Sharp 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 SHARP CORPORATION

Financial Section

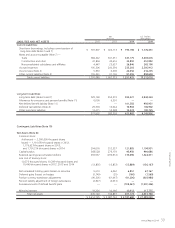

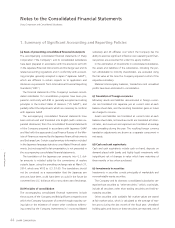

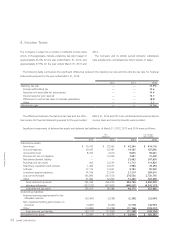

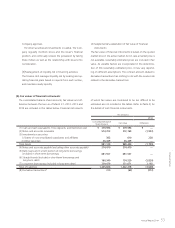

The Company is subject to a number of different income taxes

which, in the aggregate, indicate a statutory tax rate in Japan of

approximately 40.6% for the year ended March 31, 2012, and

approximately 37.9% for the year ended March 31, 2013 and

2014.

The Company and its wholly owned domestic subsidiaries

have adopted the consolidated tax return system of Japan.

The differences between the statutory tax rate and the effec-

tive tax rate for financial statement purposes for the years ended

March 31, 2012 and 2013 are not disclosed because loss before

income taxes and minority interests were recorded.

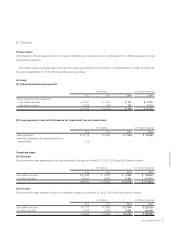

The following table summarizes the significant differences between the statutory tax rate and the effective tax rate for financial

statements purposes for the year ended March 31, 2014:

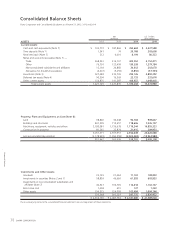

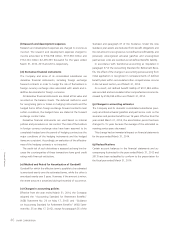

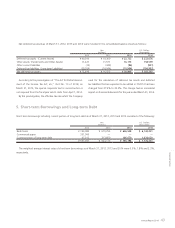

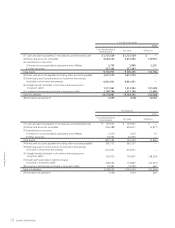

Significant components of deferred tax assets and deferred tax liabilities as of March 31, 2012, 2013 and 2014 were as follows:

4. Income Taxes

2012 2013 2014

Statutory tax rate — — 37.9%

Foreign withholding tax — — 13.6

Expenses not deductible for tax purposes — — 10.4

Income taxes for prior periods — — 15.7

Differences in normal tax rates of overseas subsidiaries — — (8.0)

Other — — 2.1

Effective tax rate — — 71.7%

Yen

(millions)

U.S. Dollars

(thousands)

2012 2013 2014 2014

Deferred tax assets:

Inventories ¥ 70,797 ¥ 73,924 ¥ 42,240 $ 414,118

Accrued expenses 20,047 15,997 19,165 187,892

Accrued bonuses 8,372 4,310 9,635 94,461

Provision for loss on litigation — 12,249 7,691 75,402

Net defined benefit liability — — 35,463 347,676

Buildings and structures 962 12,255 11,712 114,824

Machinery, equipment and vehicles 1,466 10,577 7,986 78,294

Software 17,113 14,961 9,183 90,029

Long-term prepaid expenses 14,104 21,914 21,319 209,010

Loss carried forward 161,893 247,570 278,536 2,730,745

Other 37,482 52,463 51,266 502,608

Gross deferred tax assets 332,236 466,220 494,196 4,845,059

Valuation allowance (197,223) (427,832) (448,022) (4,392,373)

Total deferred tax assets 135,013 38,388 46,174 452,686

Deferred tax liabilities:

Retained earnings appropriated for tax

allowable reserves (42,445) (3,258) (2,342) (22,961)

Net unrealized holding gains (losses) on

securities (3,087) (3,339) (3,770) (36,961)

Other (16,985) (15,238) (11,156) (109,372)

Total deferred tax liabilities (62,517) (21,835) (17,268) (169,294)

Net deferred tax assets ¥ 72,496 ¥ 16,553 ¥ 28,906 $ 283,392