Supercuts 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

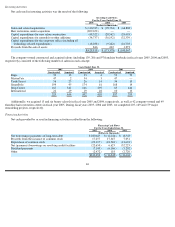

Fiscal Year 2004

In the second quarter of fiscal year 2004, we entered into an $11.9 million term loan related to our Salt Lake City Distribution Center. The

loan has a rate of 7.16 percent and matures in November of fiscal year 2011.

Fiscal Year 2003

In November 2002, we extended our revolving credit facility through November 2006. In February 2003, we renewed one of our private

placement debt facilities, thereby extending its terms through October 1, 2005 and increasing its related borrowing capacity from $125.0 to

$246.0 million. No other significant changes were made to either of the facilities’ terms. There were no other significant financing activities

during fiscal year 2003. Derivative instruments are discussed in Note 5 to the Consolidated Financial Statements and in Item 7A. of this Annual

Report on Form 10-K.

In June 2003, we borrowed $30.0 million under a 4.69 percent senior term note due June 2013 to repay existing debt from our revolving

credit facility.

Acquisitions

Acquisitions are discussed throughout Management’s Discussion and Analysis in this Item 8, as well as in Note 3 to the Consolidated

Financial Statements. The most significant of these acquisitions relates to the purchase of the hair restoration centers; refer to Note 3 of the

Consolidated Financial Statements for related pro forma information. The remainder of the acquisitions, individually and in the aggregate, were

not material to our operations. The acquisitions were funded primarily from operating cash flow, debt and the issuance of common stock.

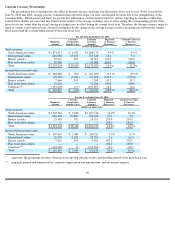

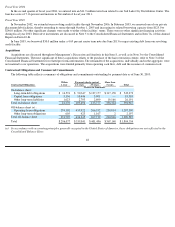

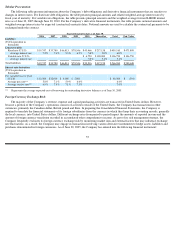

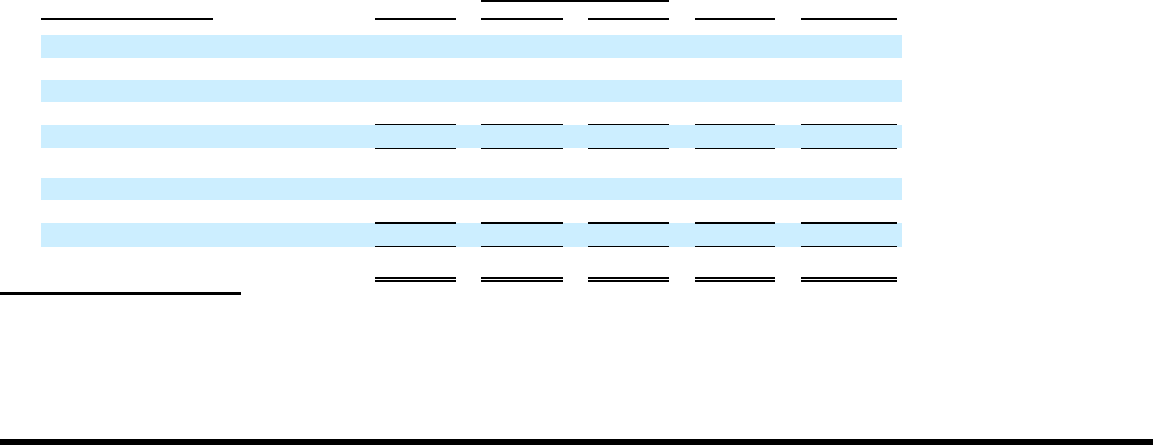

Contractual Obligations and Commercial Commitments

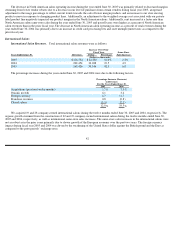

The following table reflects a summary of obligations and commitments outstanding by payment date as of June 30, 2005:

(a)

In accordance with accounting principles generally accepted in the United States of America, these obligations are not reflected in the

Consolidated Balance Sheet.

48

Within

Payments due by period

More than

Contractual Obligations

1 year

1

-

3 years

3

-

5 years

5 years

Total

(Dollars in thousands)

On

-

balance sheet:

Long

-

term debt obligations

$

14,591

$

90,347

$

127,177

$

317,158

$

549,273

Capital lease obligations

5,156

10,446

3,901

—

19,503

Other long-term liabilities

1,623

2,703

2,699

19,166

26,191

Total on-balance sheet

21,370

103,496

133,777

336,324

594,967

Off

-

balance sheet

(a)

:

Operating lease obligations

274,102

435,922

266,552

230,814

1,207,390

Other long-term obligations

605

423

1,167

2

2,197

Total off-balance sheet

274,707

436,345

267,719

230,816

1,209,587

Total

$

296,077

$

539,841

$

401,496

$

567,140

$

1,804,554