Supercuts 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REGIS CORP

FORM 10-K

(Annual Report)

Filed 09/09/05 for the Period Ending 06/30/05

Address 7201 METRO BLVD

MINNEAPOLIS, MN 55439

Telephone 9529477777

CIK 0000716643

Symbol RGS

SIC Code 7200 - Services-Personal Services

Industry Personal Services

Sector Services

Fiscal Year 06/30

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

REGIS CORP FORM 10-K (Annual Report) Filed 09/09/05 for the Period Ending 06/30/05 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 7201 METRO BLVD MINNEAPOLIS, MN 55439 9529477777 0000716643 RGS 7200 - Services-Personal Services Personal Services Services 06/30 http://www.edgar-... -

Page 2

..., Minnesota (Address of principal executive offices) 41-0749934 (I.R.S. Employer Identification No.) 55439 (Zip Code) (952) 947-7777 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which... -

Page 3

... by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes 2 No 32 The aggregate market value of the voting common stock held by non-affiliates computed by reference to the price at which common stock was last sold as of the last business day of... -

Page 4

... Strategy Salon Concepts Salon Franchising Program Salon Markets and Marketing Salon Education and Training Programs Salon Staff Recruiting and Retention Salon Design Salon Management Information Systems Salon Competition Beauty School Business Strategy Hair Restoration Business Strategy Corporate... -

Page 5

... product salons. In the last three years, the Company began acquiring and operating a limited number of beauty schools in North America and internationally. Additionally, in December 2004, the Company acquired Hair Club for Men and Women, a leading provider of hair restoration services. The Company... -

Page 6

.... Salon Site Selection. The Company's salons are located in high-traffic locations, such as; regional shopping malls, strip centers, lifestyle centers, Wal-Mart Supercenters, high-street locations and department stores. The Company's financial strength, successful salon operations and international... -

Page 7

... and capital expenditure alternatives, as well as the benefits of buying retail products, supplies and salon fixtures directly from manufacturers. Furthermore, the Company can offer employee benefit programs, training and career path opportunities that are often superior to its smaller competitors... -

Page 8

... its customers' hair care needs by providing competitively priced services and products with professional and knowledgeable stylists. The Company's operations and marketing emphasize high quality services to create customer loyalty, to encourage referrals and to distinguish the Company's salons from... -

Page 9

...in regional malls, strip centers, life style centers, Wal-Mart Supercenters, high-street locations and department stores. The Company's North American salon operations consist of 8,861 salons (2,310 franchise), operating under five concepts, each offering attractive and affordable hair care products... -

Page 10

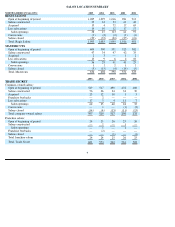

SALON LOCATION SUMMARY NORTH AMERICAN SALONS: 2005 2004 2003 2002 2001 REGIS SALONS Open at beginning of period Salons constructed Acquired Less relocations Salon openings Conversions Salons closed Total, Regis Salons MASTERCUTS Open at beginning of period Salons constructed Acquired Less ... -

Page 11

... Salons closed Total company-owned salons Franchise salons: Open at beginning of period Salons constructed Acquired Less relocations Salon openings Conversions Franchise buybacks Salons closed Total franchise salons Total, SmartStyle/Cost Cutters in Wal-Mart STRIP CENTERS Company-owned salons: Open... -

Page 12

... SALONS(1) Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open at beginning of period Salons constructed Acquired(2) Salon openings Franchise buybacks Salons closed... -

Page 13

... June 30, 2005, 134 Regis Salons were located in strip centers. The customer mix at Regis Salons is approximately 75 percent women and both appointments and walk-in customers are common. These salons offer a full range of custom styling, cutting, hair coloring, waving and waxing services as well as... -

Page 14

... Salons are comprised of company-owned and franchise salons operating in strip centers across North America under the following concepts: Supercuts. The Supercuts concept provides consistent, high quality hair care services and professional products to its customers at convenient times and locations... -

Page 15

... full-service hair salon. Salons are usually located on prominent highstreet locations and offer a full range of custom hairstyling, cutting, coloring and permanent wave, as well as hair care products. The initial capital investment required is typically over £250,000. The Company does not plan to... -

Page 16

...approve location, suppliers and the sale of a franchise. Additionally, franchisees are required to conform to company-established operational policies and procedures relating to quality of service, training, design and decor of stores, and trademark usage. The Company's field personnel make periodic... -

