Seagate 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

requiredtorenderserviceuntiltheyareterminatedinordertoreceivetheterminationbenefits.Ifemployeesarerequiredtorenderserviceuntiltheyareterminated

inordertoreceivetheterminationbenefits,aliabilityisrecognizedratablyoverthefutureserviceperiod.Otherwise,aliabilityisrecognizedwhenmanagement

hascommittedtoarestructuringplanandhascommunicatedthoseactionstoemployees.Employeeterminationbenefitscoveredbyexistingbenefitarrangements

arerecordedinaccordancewithASCTopic712,Non-retirementPostemploymentBenefits.Thesecostsarerecognizedwhenmanagementhascommittedtoa

restructuringplanandtheseverancecostsareprobableandestimable.

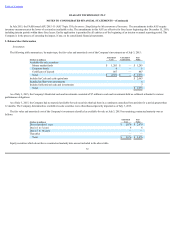

AdvertisingExpense.Thecostofadvertisingisexpensedasincurred.Advertisingcostswereapproximately$64million,$52millionand$51millionin

fiscalyears2015,2014and2013,respectively.

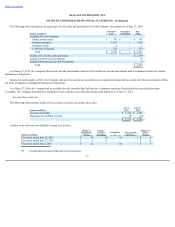

Stock-BasedCompensation.TheCompanyaccountsforstock-basedcompensationundertheprovisionsofASCTopic718(ASC718),Compensation-Stock

Compensation.TheCompanyhaselectedtoapplythewith-and-withoutmethodtoassesstherealizationofrelatedexcesstaxbenefits.

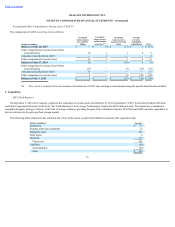

AccountingforIncomeTaxes.TheCompanyaccountsforincometaxespursuanttoASCTopic740(ASC740),IncomeTaxes.InapplyingASC740,the

Companymakescertainestimatesandjudgmentsindeterminingincometaxexpenseforfinancialstatementpurposes.Theseestimatesandjudgmentsoccurinthe

calculationoftaxcredits,recognitionofincomeanddeductionsandcalculationofspecifictaxassetsandliabilities,whicharisefromdifferencesinthetimingof

recognitionofrevenueandexpenseforincometaxandfinancialstatementpurposes,aswellastaxliabilitiesassociatedwithuncertaintaxpositions.The

calculationoftaxliabilitiesinvolvesuncertaintiesintheapplicationofcomplextaxrulesandthepotentialforfutureadjustmentoftheCompany'suncertaintax

positionsbytheInternalRevenueServiceorothertaxjurisdictions.Ifestimatesofthesetaxliabilitiesaregreaterorlessthanactualresults,anadditionaltax

benefitorprovisionwillresult.ThedeferredtaxassetstheCompanyrecordseachperioddependprimarilyontheCompany'sabilitytogeneratefuturetaxable

incomeintheUnitedStatesandcertainnon-U.S.jurisdictions.Eachperiod,theCompanyevaluatestheneedforavaluationallowanceforitsdeferredtaxassets

and,ifnecessary,adjuststhevaluationallowancesothatnetdeferredtaxassetsarerecordedonlytotheextenttheCompanyconcludesitismorelikelythannot

thatthesedeferredtaxassetswillberealized.IftheCompany'soutlookforfuturetaxableincomechangessignificantly,theCompany'sassessmentoftheneedfor,

andtheamountof,avaluationallowancemayalsochange.

ComprehensiveIncome.TheCompanypresentscomprehensiveincomeinaseparatestatement.Comprehensiveincomeiscomprisedofnetincomeand

othergainsandlossesaffectingequitythatareexcludedfromnetincome.

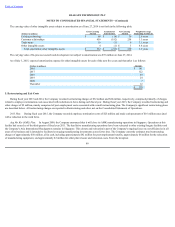

ForeignCurrencyRemeasurementandTranslation.TheU.S.dollaristhefunctionalcurrencyforthemajorityoftheCompany'sforeignoperations.

Monetaryassetsandliabilitiesdenominatedinforeigncurrenciesareremeasuredintothefunctionalcurrencyofthesubsidiaryatthebalancesheetdate.Thegains

andlossesfromtheremeasurementofforeigncurrencydenominatedbalancesintothefunctionalcurrencyofthesubsidiaryareincludedinOther,netonthe

Company'sConsolidatedStatementsofOperations.

TheCompanytranslatestheassetsandliabilitiesofitsnon-U.S.dollarfunctionalcurrencysubsidiariesintoU.S.dollarsusingexchangeratesineffectatthe

endofeachperiod.Revenueandexpensesforthesesubsidiariesaretranslatedusingratesthatapproximatethoseineffectduringtheperiod.Gainsandlossesfrom

thesetranslationsarerecognizedinforeigncurrencytranslationincludedinAccumulatedOthercomprehensiveincome(loss),whichisacomponentof

shareholders'equity.TheCompany'ssubsidiariesthatusetheU.S.dollarastheirfunctionalcurrencyremeasuremonetaryassetsandliabilitiesatexchangeratesin

effectattheendofeachperiod,andinventories,property,andnonmonetary

70