Supercuts 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

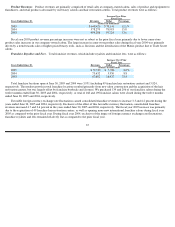

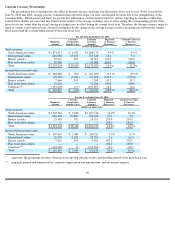

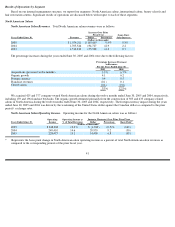

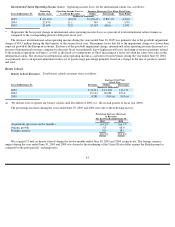

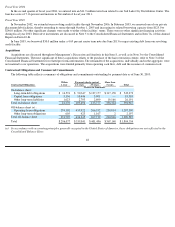

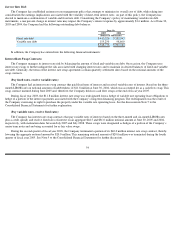

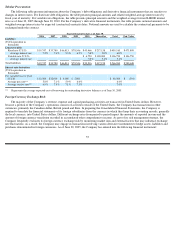

Total assets at June 30, 2005 and 2004 were as follows:

Acquisitions, including the acquisition of Hair Club for Men and Women in December 2004, were primarily funded by a combination of

operating cash flows, debt and the assumption of acquired liabilities.

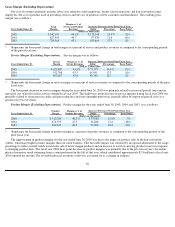

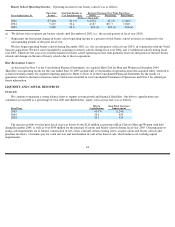

Total shareholders’ equity at June 30, 2005 and 2004 was as follows:

During fiscal year 2005 and 2004, equity increased as a result of net income, increased accumulated other comprehensive income due to

foreign currency translation adjustments as the result of the strengthening of foreign currencies that underlie our investments in those markets,

and additional paid-in capital recorded in connection with the exercise of stock options and stock issued for business acquisitions, partially

offset by share repurchases under our stock repurchase program.

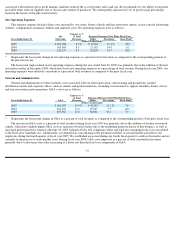

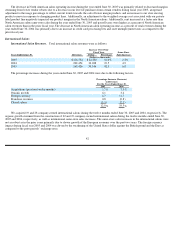

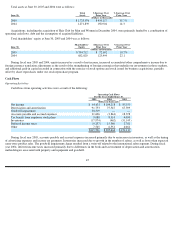

Cash Flows

Operating Activities

Cash flows from operating activities were a result of the following:

During fiscal year 2005, accounts payable and accrued expenses increased primarily due to an increase in inventory, as well as the timing

of advertising expenses and income tax payments. Inventories increased due to growth in the number of salons, as well as lower than expected

same-store product sales. The goodwill impairment charge resulted from a write-off related to the international salon segment. During fiscal

year 2004, deferred income taxes increased primarily due to differences in the book and tax treatment of depreciation and amortization

methodologies associated with property and equipment and goodwill.

45

Total

$ Increase Over

% Increase Over

June 30,

Assets

Prior Year

Prior Year

(Dollars in thousands)

2005

$

1,725,976

$

454,117

35.7

%

2004

1,271,859

158,904

14.3

Shareholders

’

$

Increase Over

% Increase Over

June 30,

Equity

Prior Year

Prior Year

(Dollars in thousands)

2005

$

754,712

$

72,692

10.7

%

2004

682,020

123,494

22.1

Operating Cash Flows

For the Years Ended June 30,

2005

2004

2003

(Dollars in thousands)

Net income

$

64,631

$

104,218

$

85,555

Depreciation and amortization

91,753

75,547

67,399

Goodwill impairment

38,319

—

—

Accounts payable and accrued expenses

31,626

(3,844

)

18,378

Tax benefit from employee stock plans

9,088

8,314

4,090

Inventories

(17,974

)

(462

)

(31,145

)

Deferred income taxes

(9,257

)

15,340

2,781

Other

7,545

6,551

4,061

$215,731

$

205,664

$

151,119