Page 17

... and high loyalty. Salon Education and Training Programs: The Company has an extensive hands-on training program for its stylists which emphasizes both technical training in hairstyling and cutting, hair coloring, perming and hair treatment regimes as well as customer service and product sales. The... -

Page 18

... competitive within the industry. Stylists benefit from the Company's high-traffic locations and receive a steady source of new business from walk-in customers. In addition, the Company offers a career path with the opportunity to move into managerial and training positions within the Company. Salon... -

Page 19

... hair care industry is highly fragmented and competitive. In every area in which the Company has a salon, there are competitors offering similar hair care services and products at similar prices. The Company faces competition within malls from companies which operate salons within department stores... -

Page 20

...to Regis Corporation. Given its long history of educating stylists, the Company seeks to improve curriculum and training techniques in its schools. Also, as the largest employer in the beauty industry, the Company believes these schools may provide a continuous pipeline of strong job applicants upon... -

Page 21

... billion annually. The competitive landscape is highly fragmented and comprised of approximately 4,000 locations. Hair Club and its franchisees have the largest market share at approximately 5 percent. In an effort to provide privacy to its customers, Hair Club for Men and Women offices are located... -

Page 22

...name to Hair Club for Men and Women. This represents a large and relatively untapped market. Women now represent approximately 45 percent of new customers. Currently, all locations offer hair systems, hair therapy and hair care products. Among the hair restoration centers' product offerings are hair... -

Page 23

... Administrative Officer Vice President, General Counsel and Secretary Senior Vice President, Real Estate Senior Vice President, Design and Construction Senior Vice President, Regis Corporation and President, Franchise Division Senior Vice President, Fashion, Education and Marketing Chief Operating... -

Page 24

...and has served as Vice President, Salon Operations since 1998. Raymond Duke was elected Senior Vice President, International Managing Director, U.K. in February, 1999 and has served as Vice President since 1992. Vicki Langan was elected Chief Operating Officer, Supercuts in April 2001 and has served... -

Page 25

... operating lease agreement for a 102,448 square foot building, also located in Edina. The Company plans to expand into this fourth building during the latter half of fiscal year 2006. This new lease agreement includes an option to purchase the property or extend the original term for two successive... -

Page 26

... terms of at least five years, generally with the ability to renew, at the Company's option, for an additional five years. Salons operating within department stores in Canada and Europe operate under license agreements, while freestanding or shopping center locations in those countries have real... -

Page 27

... of August 31, 2005, Regis shares were owned by approximately 25,500 shareholders based on the number of record holders and an estimate of individual participants in security position listings. The common stock price was $40.95 per share on August 31, 2005. 2005 Fiscal Quarter High Low High 2004 Low... -

Page 28

...fiscal year 2005 stock repurchase activity: Total Number of Shares Purchased As Part of Publicly Announced Plans or Programs Approximate Dollar Value of Shares that May Yet Be Purchased under the Plans or Programs (in thousands) Period Total Number of Shares Purchased Average Price Paid per Share... -

Page 29

...and international salons, 90 hair restoration centers and 24 beauty schools. Each of our salon concepts offer generally similar products and services and serves mass-market consumers. Our salon operations are organized to be managed based on geographical location. Our North American salon operations... -

Page 30

... of new locations in untapped markets domestically and internationally. However, the success of our hair restoration business is not dependent on the same real estate criteria used for salon expansion. In an effort to provide confidentiality for their customers, hair restoration centers operate... -

Page 31

... to our accounting policy, an annual review is performed in the third quarter of each year, or more frequently if indicators of potential impairment exist. Our impairment review process is based on a discounted future cash flow approach that uses estimates of revenues for the reporting units, driven... -

Page 32

... the acquired business with our existing structure to serve a greater number of customers through our expansion strategies. Revenue Recognition Company-owned salon revenues, beauty school revenues from services performed or products sold, and service and product sale revenues occurring in hair... -

Page 33

... of service sales, discounting and special promotions. During fiscal year 2005, we performed physical inventory counts in September 2004, February 2005 and April/May 2005 and adjusted our estimated gross profit margin to reflect the results of the observations. Significant changes in product costs... -

