Supercuts 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

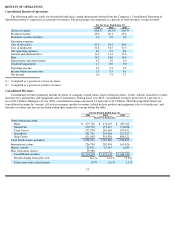

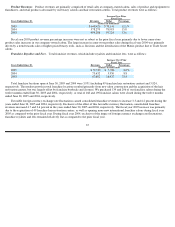

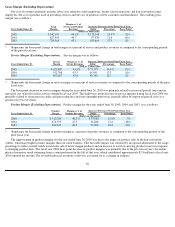

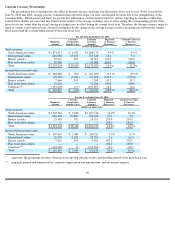

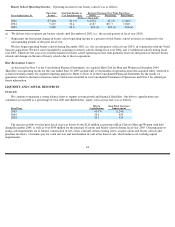

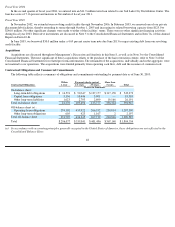

Rent

Rent expense, which includes base and percentage rent, common area maintenance and real estate taxes, was as follows:

* Represents the basis point change in rent expense as a percent of total revenues as compared to the corresponding periods of the prior

fiscal year.

The increase in this fixed-cost expense as a percent of total revenues was primarily due to rent increasing at a faster rate than salon same-

store sales during the year ended June 30, 2005. During fiscal year 2004, rent expense remained consistent as a percent of consolidated

revenues compared to the prior fiscal year.

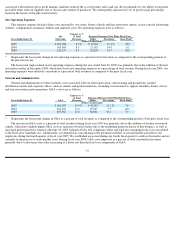

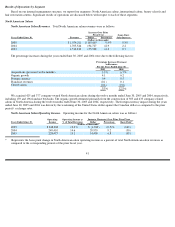

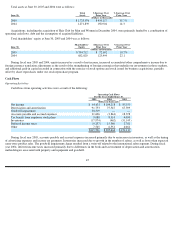

Depreciation and Amortization

Depreciation and amortization expense (D&A) was as follows:

* Represents the basis point change in depreciation and amortization as a percent of total revenues as compared to the corresponding

periods of the prior fiscal year.

The basis point increase in this expense category as a percent of total revenues was primarily due to amortization of intangible assets that

we acquired in the acquisition of the hair restoration centers during the second quarter of fiscal year 2005. During fiscal year 2004, D&A

remained relatively consistent as a percent of total consolidated revenues compared to the prior fiscal year.

