Sharp 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2014 49

Financial Section

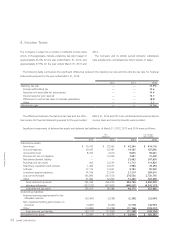

According to the promulgation of “The Act for Partial Amend-

ment of the Income Tax Act, etc,” (Act No. 10 of 2014) on

March 31, 2014, the special corporate tax for reconstruction is

not imposed from the fiscal year which starts from April 1, 2014.

By this promulgation, the effective tax rate which the Company

used for the calculation of deferred tax assets and deferred

tax liabilities that are expected to be settled in FY2014 has been

changed from 37.9% to 35.5%. This change had an immaterial

impact on financial statements for the year ended March 31, 2014.

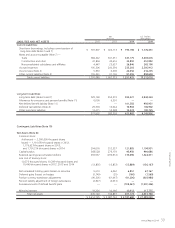

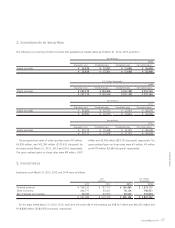

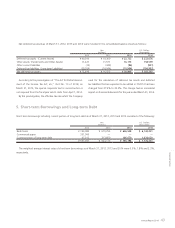

Short-term borrowings including current portion of long-term debt as of March 31, 2012, 2013 and 2014 consisted of the following:

The weighted average interest rates of short-term borrowings as of March 31, 2012, 2013 and 2014 were 0.5%, 1.8% and 2.2%,

respectively.

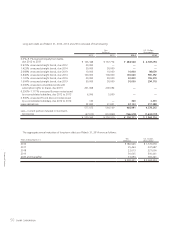

Net deferred tax assets as of March 31, 2012, 2013 and 2014 were included in the consolidated balance sheets as follows:

5. Short-term Borrowings and Long-term Debt

Yen

(millions)

U.S. Dollars

(thousands)

2012 2013 2014 2014

Bank loans ¥ 199,085 ¥ 610,254 ¥ 626,528 $ 6,142,431

Commercial paper 351,000 — — —

Current portion of long-term debt 47,912 313,859 166,670 1,634,020

¥ 597,997 ¥ 924,113 ¥ 793,198 $ 7,776,451

Yen

(millions)

U.S. Dollars

(thousands)

2012 2013 2014 2014

Deferred tax assets (Current Assets) ¥ 90,394 ¥ 19,369 ¥ 23,733 $ 232,676

Other assets (Investments and Other Assets) 11,421 11,571 16,173 158,559

Other current liabilities (15) (343) (96) (941)

Deferred tax liabilities (Long-term Liabilities) (29,304) (14,044) (10,904) (106,902)

Net deferred tax assets ¥ 72,496 ¥ 16,553 ¥ 28,906 $ 283,392