Page 34

...8.1 5.1 Consolidated Revenues Consolidated revenues primarily include revenues of company-owned salons, hair restoration centers, beauty schools, franchise royalties, franchise fees and product and equipment sales to franchisees. During fiscal year 2005, consolidated revenues increased 14.1 percent... -

Page 35

... rate between the current fiscal year and the prior fiscal year. Service Revenues. Service revenues include revenues generated from company-owned salons, tuition and service revenues generated within our beauty schools, and service revenues generated by hair restoration centers. Total service... -

Page 36

...The large increase in same-store product sales during fiscal year 2004 was primarily driven by a trend towards sales of higher priced beauty tools, such as flat irons and the introduction of the Matrix product line to Trade Secret salons. Franchise Royalties and Fees. Total franchise revenues, which... -

Page 37

... Depreciation) Our cost of revenues primarily includes labor costs related to salon employees, beauty school instructors and hair restoration center employees, the cost of product used in providing services and the cost of products sold to customers and franchisees. The resulting gross margin was as... -

Page 38

... supervision, salon training and promotions, product distribution centers and corporate offices (such as salaries and professional fees), including costs incurred to support franchise, beauty school and hair restoration center operations. G&A costs were as follows: Expense as % Increase (Decrease... -

Page 39

... Rent expense, which includes base and percentage rent, common area maintenance and real estate taxes, was as follows: Expense as % Increase (Decrease) Over Prior Fiscal Year of Total Revenues Dollar Percentage Basis Point* (Dollars in thousands) Years Ended June 30, Rent 2005 2004 2003 * $ 310... -

Page 40

...in wages. Nevertheless, we estimate that we must achieve an annual same-store sales increase in excess of two percent to offset the impact of inflationary pressures on fixed costs, such as rent, site operating expenses and general and administrative expenses in order to achieve our long-term earning... -

Page 41

... fiscal year. For the Year Ended June 30, 2005 Currency Constant Reported Translation Currency % Increase Benefit (Loss) Amount (Decrease)* (Dollars in thousands) Constant Currency % Increase (Decrease)* Reported Amount Total revenues: North American salons International salons Beauty schools Hair... -

Page 42

... structure, we report four segments: North American salons, international salons, beauty schools and hair restoration centers. Significant results of operations are discussed below with respect to each of these segments. North American Salons North American Salon Revenues. Total North American salon... -

Page 43

... label product line negatively impacted our product margins in the North American salons. Additionally, rent increased at a faster rate than North American salon same-store sales during the year ended June 30, 2005 and payroll taxes were higher as a percent of North American salon revenues than... -

Page 44

... severance payments related to the franchise operations in France), as well as the fixed cost components of G&A increasing at a faster rate than the same-store sales in the international salons. The decrease in international salon operating income as a percent of total revenues during the year ended... -

Page 45

... fiscal year 2005. Our principal ongoing cash requirements are to finance construction of new stores, remodel certain existing stores, acquire salons and beauty schools and purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which reduces our working... -

Page 46

... timing of advertising expenses and income tax payments. Inventories increased due to growth in the number of salons, as well as lower than expected same-store product sales. The goodwill impairment charge resulted from a write-off related to the international salon segment. During fiscal year 2004... -

Page 47

...: Financing Cash Flows For the Years Ended June 30, 2005 2004 2003 (Dollars in thousands) Net borrowings (payments) of long-term debt Proceeds from the issuance of common stock Repurchase of common stock Net (payments) borrowings on revolving credit facilities Dividend payments Other $ 280... -

Page 48

... to the exercise of stock options. In the third quarter of fiscal year 2004, the quarterly dividend was increased from its historical rate of $0.03 per share to $0.04 per share. New Financing Arrangements Fiscal Year 2005 We acquired Hair Club for Men and Women in December 2004 for approximately... -

Page 49

..., 2005: Within 1 year Payments due by period More than 1-3 years 3-5 years 5 years (Dollars in thousands) Contractual Obligations Total On-balance sheet: Long-term debt obligations Capital lease obligations Other long-term liabilities Total on-balance sheet Off-balance sheet (a) : Operating lease... -

Page 50

... Financial Statements for additional information. Off-Balance Sheet Arrangements Operating leases primarily represent long-term obligations for the rental of salon, school and hair restoration center premises, including leases for company-owned locations, as well as salon franchisee subleases of... -

Page 51

... discontinued with respect to any new franchise area development agreements and most franchisees who were offered the program in the past choose to continue operating the salons themselves. Further, in the case of a franchisee initiating the buyback program, we anticipate finding another franchisee... -

