Seagate 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

ITEM7A.QUANTITATIVEANDQUALITATIVEDISCLOSURESABOUTMARKETRISK

Wehaveexposuretomarketrisksduetothevolatilityofinterestrates,foreigncurrencyexchangerates,equityandbondmarkets.Aportionoftheserisksare

hedged,butfluctuationscouldimpactourresultsofoperations,financialpositionandcashflows.Additionally,wehaveexposuretodowngradesinthecredit

ratingsofourcounterpartiesaswellasexposurerelatedtoourcreditratingchanges.

InterestRateRisk.Ourexposuretomarketriskforchangesininterestratesrelatesprimarilytoourinvestmentportfolio.AsofJuly3,2015,theCompany

hadnomaterialavailable-for-salesecuritiesthathadbeeninacontinuousunrealizedlosspositionforaperiodgreaterthan12months.TheCompanydeterminedno

materialavailable-for-salesecuritieswereother-than-temporarilyimpairedasofJuly3,2015.Wecurrentlydonotusederivativefinancialinstrumentsinour

investmentportfolio.

Wehavefixedratedebtobligations.Weenterintodebtobligationsforgeneralcorporatepurposesincludingcapitalexpendituresandworkingcapitalneeds.

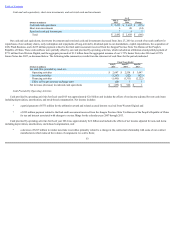

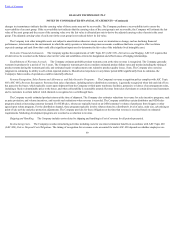

Thetablebelowpresentsprincipalamountsandrelatedweightedaverageinterestratesbyyearofmaturityforourinvestmentportfolioanddebtobligationsas

ofJuly3,2015.

FiscalYearsEnded

ForeignCurrencyExchangeRisk.Wemayenterintoforeigncurrencyforwardexchangecontractstomanageexposurerelatedtocertainforeigncurrency

commitmentsandanticipatedforeigncurrencydenominatedexpenditures.Ourpolicyprohibitsusfromenteringintoderivativefinancialinstrumentsfor

speculativeortradingpurposes.

Wealsohedgeaportionofourforeigncurrencydenominatedbalancesheetpositionswithforeigncurrencyforwardexchangecontractstoreducetheriskthat

ourearningswillbeadverselyaffectedbychangesincurrencyexchangerates.Thechangesinfairvalueofthesehedgesarerecognizedinearningsinthesame

periodasthegainsandlossesfromtheremeasurementoftheassetsandliabilities.Theseforeigncurrencyforwardexchangecontractsarenotdesignatedas

hedginginstrumentsunderASC815,DerivativesandHedging.Alltheseforeigncurrencyforwardcontractsmaturewithin12months.

WeevaluatehedgingeffectivenessprospectivelyandretrospectivelyandrecordanyineffectiveportionofthehedginginstrumentsinCostofrevenueonthe

ConsolidatedStatementsofOperations.Wedidnothaveanymaterialnetgains(losses)recognizedinCostofrevenueforcashflowhedgesduetohedge

ineffectivenessordiscontinuedcashflowhedgesduringthefiscalyears2015and2014.

60

(Dollarsinmillions,exceptpercentages) 2016 2017 2018 2019 2020 Thereafter Total

FairValue

at

July3,2015

Assets

Cashequivalents:

Fixedrate $ 2,063 $ — $ — $ — $ — $ — $ 2,063 $ 2,063

Averageinterestrate 0.17% 0.17%

Short-terminvestments:

Fixedrate $ — $ — $ 5 $ — $ — $ 1 $ 6 $ 6

Averageinterestrate 9.30% 4.30% 8.47%

Totalfixedincome $ 2,063 $ — $ 5 $ — $ — $ 1 $ 2,069 $ 2,069

Averageinterestrate 0.17% 9.30% 4.30% 0.19%

Debt

Fixedrate $ — $ — $ — $ 800 $ — $ 3,358 $ 4,158 $ 4,175

Averageinterestrate 3.75% 5.03% 4.78%