. Interest

payments on the fixed rate obligations are due semi-annually and interest payments on the variable rate obligations are due quarterly.

The Master Note Purchase Agreement includes financial covenants and other customary terms and conditions for debt of this type. The

maturity date for the debt may be accelerated upon the occurrence of various Events of Default, including breaches of the agreement, certain

cross-default situations, certain bankruptcy-related situations, and other customary events of default for debt of this type.

In anticipation of its new Master Note Purchase Agreement discussed above, the Company entered into a First Amendment to Note

Purchase Agreement with respect to an existing Note Purchase Agreement dated as of March 1, 2002. The Company closed on the amendment

on April 7, 2005. The amendment modified certain financial covenants so that they would be more consistent with the financial covenants in

the new Master Note Purchase Agreement.

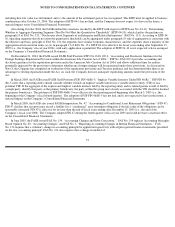

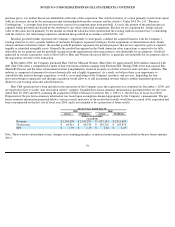

Fiscal Year 2004

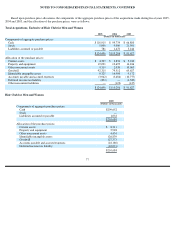

In the second quarter of fiscal year 2004, the Company entered into an $11.9 million term loan related to its Salt Lake City Distribution

Center. The loan has a rate of 7.16 percent and matures in November of fiscal year 2011.

General Financing Information

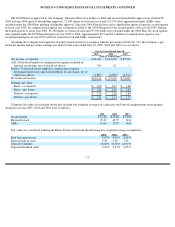

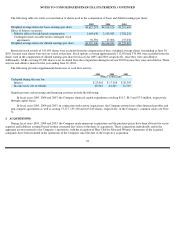

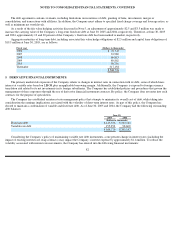

The equipment and leasehold notes payable are primarily comprised of capital lease obligations totaling $19.5 and $12.8 million at

June 30, 2005 and 2004, respectively. These capital lease obligations are payable in monthly installments through fiscal year 2010.

All of the Company’s debt instruments are unsecured, except for its capital lease obligations which are collateralized by the assets

purchased under the agreement and the term loan entered into during fiscal year 2004 related to the Salt Lake City Distribution Center.

81