Page 52

... repurchased under this program. Risk Factors Impact of Acquisition and Real Estate Availablity The key driver of our revenue and earnings growth is the number of salons we acquire or construct. While we believe that substantial future acquisition and organic growth opportunities exist, any material... -

Page 53

.... Historically, our revenue and net earnings have generally been realized evenly throughout the fiscal year. The service and retail product revenues associated with our corporate salons, as well as our franchise revenues, are of a replenishment nature. We estimate that customer visitation patterns... -

Page 54

... suitable locations and financing for new salon development; governmental initiatives such as minimum wage rates, taxes and possible franchise legislation; the ability of the Company to successfully identify and acquire salons that support its growth objectives; or other factors not listed above... -

Page 55

... no cash flow swaps at the end of fiscal year 2005. During fiscal year 2003, the $11.8 million interest rate swap was redesignated from a hedge of variable rate operating lease obligations to hedge of a portion of the interest payments associated with the Company's long-term financing program. The... -

Page 56

... contractual payments to be exchanged under the contract. 2006 2007 2008 Expected maturity date as of June 30, 2009 2010 Thereafter Total Fair Value Liabilities (U.S.$ equivalent in thousands) Long-term debt: Fixed rate (U.S.$) Average interest rate Variable rate (U.S.$) Average interest rate Total... -

Page 57

...Euro/U.S.) Euro amount Average pay Euro rate U.S.$ amount Average receive U.S. rate $73,799 70,904 56,832 â,¬23,782 8.29 % $21,284 8.39 % The cross-currency swap derivative financial instrument expires in fiscal year 2007. At June 30, 2005 and 2004, the Company's net investment in this derivative... -

Page 58

... excluded from its assessment of the effectiveness of the Company's internal control over financial reporting as of June 30, 2005 certain elements of the internal control over financial reporting of Hair Club for Men and Women (Hair Club). Hair Club was acquired by the Company in a material purchase... -

Page 59

...the results of their operations and their cash flows for each of the three years in the period ended June 30, 2005, in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedule listed in the index appearing... -

Page 60

... control over financial reporting of Hair Club for Men and Women (Hair Club) from its assessment of the Company's internal control over financial reporting as of June 30, 2005 because Hair Club was acquired by the Company in a purchase business combination during fiscal year 2005. Subsequent to the... -

Page 61

REGIS CORPORATION CONSOLIDATED BALANCE SHEET (Dollars in thousands, except per share amounts) June 30, 2005 2004 ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Deferred income taxes Other current assets Total current assets Property and equipment, net Goodwill Other ... -

Page 62

... CORPORATION CONSOLIDATED STATEMENT OF OPERATIONS (Dollars and shares in thousands, except per share amounts) 2005 Years Ended June 30, 2004 2003 Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative... -

Page 63

... fair market value of financial instruments designated as hedges of interest rate exposure, net of taxes and transfers Stock repurchase plan Proceeds from exercise of stock options Share-based compensation Shares issued through franchise stock incentive program Shares issued in connection with salon... -

Page 64

...of salon and school net assets, net of cash acquired Purchase of hair restoration centers, net of cash acquired Net cash used in investing activities Cash flows from financing activities: Borrowings on revolving credit facilities Payments on revolving credit facilities Proceeds from issuance of long... -

Page 65

.... Franchise salons throughout the United States are primarily located in strip shopping centers. The company-owned and franchise salons in the U.K., France and several other countries are owned and operated in malls, leading department stores, mass merchants and high-street locations. Beauty schools... -

Page 66

... for sale. Inventories are stated at the lower of cost or market with cost determined on a weighted average basis. Cost of product used and sold associated with the Company's salon business are determined by applying estimated gross profit margins to service and product revenues, which are based on... -

Page 67

... carrying value of the European business to reflect its estimated fair value. As a result, it recorded a pre-tax, non-cash charge of $38.3 million during the third quarter. Asset Impairment Assessments: The Company reviews long-lived assets for impairment at the salon level annually or if events or... -

Page 68

... Revenue: Company-owned salon revenues and related cost of sales are recognized at the time of sale, as this is when the services have been provided or, in the case of product revenues, delivery has occurred, and the salon receives the customer's payment. Revenues from purchases made with gift cards... -