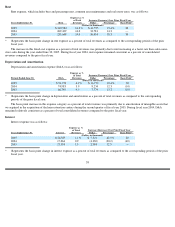

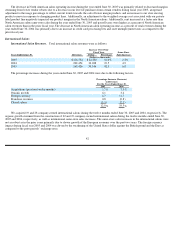

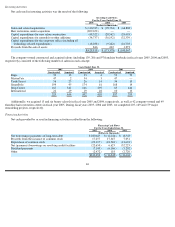

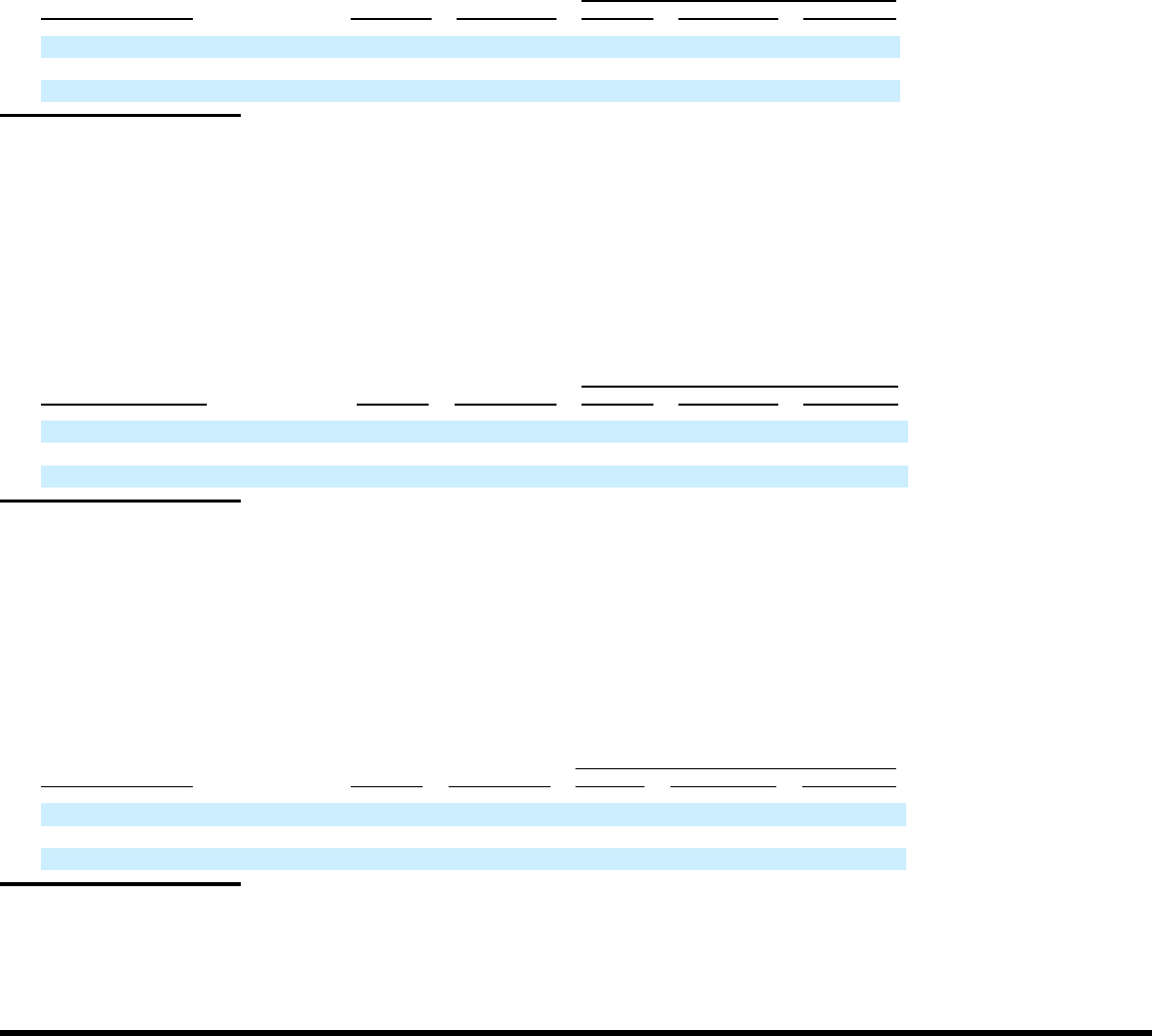

Interest

Interest expense was as follows:

* Represents the basis point change in interest expense as a percent of total revenues as compared to the corresponding periods of the prior

fiscal year.

38

Expense as %

of Total

Increase (Decrease) Over Prior Fiscal Year

Years Ended June 30,

Rent

Revenues

Dollar

Percentage

Basis Point*

(Dollars in thousands)

2005

$

310,984

14.2

%

$

41,555

15.4

%

20

2004

269,429

14.0

33,781

14.3

—

2003

235,648

14.0

36,434

18.3

30

Expense as %

of Total

Increase (Decrease) Over Prior Fiscal Year

Periods Ended June 30,

D&A

Revenues

Dollar

Percentage

Basis Point*

(Dollars in thousands)

2005

$

91,753

4.2

%

$

16,770

22.4

%

30

2004

74,983

3.9

8,234

12.3

(10

)

2003

66,749

4.0

7,774

13.2

(10

)

Expense as %

of Total

Increase (Decrease) Over Prior Fiscal Year

Years Ended June 30,

Interest

Revenues

Dollar

Percentage

Basis Point*

(Dollars in thousands)

2005

$

24,385

1.1

%

$

7,321

42.9

%

20

2004

17,064

0.9

(4,330

)

(20.2

)

(40

)

2003

21,394

1.3

2,384

12.5

—