Supercuts 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

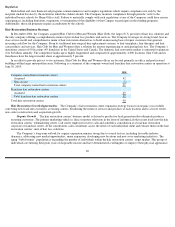

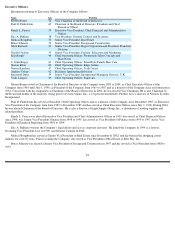

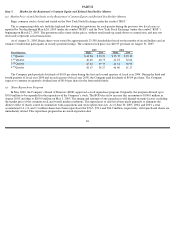

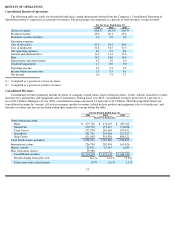

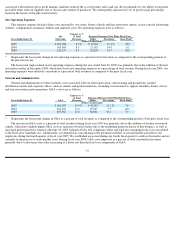

All repurchases of the Company’s common stock during the quarter ended June 30, 2005 were part of this repurchase program. The

following table shows the monthly, fourth quarter fiscal year 2005 stock repurchase activity:

*

In May 2005, the BOD elected to increase the maximum allowed for repurchase under the stock repurchase program from $100.0 to

$200.0 million

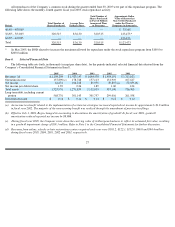

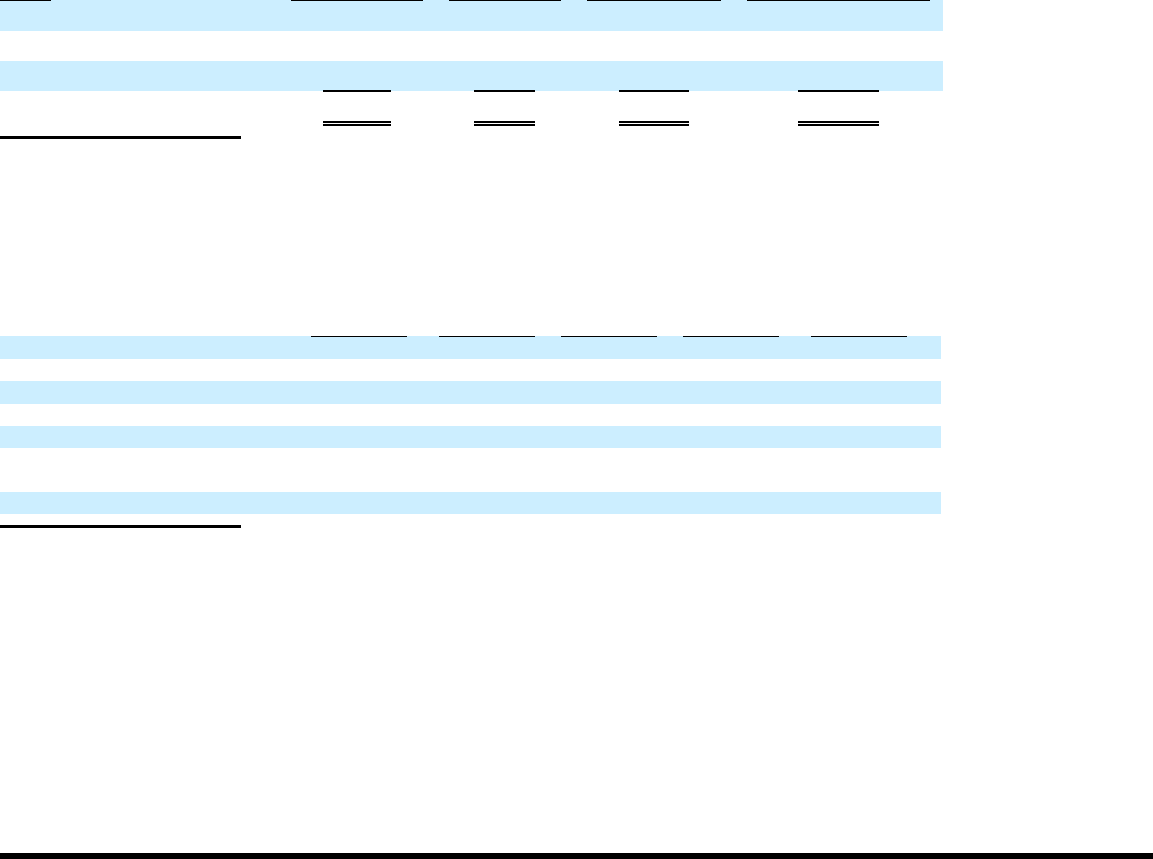

Item 6.

Selected Financial Data

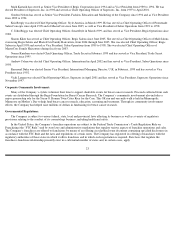

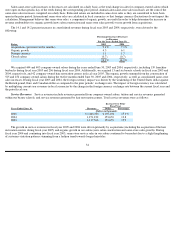

The following table sets forth, in thousands (except per share data), for the periods indicated, selected financial data derived from the

Company’s Consolidated Financial Statements in Item 8.

(a)

An income tax benefit related to the implementation of certain tax strategies increased reported net income by approximately $1.8 million

in fiscal year 2002. The majority of the nonrecurring benefit was realized through the amendment of previous tax filings.

(b)

Effective July 1, 2001, Regis changed its accounting to discontinue the amortization of goodwill. In fiscal year 2001, goodwill

amortization reduced reported net income by $8,866.

(c)

During fiscal year 2005, the Company wrote down the carrying value of its European business to reflect its estimated fair value, resulting

in a goodwill impairment charge of $38.3 million. Refer to Note 1 to the Consolidated Financial Statements for further discussion.

(d)

Revenues from salons, schools or hair restorations centers acquired each year were $181.2, $122.3, $152.9, $46.8 and $94.4 million

during fiscal years 2005, 2004, 2003, 2002 and 2001, respectively.

27

Total Number of

Approximate Dollar

Shares Purchased

Value of Shares that

As Part of Publicly

May Yet Be Purchased

Total Number of

Average Price

Announced Plans

under the Plans or

Period

Shares Purchased

Paid per Share

or Programs

Programs (in thousands)

4/1/05 - 4/30/05

—

—

—

$

35,108

5/1/05

-

5/31/05

320,515

$

36.30

320,515

123,473

*

6/1/05 - 6/30/05

—

—

—

123,473

Total

320,515

$

36.30

320,515

$

123,473

2005

2004

2003

2002

2001

Revenues (d)

$

2,194,294

$

1,923,143

$

1,684,530

$

1,454,191

$

1,311,621

Operating income

137,890

(c)

178,748

157,113

131,919

107,617

Net income

64,631

104,218

85,555

70,855

(a)

52,035

(b)

Net income per diluted share

1.39

2.26

1.89

1.60

1.24

Total assets

1,725,976

1,271,859

1,112,955

957,190

736,505

Long-term debt, including current

portion

568,776

301,143

301,757

299,016

261,558

Dividends declared

$

0.16

$

0.14

$

0.12

$

0.12

$

0.12