Page 69

...net rental income (see Note 6). Royalties are recognized as revenue in the month in which franchisee services are rendered or products are sold to franchisees. The Company recognizes revenue from initial franchise fees at the time franchise locations are opened, as this is generally when the Company... -

Page 70

... shares. The Company's dilutive securities include shares issuable under the Company's stock option plan and longterm incentive plan, as well as shares issuable under contingent stock agreements. Diluted EPS is calculated as net income divided by weighted average common shares outstanding, increased... -

Page 71

...the cash flows from the respective hedged items. Stock-Based Employee Compensation Plans: At June 30, 2005, the Company had the 2004 Long Term Incentive Plan (2004 Plan) and the 2000 Stock Option Plan. Additionally, the Company has outstanding stock options under its 1991 Stock Option Plan, although... -

Page 72

... and pro forma earnings per share for the years ended June 30, 2005, 2004 and 2003 was as follows: For the Years Ended June 30, 2005 2004 2003 (Dollars in thousands) Net income, as reported Add: Stock-based employee compensation expense included in reported net income, net of related tax effects... -

Page 73

... or annual reporting period that begins after June 15, 2005 (i.e., the beginning of the Company's fiscal year 2006). As previously discussed in conjunction with stock-based employee compensation plans, the Company currently has three types of stockbased compensation: stock options, equity-based SARs... -

Page 74

... ending after September 15, 2005 (i.e., the Company's fiscal year 2006), with early application is permitted. The adoption of EITF 04-10 is not expected to have an impact on the Company's Consolidated Financial Statements. On December 21, 2004, the FASB issued FASB Staff Position (FSP) No. FAS 109... -

Page 75

... provides additional information concerning selected balance sheet accounts as of June 30, 2005 and 2004: 2005 2004 (Dollars ...expenses: Payroll and payroll related costs Insurance Deferred revenues Taxes payable, primarily income taxes Book overdrafts payable Other Other noncurrent liabilities... -

Page 76

... benefits obtained by the Company in that reporting period. The weighted average amortization periods, in total and by major intangible asset class, are as follows: Weighted Average Amortization Period (in years) Amortized intangible assets: Trade names Customer list Franchise agreements Product... -

Page 77

... and liabilities assumed based on their estimated fair values at the dates of acquisition. These acquisitions individually and in the aggregate are not material to the Company's operations, with the exception of Hair Club for Men and Women. Operations of the acquired companies have been included... -

Page 78

...589) - (123) (127) $ 110,206 $ 91,627 $ 124,696 Hair Club for Men and Women 2005 (Dollars in thousands) Components of aggregate purchase prices: Cash Stock Liabilities assumed or payable Allocation of the purchase prices: Current assets Property and equipment Other noncurrent assets Identifiable... -

Page 79

.... Based upon the actual and preliminary purchase price allocations, the change in the carrying amount of the goodwill for the years ended June 30, 2005 and 2004 is as follows: Hair Salons Beauty Restoration North America International Schools Centers (Dollars in thousands) Consolidated Balance at... -

Page 80

... as cross-marketing of the Company's products and services. Expanding the hair restoration business organically and through acquisition would allow us to add incremental revenue which is neither dependent upon nor dilutive to our existing salon and school businesses. Hair Club operations have been... -

Page 81

... following: Maturity Dates (fiscal year) Interest rate % 2005 2004 Amounts outstanding 2005 2004 (Dollars in thousands) Senior term notes Revolving credit facilities Equipment and leasehold notes payable Other notes payable Less current portion Long-term portion 2006-2015 2010 2006-2010 2007-2011... -

Page 82

... consistent with the financial covenants in the new Master Note Purchase Agreement. Fiscal Year 2004 In the second quarter of fiscal year 2004, the Company entered into an $11.9 million term loan related to its Salt Lake City Distribution Center. The loan has a rate of 7.16 percent and matures in... -

Page 83

... specified fixed charge coverage and leverage ratios, as well as minimum net worth levels. As a result of the fair value hedging activities discussed in Note 5, an adjustment of approximately $2.5 and $3.5 million was made to increase the carrying value of the Company's long-term fixed rate debt at... -

Page 84

... Unrealized net gain (loss) from changes in fair value of cash flow swap $ 271 480 $ 751 $ 386 $ 2,510 (231 ) (684 ) $ 155 $ 1,826 Fair Value Hedges The Company has interest rate swap contracts that pay variable rates of interest (based on the three-month and six-month LIBOR rates plus a credit... -

