Sharp 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 SHARP CORPORATION

Financial Section

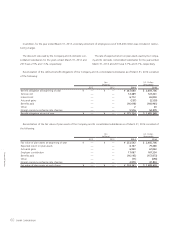

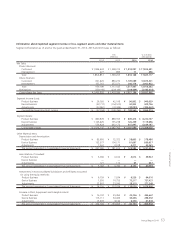

These restructuring charges for the year ended March 31, 2012

are related to the LCD business restructuring, etc. Those mainly

comprise depreciation and maintenance charges of ¥37,717

million concerning plants that were suspended in the Company

and its consolidated subsidiary, Sharp Display Products Corpora-

tion (its corporate name was changed to Sakai Display Products

Corporation on July 17, 2012) to improve production to meet

the increasing demand for high value-added products, and costs

of ¥68,125 million incurred to reinforce business foundations

(inventory write-down, etc.) in preparation for promoting estab-

lishment of strategic vertical integration of the large-size LCD

business.

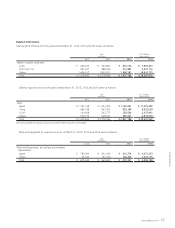

These restructuring charges for the year ended March 31,

2013 are as follows:

(a) This concerns LCD business and comprises costs of

¥12,056 million incurred for maintenance of inactive fixed as-

sets caused in the Company and its consolidated subsidiary,

Sharp Display Products Corporation (its corporate name was

changed to Sakai Display Products Corporation on July 17,

2012), along with improving production to meet the increas-

ing demand for high value-added products.

(b) This mainly concerns reduction of production of the Com-

pany’s Large-size LCD panels and comprises the loss on valua-

tion of inventories of ¥53,468 million.

(c) This mainly concerns a structural switch of Solar Cells busi-

ness and comprises costs of ¥31,526 million incurred to im-

pairment loss on fixed assets.

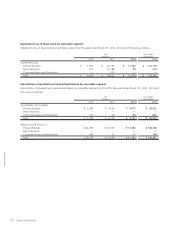

The Company and its consolidated subsidiaries categorizes

assets for business use in view of business facility, type of busi-

ness and others in a comprehensive manner. Idle assets are

categorized by each asset.

The Company and its consolidated subsidiaries reduced

the book value of idle and unused-in-the-future production

equipment of thin-film solar cells to an estimated recoverable

amount, and recognized the decreased amount of ¥31,526

million as a restructuring charge included in other expenses.

Details are as follows: ¥17,568 million, for buildings and

structures; ¥4,963 million, for machinery, equipment and

vehicles; ¥4,007 million, for lease assets; ¥2,247 million, for

long-term prepaid expenses; ¥2,741 million, for other.

(d) This comprises the loss on cancellation of lease contracts,

etc. by structural switch of Solar Cells business, of ¥14,249

million.

(e) This comprises the costs of restructuring of consolidated

subsidiaries of, ¥6,602 million.

(f) This comprises the costs of the voluntary retirement pro-

gram for employees of the Company and its domestic consoli-

dated subsidiaries, of ¥25,496 million.

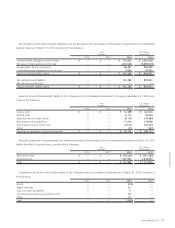

15. Restructuring Charges