Sharp 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 SHARP CORPORATION

Financial Section

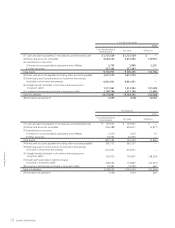

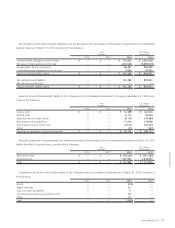

Adjustments of segment income or loss were ¥(33,861) mil-

lion, ¥(33,954) million and ¥(33,095) million ($(324,461) thou-

sand) for the years ended March 31, 2012, 2013 and 2014,

respectively, and comprised elimination of intersegment trans-

actions and corporate expenses not allocated to each report-

able segment. The elimination of intersegment transactions

was ¥1,061 million ¥1,117 million and ¥228 million ($2,235

thousand), respectively. Corporate expenses not allocated to

each reportable segment were ¥(35,704) million, ¥(36,306) mil-

lion and ¥(33,049) million ($(324,010) thousand), for the years

ended March 31, 2012, 2013 and 2014, respectively. Corporate

expenses were mainly attributable to basic R&D expenses and

expenses related to the administrative groups of the Company’s

headquarters.

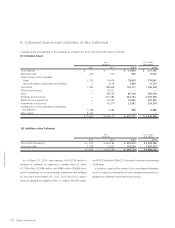

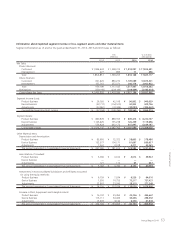

Adjustments of segment assets were ¥556,828 million,

¥463,172 million and ¥615,997 million ($6,039,186 thousand)

as of March 31, 2012, 2013 and 2014, respectively, and com-

prised elimination of intersegment transactions and corporate as-

sets not allocated to each reportable segment. The elimination

of intersegment transactions was ¥(19,296) million, ¥(11,217)

million and ¥(10,545) million ($(103,382) thousand), respec-

tively. Corporate assets not allocated to each reportable segment

were ¥576,124 million, ¥474,389 million and ¥626,542 million

($6,142,569 thousand), as of March 31, 2012, 2013 and 2014,

respectively. Corporate assets not allocated to each reportable

segment were mainly attributable to cash and cash equivalents,

the Company’s investments in securities, and depreciable assets

related to the Company’s R&D groups as well as the administra-

tive, sales and distribution groups of the Company’s headquarters.

Adjustments of investments in nonconsolidated subsidiar-

ies and affiliates accounted for using the equity method were

¥22,807 million ¥25,245 million and ¥28,310 million ($277,549

thousand), as of March 31, 2012, 2013 and 2014, respectively,

and mainly comprised investments in Sharp Finance Corporation.

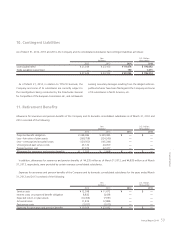

Adjustments of increase in plant, equipment and intangible

assets were ¥13,493 million, ¥8,142 million and ¥6,308 million

($61,843 thousand) for the years ended March 31, 2012, 2013

and 2014, respectively, and mainly comprised increase in the

Company’s R&D groups and the administrative, sales and distri-

bution groups of the Company’s headquarters.

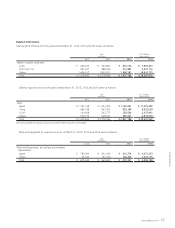

Depreciation and amortization includes the amortization of

long-term prepaid expenses.

Increase in plant, equipment and intangible assets includes

the increase in long-term prepaid expenses.