Page 85

...for the Company's international department store salons is based primarily on a percent of sales. The Company also leases the premises in which the majority of its franchisees operate and has entered into corresponding sublease arrangements with the franchisees. These leases, generally with terms of... -

Page 86

... classified in the royalties and fees caption of the Consolidated Statement of Operations. Total rent expense, excluding rent expense on premises subleased to franchisees, includes the following: 2005 2004 (Dollars in thousands) 2003 Minimum rent Percentage rent based on sales Real estate taxes and... -

Page 87

... to future salon locations, and continues to enter into transactions to acquire established hair care salons and businesses. Contingencies: The Company is self-insured for most workers' compensation and general liability losses subject to per occurrence and aggregate annual liability limitations... -

Page 88

... income earned outside the U.S. at an effective U.S. income tax rate as low as 5.25 percent as long as the repatriated income is invested in the U. S. pursuant to a plan. On January 13, 2005, the Internal Revenue Service issued its guidelines for applying the repatriation provisions of the Act... -

Page 89

.... Under terms of the plan, eligible employees may purchase the Company's common stock through payroll deductions. The Company contributes an amount equal to 15 percent of the purchase price of the stock to be purchased on the open market and pays all expenses of the SPP and its administration, not... -

Page 90

... also be granted to the Company's outside directors for a term not to exceed ten years from the grant date. The 2000 Plan contains restrictions on transferability, time of exercise, exercise price and on disposition of any shares acquired through exercise of the options. Stock options are granted at... -

Page 91

... of compensation cost for its incentive stock option plans, as well as pro forma information. 2004 Long Term Incentive Plan: In May of 2004, the Company's Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received shareholder approval at the annual shareholders... -

Page 92

... contracts and a discount rate based on the Aa Bond index rate (6.25 percent at June 30, 2005). Compensation associated with these agreements is charged to expense as services are provided. Associated costs included in general and administrative expenses on the Consolidated Statement of Operations... -

Page 93

... for the same exercise price common stock of the Company (or in certain cases common stock of an acquiring company) having a market value of twice the exercise price of a right. Stock Repurchase Plan: In May 2000, the Company's Board of Directors approved a stock repurchase program. Originally, the... -

Page 94

.... Management began reviewing the operations of the beauty schools separately from the salon operations during fiscal year 2005 in anticipation of further expansion into the beauty school business. Further, the acquisition of Hair Club for Men and Women allowed the Company to expand into a new line... -

Page 95

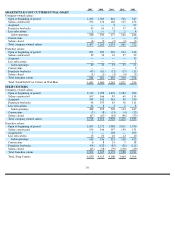

... 30, 2005 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent... -

Page 96

... 30, 2004 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent... -

Page 97

... 30, 2003 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent... -

Page 98

... forms, and that such information is accumulated and communicated to management, including the chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure. Management necessarily applied its judgment in assessing the costs and benefits... -

Page 99

... in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Management's Annual Report on Internal Control over Financial Reporting Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company... -

Page 100

... on the Company's website at www.regiscorp.com , under the heading "Corporate Governance" (within the "Corporate Information" section). The Company intends to disclose any substantive amendments to, or waivers from, its Code of Business Conduct & Ethics on its website or in a report on Form 8-K. In... -

Page 101

...2,484,800 Includes stock options granted under the Regis Corporation 2000 Stock Option Plan and 1991 Stock Option Plan., as well as shares granted through stock appreciation rights under the 2004 Long Term Incentive Plan. Information regarding the stock-based compensation plans is included in Notes... -

Page 102

... that its Board of Directors approved an increase in the Company's common stock repurchase program from the previously authorized $100.0 million to $200.0 million. Form 8-K dated May 6, 2005 related to the Company's entry into a ten-year operating lease agreement with France Edina, Property... -

Page 103

...for the year ended June 30, 1998.) Form of Employment and Deferred Compensation Agreement between the Company and six executive officers. (Incorporated by reference to Exhibit 10(b) of the Company's Report on Form 10K date September 24, 1997.) Northwestern Mutual Life Insurance Company Policy Number... -

Page 104

... Registrant and the Prudential Insurance Company of America. (Incorporated by reference to Exhibit 10(y) of the Company's Report on Form 10-K dated September 24, 1997, for the year ended June 30, 1997.) Compensation and non-competition agreement dated May 7, 1997, between the Company and Myron Kunin... -

