Supercuts 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

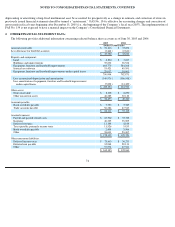

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

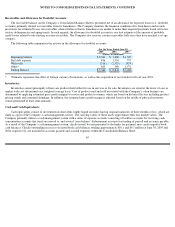

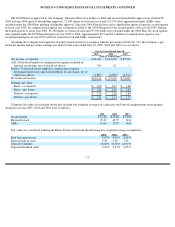

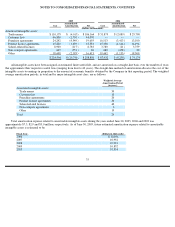

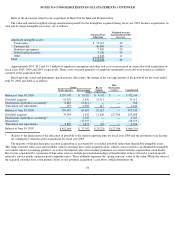

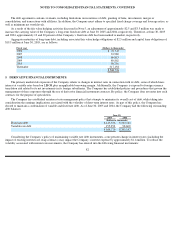

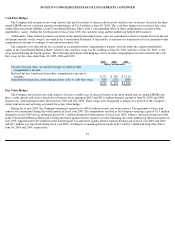

All intangible assets have been assigned an estimated finite useful life, and are amortized on a straight-line basis over the number of years

that approximate their respective useful lives (ranging from four to 40 years). The straight-line method of amortization allocates the cost of the

intangible assets to earnings in proportion to the amount of economic benefits obtained by the Company in that reporting period. The weighted

average amortization periods, in total and by major intangible asset class, are as follows:

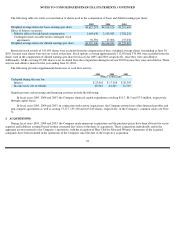

Total amortization expense related to amortizable intangible assets during the years ended June 30, 2005, 2004 and 2003 was

approximately $7.5, $2.9 and $3.0 million, respectively. As of June 30, 2005, future estimated amortization expense related to amortizable

intangible assets is estimated to be:

75

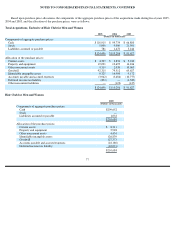

2005

2004

Accumulated

Accumulated

Cost

Amortization

Net

Cost

Amortization

Net

(Dollars in thousands)

Amortized intangible assets:

Trade names

$

110,179

$

(4,015

)

$

106,164

$

31,879

$

(2,089

)

$

29,790

Customer lists

46,800

(2,730

)

44,070

—

—

—

Franchise agreements

24,242

(4,549

)

19,693

16,513

(3,413

)

13,100

Product license agreements

15,220

(1,639

)

13,581

15,338

(1,144

)

14,194

School

-

related licenses

8,900

(117

)

8,783

3,780

(21

)

3,759

Non

-

compete agreements

647

(551

)

96

480

(458

)

22

Other

18,608

(2,195

)

16,413

19,442

(1,133

)

18,309

$

224,596

$

(15,796

)

$

208,800

$

87,432

$

(8,258

)

$

79,174

Weighted Average

Amortization Period

(in years)

Amortized intangible assets:

Trade names

39

Customer list

10

Franchise agreements

20

Product license agreements

30

School

-

related licenses

40

Non

-

compete agreements

6

Other

19

Total

29

Fiscal Year

(Dollars in thousands)

2006

$

10,956

2007

10,952

2008

10,921

2009

10,852

2010

10,814