Supercuts 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Regulation

Both federal and state financial aid programs contain numerous and complex regulations which require compliance not only by the

recipient student but also by the institution which the student attends. The Company monitors compliance through periodic visits to the

individual beauty schools by Home Office staff. Failure to materially comply with such regulations at any of the Campuses could have serious

consequences, including limitation, suspension, or termination of the eligibility of that Campus to participate in the funding programs.

Additionally, these aid programs require accreditation by the schools.

Hair Restoration Business Strategy:

In December 2004, the Company acquired Hair Club for Men and Women (Hair Club), the largest U.S. provider of hair loss solutions and

the only company offering a comprehensive menu of proven hair loss products and services. The Company leverages its strong brand, best-in-

class service model and comprehensive menu of hair restoration alternatives to build an increasing base of repeat customers that generate

recurring cash flow for the Company. From its traditional non-surgical hair replacement systems, to hair transplants, hair therapies and hair

care products and services, Hair Club for Men and Women offers a solution for anyone experiencing or anticipating hair loss. The Company’s

operations consist of 90 locations (49 franchise) in the United States and Canada. The domestic hair restoration market is estimated to generate

over $4 billion annually. The competitive landscape is highly fragmented and comprised of approximately 4,000 locations. Hair Club and its

franchisees have the largest market share at approximately 5 percent.

In an effort to provide privacy to its customers, Hair Club for Men and Women offices are located primarily in office and professional

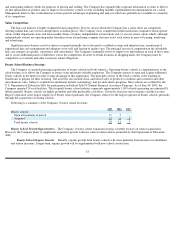

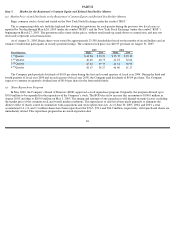

buildings within larger metropolitan areas. Following is a summary of the company-

owned and franchise hair restoration centers in operation at

June 30, 2005:

Hair Restoration Growth Opportunities. The Company’s hair restoration center expansion strategy focuses on organic (successfully

converting new leads into customers at existing centers, broadening the menu of services and products at each location and to a lesser extent,

new center construction) and acquisition growth.

Organic Growth . The hair restoration centers’ business model is driven by productive lead generation that ultimately produces

recurring customers. The primary marketing vehicle is direct response television in the form of infomercials that create leads into the hair

restoration centers’ telemarketing center. Call center employees receive calls and schedule a consultation at a local hair restoration

corporate or franchise center. At the consultation, sales consultants assess the needs of each individual client and educate them on the hair

restoration centers’ suite of hair loss solutions.

The Company’s long-term outlook for organic expansion remains strong due to several factors, including favorable industry

dynamics, addressing new market opportunities, menu expansion, developing new locations and new cross-marketing initiatives. The

aging “baby boomer” population is expanding the number of individuals within the hair restoration centers’ target market. This group of

individuals are entering their peak years of disposable income and have demonstrated a willingness to improve their physical appearance.

20

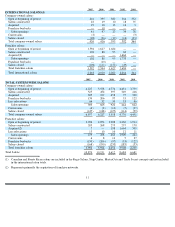

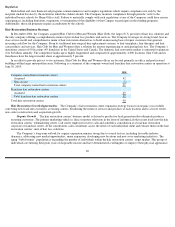

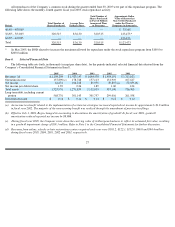

2005

Company-owned hair restoration centers:

Acquired

42

Sites closed

(1

)

Total company

-

owned hair restoration centers

41

Franchise hair restoration centers:

Acquired

49

Total franchise hair restoration centers

49

Total hair restoration centers

90