Supercuts 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

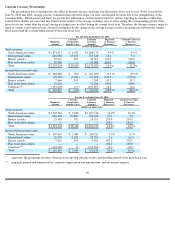

value is not recoverable through those cash flows, the asset grouping is considered to be impaired. The impairment is measured by the

difference between the assets’ carrying amount and their fair value, based on the best information available, including market prices or

discounted cash flow analysis.

Judgments made by management related to the expected useful lives of long-

lived assets and the ability to realize undiscounted cash flows

in excess of the carrying amounts of such assets are affected by factors such as the ongoing maintenance and improvement of the assets,

changes in economic conditions and changes in operating performance. As the ongoing expected cash flows and carrying amounts of long-

lived assets are assessed, these factors could cause us to realize material impairment charges.

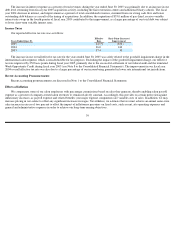

Purchase Price Allocation

We make numerous acquisitions. The purchase prices are allocated to assets acquired, including identifiable intangible assets, and

liabilities assumed based on their estimated fair values at the dates of acquisition. Fair value is estimated based on the amount for which the

asset or liability could be bought or sold in a current transaction between willing parties. For our acquisitions, the majority of the purchase price

that is not allocated to identifiable assets, or liabilities assumed, is accounted for as residual goodwill rather than identifiable intangible assets.

This stems from the value associated with the walk-in customer base of the acquired salons, the value of which is not recorded as an

identifiable intangible asset under current accounting guidance and the limited value of the acquired leased site and customer preference

associated with the acquired hair salon brand. Residual goodwill further represents our opportunity to strategically combine the acquired

business with our existing structure to serve a greater number of customers through our expansion strategies.

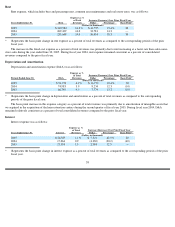

Revenue Recognition

Company-owned salon revenues, beauty school revenues from services performed or products sold, and service and product sale revenues

occurring in hair restoration centers which do not require future services, along with the related gross margins, are recorded at the time of sale.

This treatment results as services are provided or delivery occurs (for product revenues), and the customer’s payment is received, at the time of

sale. There are minimal accounting judgments and uncertainties affecting the application of this policy. Based on historical results, refunds to

the customer represent less than one percent of total company-owned revenues. The vast majority of returns and refunds occur within a matter

of days of the original sales transaction. A significant increase in returns or refunds could have a material impact on revenues disclosed in the

Consolidated Financial Statements.

Beauty school tuition payments are originally recorded as deferred revenues. The earnings process is culminated once the Company

performs under the terms of the contract (i.e., instructs a class). Therefore, revenue is recognized and deferred revenue is reversed

proportionally as the classes are held. Based on this practice, little judgment is exercised related to recognizing beauty school tuition revenues.

However, we must estimate our expected exposure to refunds and uncollectible accounts, which are recorded as a reduction to tuition revenues.

A significant variance between expected and actual refunds could have a material impact on revenues disclosed in the Consolidated Financial

Statements.

Payments for services performed under customer contracts covering a specified time span in the hair restoration centers are originally

recorded as deferred revenues. The earnings process is culminated once the Company performs under the terms of the contract. Therefore,

revenue is recognized and deferred revenue is reversed on a straight-line basis over the course of contract period, which could vary slightly

from the actual timing of services performed under the contract.

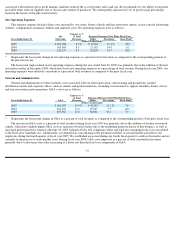

Cost of Product Used and Sold

Product costs are determined by applying estimated gross profit margins to service and product revenues, which are based on historical

factors including product pricing trends and estimated shrinkage. In addition, the estimated gross profit margin is adjusted based on the results

of physical inventory counts

31