Supercuts 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Control Over Salon Operations. The Company manages its expansive salon base through a combination of area and regional

supervisors, corporate salon directors and chief operating officers. Each area supervisor is responsible for the management of approximately ten

salons. Regional supervisors oversee the performance of five area supervisors or approximately 50 salons. Salon directors manage

approximately 200 salons while chief operating officers are responsible for the oversight of an entire salon concept. This operational hierarchy

is key to the Company’s ability to expand successfully. In addition, the Company has an extensive training program, including the production

of training DVDs for use in the salons, to ensure its stylists are knowledgeable in the latest haircutting and fashion trends and provide

consistent quality hair care services. Finally, the Company tracks salon activity for all of its company-owned salons through the utilization of

daily sales detail delivered from the salons’ point of sale system. This information is used to reconcile cash on a daily basis and is also reported

to the Company’s Chief Executive Officer, who is also the Chief Operating Decision Maker.

Consistent, Quality Service. The Company is committed to meeting its customers’ hair care needs by providing competitively priced

services and products with professional and knowledgeable stylists. The Company’s operations and marketing emphasize high quality services

to create customer loyalty, to encourage referrals and to distinguish the Company’s salons from its competitors. To promote quality and

consistency of services provided throughout the Company’s salons, the Company employs full and part-time artistic directors whose duties are

to train salon stylists in current styling trends. The major services supplied by the Company’s salons are haircutting and styling, hair coloring

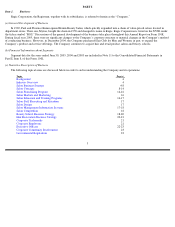

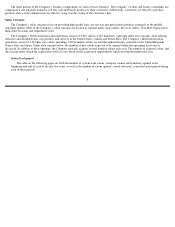

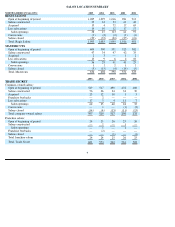

and waving, shampooing, conditioning and waxing. During fiscal year 2005, 2004 and 2003, the percentage of company-owned service

revenues attributable to each of these services was as follows:

High Quality, Professional Products. The Company’s salons merchandise nationally-recognized hair care and beauty products as well

as a complete line of private label products sold under the Regis, MasterCuts and Cost Cutters labels. The retail products offered by the

Company are sold through professional salons. The top selling brands include Matrix, Paul Mitchell, Tigi, Redken, Sebastian, Nioxin, OPI and

the Company’s various private label brands.

The Company has launched a product diversion website for the entire industry to use as a measurement tool to track diversion. Diversion

involves the selling of salon-

exclusive hair care products to discount retailers. Diversion is harmful to the consumer because diverted product is

often old, tainted or damaged. It is also harmful to the salon owners and stylists because their credibility is questioned, as well as to

manufacturers and distributors because their actions are scrutinized.

The Company has the most comprehensive assortment of retail products in the industry, with an estimated share of the North American

retail beauty product market of up to 15 percent. Although the Company constantly strives to carry an optimal level of inventory in relation to

consumer demand, it is more economical for the Company to have a higher amount of inventory on hand than to run the risk of being under-

stocked should demand prove higher than expected. The extended shelf life and lack of seasonality related to the beauty products allows the

cost of carrying inventory to be relatively low and lessens the importance of inventory turnover ratios. The Company’s primary goal is to

maximize revenues rather than inventory turns.

7

2005

2004

2003

Haircutting and styling (including shampooing & conditioning)

72

%

73

%

74

%

Hair coloring

18

17

15

Hair waving

5

5

5

Waxing

2

2

2

Other

3

3

4

100

%

100

%

100

%