Sharp 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

during the agreement period. Accordingly, uctuations in prices

which may adversely affect Sharp’s brand image or inuence its

made a reasonable estimate of potential future losses and provided

a reserve in the amount deemed necessary. However, it is difficult

to predict or estimate all results at this stage. In addition to pro-

ceedings already under way, new investigations by regulatory au-

thorities or civil litigations may be filed in the future. Any adverse

results could affect Sharp’s business results and financial position.

(14) Leakage of Personal Data and Other Information

Sharp retains personal data and other confidential information con-

cerning its customers, business partners and employees. Extreme

care is taken to protect this information. A company-wide manage-

ment system promotes employee education, internal auditing, and

other measures aimed at ensuring compliance with management

regulations. If information is leaked, however, it may reduce confi-

dence in Sharp or result in substantial costs (associated with leakage

prevention measures or indemnification for damages, for instance),

which may affect Sharp’s business results and financial position.

(15) Large-Scale Natural Disasters

Sharp has created and adopted preventative/emergency measures

and a business continuity plan aimed at rapid recovery/restoration

in order to be prepared and limit damage in the event of large-scale

natural disasters such as earthquakes and typhoons. However, if

Sharp or its partners’ business activities are impaired due to the

occurrence of a large-scale natural disaster, it may affect Sharp’s

business results and financial position.

(16) Risks Accompanying the Nuclear Power Plant Disaster

Electric power generation problems, caused by the nuclear power

plant accident accompanying the Great East Japan Earthquake,

have had various adverse effects on both Japanese and overseas

markets, which is affecting Sharp’s business results and financial

position. The Japanese government has signaled its intention to

reinstate nuclear power generation following cabinet approval of a

basic energy plan defining nuclear as an “important baseload pow-

er source.” In the absence of a timeframe for reinstatement, how-

ever, power generation problems remain unsolved at the present

time. Any possible future restrictions on electricity usage or hikes

in electricity prices stemming from electricity shortages could cause

plant operations to be reduced and/or costs to increase, which may

affect Sharp’s business results and financial position.

(17) Competition to Secure Skilled Personnel

Exceptional human resources in such fields as technology and man-

agement are crucial to Sharp’s future growth and development.

However, since demand for talented personnel in various fields

exceeds supply, competition to secure human resources is inten-

sifying. In the event that Sharp is unable to attract new personnel

or prevent the departure of existing employees, or is unable to im-

prove the skills of key personnel engaged in business management,

its business results and financial position may be affected.

(18) Other Key Variable Factors

In addition to the aforementioned risks, Sharp’s business results

may be significantly affected by human-induced calamities such as

accidents, conicts, insurrections or terrorism; the spread of a new

strain of inuenza or other infectious disease; or major uctuations

in the stock and bond markets.

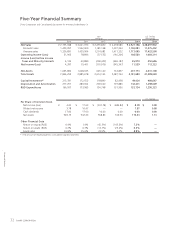

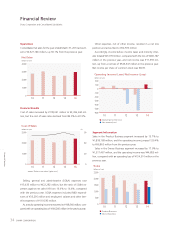

(19) Outline of Significant Events Relating to Assumed Going Concern

Sharp has been working hard to create and strengthen sales of dis-

tinctive devices and original products, including high-resolution 4K

AQUOS TVs; high-resolution, high-picture-quality Quattron Pro TVs

with 4K-equivalent Full HD panels; smartphones with IGZO LCDs;

solar cells for the domestic market where demand is ourishing;

and small- and medium-size LCDs for mobile devices. In addition,

Sharp has pursued various company-wide measures to improve

operations, such as reducing inventories, restraining capital invest-

ment, and rigorously cutting overall costs. Accordingly, in fiscal

2013 Sharp achieved an 18.1% year-on-year increase in net sales.

Sharp also returned to profitability with respect to operating in-

come and net income and generated positive operating cash ows.

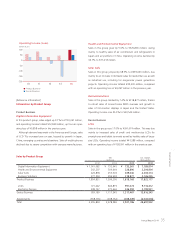

In the previous two years through fiscal 2012, however, Sharp con-

secutively posted large operating losses and net losses, as well as

negative operating cash ows. Under these circumstances, interest-

bearing debt increased, and the short-term portion of such debt

reached a high level. Sharp’s short-term debt includes unsecured

straight bonds and a syndicated loan with financial covenants.

Although there are events or conditions that may cast significant

doubt on the entity’s ability to continue as a going concern, we be-

lieve that these conditions will not cast a material uncertainty about

Sharp’s ability to continue as a going concern, due to implementa-

tion of various measures to resolve these and other major issues as

described below. Therefore, no further disclosure for the “Going

Concern Assumption” in the notes to the consolidated financial

statements is necessary.

In fiscal 2013, Sharp returned to profitability in terms of operat-

ing income and net income, and also generated positive operating

cash ows. These results underscore the steady progress of Sharp’s

Medium-Term Management Plan, announced on May 14, 2013. In

addition, Sharp has received continued support and cooperation

from financial institutions. Under these arrangements, the agree-

ment pertaining to its ¥360.0 billion syndicated loan was amended,

and another agreement was reached to obtain an additional bor-

rowing facility of ¥150.0 billion. Sharp also completed the redemp-

tion of 20th unsecured convertible bonds with subscription rights

to shares due in September 2013, and its 22nd unsecured straight

bonds due in March 2014. In addition, Sharp issued new shares

through a public offering and a secondary offering due to over-

allotment, as well as a third-party allotment under a strategic al-

liance in a new business field that leverages Sharp’s strengths in

manufacturing. In these and other ways, Sharp is securing capi-

tal with a focus on strategic investment areas while at the same

time reinforcing its financial foundation. Going forward, Sharp will

steadily implement measures under its Medium-Term Management

Plan, with the aim of creating a “new Sharp” that achieves stable

income growth and generates sound cash ows.

Annual Report 2014 29

Risk Factors