Seagate 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

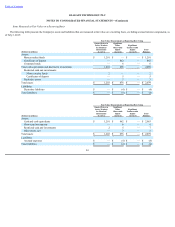

9.FairValue

MeasurementofFairValue

Fairvalueisdefinedasthepricethatwouldbereceivedfromsellinganassetorpaidtotransferaliabilityinanorderlytransactionbetweenmarket

participantsatthemeasurementdate.Whendeterminingthefairvaluemeasurementsforassetsandliabilitiesrequiredtoberecordedatfairvalue,theCompany

considerstheprincipalormostadvantageousmarketinwhichitwouldtransactanditconsidersassumptionsthatmarketparticipantswouldusewhenpricingthe

assetorliability.

FairValueHierarchy

Afairvaluehierarchyisbasedonwhetherthemarketparticipantassumptionsusedindeterminingfairvalueareobtainedfromindependentsources

(observableinputs)orreflectstheCompany'sownassumptionsofmarketparticipantvaluation(unobservableinputs).Afinancialinstrument'scategorizationwithin

thefairvaluehierarchyisbaseduponthelowestlevelofinputthatissignificanttothefairvaluemeasurement.Thethreelevelsofinputsthatmaybeusedto

measurefairvalue:

Level1—Quotedpricesinactivemarketsthatareunadjustedandaccessibleatthemeasurementdateforidentical,unrestrictedassetsorliabilities;

Level2—Quotedpricesforidenticalassetsandliabilitiesinmarketsthatareinactive;quotedpricesforsimilarassetsandliabilitiesinactivemarketsor

financialinstrumentsforwhichsignificantinputsareobservable,eitherdirectlyorindirectly;or

Level3—Pricesorvaluationsthatrequireinputsthatarebothunobservableandsignificanttothefairvaluemeasurement.

TheCompanyconsidersanactivemarkettobeoneinwhichtransactionsfortheassetorliabilityoccurwithsufficientfrequencyandvolumetoprovide

pricinginformationonanongoingbasis,andviewsaninactivemarketasoneinwhichtherearefewtransactionsfortheassetorliability,thepricesarenotcurrent,

orpricequotationsvarysubstantiallyeitherovertimeoramongmarketmakers.WhereappropriatetheCompany'sorthecounterparty'snon-performanceriskis

consideredindeterminingthefairvaluesofliabilitiesandassets,respectively.

93