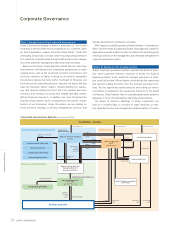

Sharp 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Main Products

LCD color televisions, color televisions, projectors, Blu-ray Disc recorders, mobile phones, tablet terminals, electronic dictionaries,

calculators, facsimiles, telephones

Main Products

Refrigerators, superheated steam ovens, microwave ovens, small cooking appliances, air conditioners, washing machines, vacuum

cleaners, air purifiers, electric fans, dehumidifiers, humidifiers, Plasmacluster Ion generators, electric heaters, beauty appliances, LED

lights, network control units

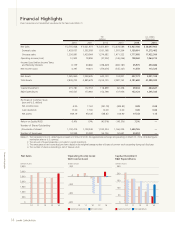

Digital Information Equipment

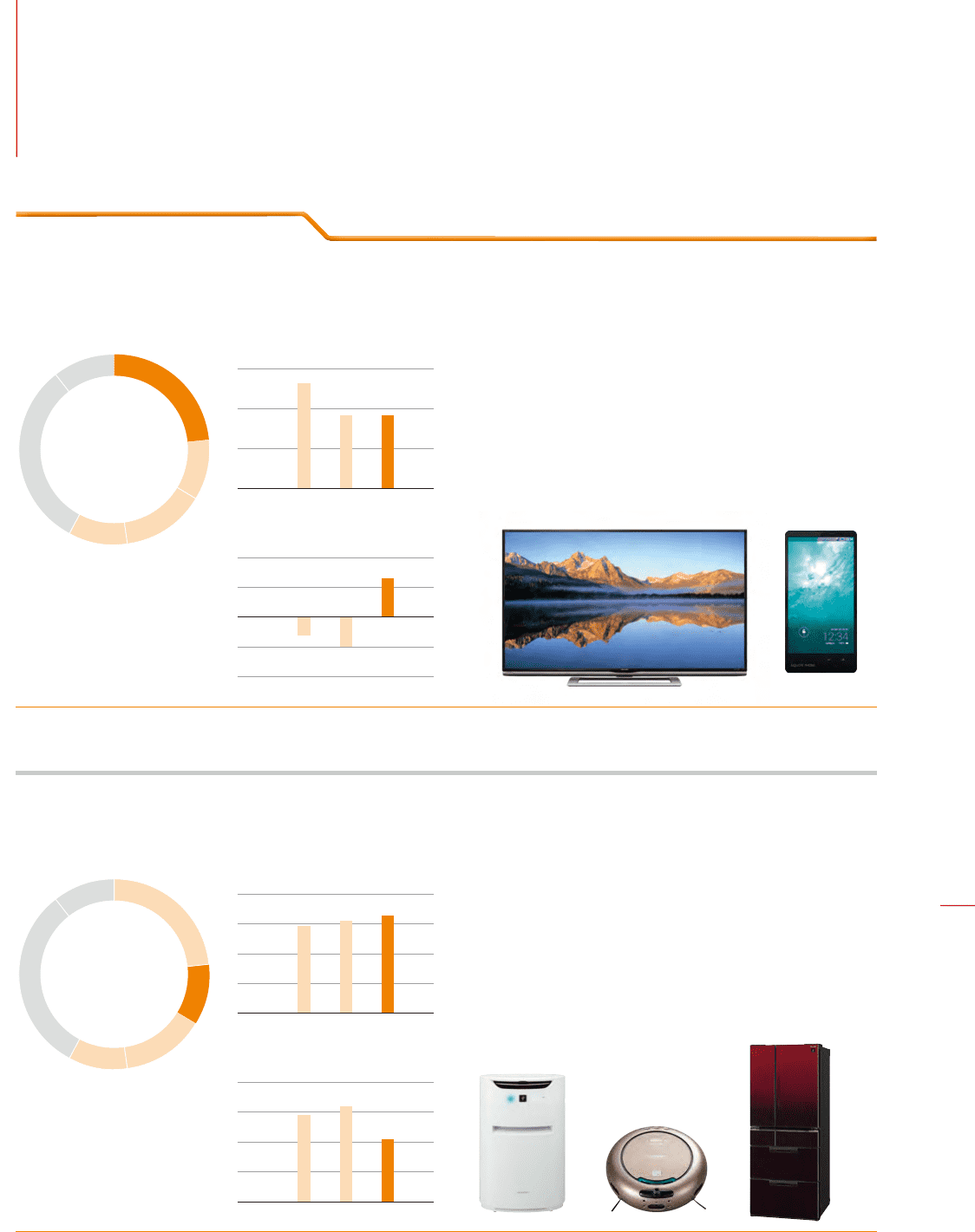

Health and Environmental Equipment

• Sales gures include internal sales between segments (Product Business and Device Business). The percentage of sales in the pie chart has been calculated accordingly.

• Operating income (loss) gures are the amounts before adjustments for intersegment trading. The percentage of operating income in the pie chart has been calculated accordingly.

• Total assets gures are the amounts before adjustments for intersegment trading. The percentage of total assets in the pie chart has been calculated accordingly.

• Capital investment gures include the amounts of leased properties, and do not include unallocated capital investments. The percentage of capital investment in the pie chart has been

• Effective for the year ended March 31, 2014, the Company has changed its segment classication. Figures for the previous years have been adjusted to reect the new classication.

Product Business

Despite a decline in sales of mobile phones, total sales in this

product group were mostly unchanged thanks to growth of

LCD TVs. This group also returned to profitability owing to cost-

cutting and other restructuring efforts.

We will work to boost sales of the group through following

initiatives. We will step up sales of high-resolution, large-screen

TVs, such as the 4K AQUOS series. At the same time, we will

launch distinctive smartphones such as the thin-bezel design

EDGEST model, and tap the demand of feature phones, in order

to recapture domestic market share for mobile phones.

Sales by Product Group

23.4%

Net Sales

(billions of yen)

1,200

800

400

0

141312

Operating Income (Loss)

(billions of yen)

20

10

0

-20

-10

141312

This product group enjoyed an increase in sales due to solid

performance for refrigerators and air-conditioners in Japan and

healthy sales of air purifiers in China. However, operating income

declined as the yen’s continued depreciation caused the profitabil-

ity of imported products for the domestic market to deteriorate.

We will work to stimulate new demand in Japan by launch-

ing distinctive products, such as robotic home appliances and

cooking appliances for health-conscious customers. We will also

endeavor to broaden our overseas business by facilitating local

production for local consumption, especially in ASEAN region,

and minimize the impact of foreign exchange factors.

Sales by Product Group

10.4%

400

300

200

100

0

141312

Net Sales

(billions of yen)

40

30

20

0

10

141312

Operating Income

(billions of yen)

Fiscal 2013 Review by Product Group

Sharp Corporation and Consolidated Subsidiaries for the Years ended March 31

Annual Report 2014 17

Fiscal 2013 Review by Product Group