Page 105

... June 30, 2004.) 2004 Long Term Incentive Plan (Draft). (Incorporated by reference to Exhibit 10(ff) of the Company's Report on Form 10-K dated September 10, 2004, for the year ended June 30, 2004.) Purchase Agreement between Regis Corporation and Hair Club for Men and Women, Inc. (Incorporated by... -

Page 106

...Executive Vice President, Chief Financial and Administrative Officer of Regis Corporation: Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Chairman of the Board of Directors, President and Chief Executive Officer of Regis Corporation: Certification pursuant to Section 906 of... -

Page 107

... the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. REGIS CORPORATION By /s/ PAUL D. FINKELSTEIN Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer By /s/ RANDY L. PEARCE Randy L. Pearce... -

Page 108

... CORPORATION SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS as of June 30, 2005, 2004 and 2003 (dollars in thousands) Column A Description Column B Balance at beginning of period Column C Charged to costs and Charged to expenses Other Accounts Column D Deductions Column E Balance at end of period... -

Page 109

... in Control Code Committee Company Covered Employee Disability Effective Date Participant Performance Goals Plan Representative Termination of Employment ADMINISTRATION Committee Structure and Actions Committee Authority ELIGIBILITY Eligibility AWARDS General Award Amounts Performance Goals Payments... -

Page 110

...by making awards based on annual achievement of Performance Goals. ARTICLE II DEFINITIONS For purposes of the Plan, the following terms are defined as set forth below: 2.1 " Affiliate " means any individual, corporation, partnership, association, limited liability company, joint-stock company, trust... -

Page 111

... Plan, which initially shall be the Compensation Committee of the Board, until such time as the Board may designate a different committee. The Committee shall consist solely of two or more directors, each of whom is an "outside director" under Section 162(m) of the Code. 2.10 " Company " means Regis... -

Page 112

...the applicable fiscal year. 2.16 " Plan " means the Regis Corporation Short Term Incentive Compensation Plan, as herein set forth and as may be amended from time to time. 2.17 " Representative " means (a) the person or entity acting as the executor or administrator of a Participant's estate pursuant... -

Page 113

...a business owned or operated by the Company or its Affiliates. A Termination of Employment shall occur with respect to an employee who is employed by an Affiliate if the Affiliate shall cease to be an Affiliate and the Participant shall not immediately thereafter become an employee of the Company or... -

Page 114

... to an Award (the " Target Pay-out ") shall be determined by the Committee and shall be based on a percentage of a Participant's actual annual base salary at the time of grant (" Participation Factor "), within the range established by this Section and any Appendix to the Plan. Any such amount shall... -

Page 115

... Plan, the maximum dollar amount a Plan Participant may be paid under an Award, with respect to any fiscal year is $2,000,000. The Committee may, in its discretion, decrease this maximum, but may not, under any circumstances, increase this maximum. Additional restrictions designed to satisfy Code... -

Page 116

...margin; return on net assets; economic value added; return on total assets; return on common equity; return on total capital; total shareholder return; revenue; revenue growth; earnings before interest, taxes, depreciation and amortization (" EBITDA "); EBITDA growth; funds from operations per share... -

Page 117

..." status of the Plan. 7.3 Provisions Relating to Internal Revenue Code Section 162(m) . It is the intent of the Company that Awards granted to persons who are Covered Employees shall constitute "qualified performance-based compensation" satisfying the requirements of Code Section 162(m). Accordingly... -

Page 118

...to have the right to terminate the employment or service relationship at any time for any reason, except as provided in a written contract. The Company or an Affiliate shall have no obligation to retain the Participant in its employ or service as a result of this Plan. There shall be no inference as... -

Page 119

... SARBANES-OXLEY ACT OF 2002 I, Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer of Regis Corporation, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Regis Corporation; Based on my knowledge, this report does not contain any untrue... -

Page 120

...2002 I, Randy L. Pearce, Executive Vice President, Chief Financial and Administrative Officer of Regis Corporation, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Regis Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or... -

Page 121

... Exchange Act of 1934; and (2) The information contained in the Annual Report on Form 10-K fairly presents, in all material respects, the financial condition and results of operations of the Registrant. September 9, 2005 /s/ PAUL D. FINKELSTEIN Paul D. Finkelstein, Chairman of the Board of...