Seagate 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

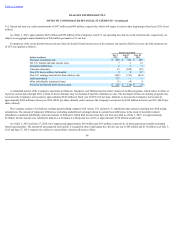

fairvaluesofallofitscashequivalentsandshort-terminvestments.Forthecashequivalentsandshort-terminvestmentsintheCompany'sportfolio,multiple

pricingsourcesaregenerallyavailable.Thepricingserviceusesinputsfrommultipleindustrystandarddataprovidersorotherthirdpartysourcesandvarious

methodologies,suchasweightingandmodels,todeterminetheappropriatepriceatthemeasurementdate.TheCompanycorroboratesthepricesobtainedfromthe

pricingserviceagainstotherindependentsourcesand,asofJuly3,2015,hasnotfounditnecessarytomakeanyadjustmentstothepricesobtained.TheCompany's

derivativefinancialinstrumentsarealsoclassifiedwithinLevel2.TheCompany'sderivativefinancialinstrumentsconsistofforeigncurrencyforwardexchange

contractsandtheTRS.TheCompanyrecognizesderivativefinancialinstrumentsinitsconsolidatedfinancialstatementsatfairvalue.TheCompanydeterminesthe

fairvalueoftheseinstrumentsbyconsideringtheestimatedamountitwouldpayorreceivetoterminatetheseagreementsatthereportingdate.

AsofJuly3,2015andJune27,2014,wehadnoLevel3assets.

ItemsMeasuredatFairValueonaNon-RecurringBasis

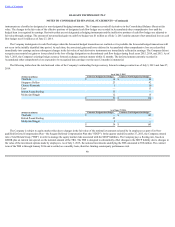

TheCompanyentersintocertainstrategicinvestmentsforthepromotionofbusinessandstrategicobjectives.Strategicinvestmentsinequitysecuritieswhere

theCompanydoesnothavetheabilitytoexercisesignificantinfluenceovertheinvestees,includedinOtherassets,netintheConsolidatedBalanceSheets,are

recordedatcostandareperiodicallyanalyzedtodeterminewhetherornotthereareindicatorsofimpairment.ThecarryingvalueoftheCompany'sstrategic

investmentsatJuly3,2015andJune27,2014totaled$120millionand$46million,respectively,andconsistedprimarilyofprivatelyheldequitysecuritieswithout

areadilydeterminablefairvalue.

Duringthefiscalyears2015,2014and2013,theCompanydeterminedthatcertainofitsequityinvestmentsaccountedforunderthecostmethodwereother-

than-temporarilyimpaired,andrecognizedchargesof$7million,$2millionand$5million,respectively,inordertowritedownthecarryingamountofthe

investmentstoitsestimatedfairvalue.TheseamountswererecordedinOther,netintheConsolidatedStatementsofOperations.Sincetherewasnoactivemarket

fortheequitysecuritiesoftheinvestee,theCompanyestimatedfairvalueoftheinvesteebyanalyzingtheunderlyingcashflowsandfutureprospectsofthe

investee.

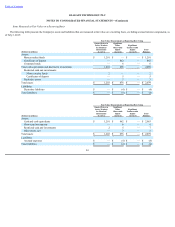

OtherFairValueDisclosures

TheCompany'sdebtiscarriedatamortizedcost.ThefairvalueoftheCompany'sdebtisderivedusingtheclosingpriceofthesamedebtinstrumentsasofthe

dateofvaluation,whichtakesintoaccounttheyieldcurve,interestrates,andotherobservableinputs.Accordingly,thesefairvaluemeasurementsare

96