Seagate 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

•$0.7billionfortherepurchaseandredemptionoflongtermdebt;

•$0.6billionindividendspaidtoourshareholders;partiallyoffsetby

•proceedsof$1.8billionfromaggregatecashgeneratedfromtheissuanceofour3.75%SeniorNotesduein2018and4.75%SeniorNotesduein

2025.

Netcashusedinfinancingactivitiesof$2.2billionforfiscalyear2013wasattributabletothefollowingactivities:

•$1.7billionpaidtorepurchase54millionofourordinaryshares;

•$1.2billionfortherepurchaseandredemptionoflongtermdebt;

•$0.5billionindividendspaidtoourshareholders;partiallyoffsetby

•proceedsfromtheissuanceof$1billionofour4.75%notesdue2023;and

•proceedsof$0.3billionfromtheissuanceofordinarysharesunderemployeestockplans.

LiquiditySources

OurprimarysourcesofliquidityasofJuly3,2015,consistedof:(1)approximately$2.5billionincashandcashequivalents,andshort-terminvestments,

(2)cashweexpecttogeneratefromoperationsand(3)a$700millionseniorrevolvingcreditfacility.

AsofJuly3,2015,noborrowingshavebeendrawnundertherevolvingcreditfacilityorhadbeenutilizedforlettersofcreditissuedunderthiscreditfacility.

Thelineofcreditisavailableforborrowings,subjecttocompliancewithfinancialcovenantsandothercustomaryconditionstoborrowing.

Thecreditagreementthatgovernsourrevolvingcreditfacility,asamended,containscertaincovenantsthatwemustsatisfyinordertoremainincompliance

withthecreditagreement,asamended.Theagreementincludesthreefinancialcovenants:(1)minimumcash,cashequivalentsandmarketablesecurities;(2)a

fixedchargecoverageratio;and(3)anetleverageratio.AsofJuly3,2015,wewereincompliancewithallofthecovenantsunderourRevolvingCreditFacility

anddebtagreements.

AsofJuly3,2015,cashandcashequivalentsheldbynon-Irishsubsidiarieswas$2.5billion.ThisamountispotentiallysubjecttotaxationinIrelandupon

repatriationbymeansofadividendintoourIrishparent.However,itisourintenttoindefinitelyreinvestearningsofnon-IrishsubsidiariesoutsideofIrelandand

ourcurrentplansdonotdemonstrateaneedtorepatriatesuchearningsbymeansofataxableIrishdividend.ShouldfundsbeneededintheIrishparentcompany

andshouldwebeunabletofundparentcompanyactivitiesthroughmeansotherthanataxableIrishdividend,wewouldberequiredtoaccrueandpayIrishtaxes

onsuchdividend.

Webelievethatoursourcesofcashwillbesufficienttofundouroperationsandmeetourcashrequirementsforatleastthenext12months.

CashRequirementsandCommitments

Ourliquidityrequirementsareprimarilytomeetourworkingcapital,researchanddevelopmentandcapitalexpenditureneeds,tofundscheduledpaymentsof

principalandinterestonourindebtedness,andtofundourdividend.Ourabilitytofundtheserequirementswilldependonourfuturecashflows,whichare

determinedbyfutureoperatingperformance,andtherefore,subjecttoprevailingglobalmacroeconomicconditionsandfinancial,businessandotherfactors,some

ofwhicharebeyondourcontrol.

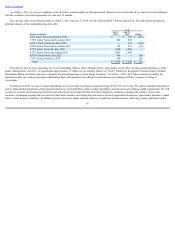

OnJuly21,2015,ourBoardofDirectorsapprovedaquarterlycashdividendof$0.54pershare,whichwillbepayableonAugust25,2015toshareholdersof

recordasofthecloseofbusinessonAugust11,2015.

55