Seagate 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

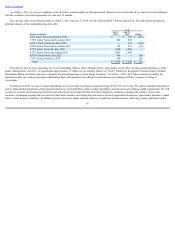

AsofJuly3,2015,wewereincompliancewithallofthecovenantsunderourdebtagreements.Basedonourcurrentoutlook,weexpecttobeincompliance

withthecovenantsofourdebtagreementsoverthenext12months.

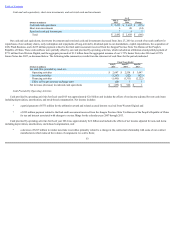

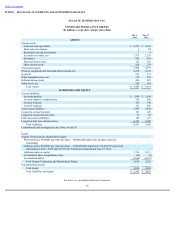

Thecarryingvalueofourlong-termdebtasofJuly3,2015andJune27,2014was$4.2billionand$3.9billion,respectively.Thetablebelowpresentsthe

principalamountsofouroutstandinglong-termdebt:

Fromtimetotimewemayrepurchaseanyofouroutstandingordinarysharesthroughprivate,openmarket,tenderoffers,brokerassistedpurchasesorother

means.Duringfiscalyear2015,werepurchasedapproximately19millionofourordinaryshares.See"Item5.MarketforRegistrant'sCommonEquity,Related

StockholderMattersandIssuerPurchasesofEquitySecurities-RepurchasesofOurEquitySecurities."AsofJuly3,2015,$2.9billionremainedavailablefor

repurchaseunderourexistingrepurchaseauthorizationlimit.AllrepurchasesareeffectedasredemptionsinaccordancewiththeCompany'sArticlesof

Association.

Forfiscalyear2016,weexpectcapitalexpenditurestobeatorbelowourlong-termtargetedrangeof6%to8%ofrevenue.Werequiresubstantialamountsof

cashtofundscheduledpaymentsofprincipalandinterestonourindebtedness,futurecapitalexpendituresandanyincreasedworkingcapitalrequirements.Wewill

continuetoevaluateandmanagetheretirementandreplacementofexistingdebtandassociatedobligations,includingevaluatingtheissuanceofnewdebt

securities,exchangingexistingdebtsecuritiesforotherdebtsecuritiesandretiringdebtpursuanttoprivatelynegotiatedtransactions,openmarketpurchases,tender

offersorothermeansorotherwise.Inaddition,wemayselectivelypursuestrategicalliances,acquisitionsandinvestments,whichmayrequireadditionalcapital.

56

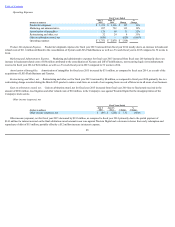

Asof

(Dollarsinmillions)

July3,

2015

June27,

2014 Change

6.8%SeniorNotesdueOctober2016 $ — $ 335 $ (335)

3.75%SeniorNotesdueNovember2018 800 800 —

6.875%SeniorNotesdueMay2020 — 534 (534)

7.00%SeniorNotesdueNovember2021 158 251 (93)

4.75%SeniorNotesdueJune2023 1,000 1,000 —

4.75%SeniorNotesdueJanuary2025 1,000 1,000 —

4.875%SeniorNotesDue2027 700 — 700

5.75%SeniorNotesDue2034 500 — 500

Total $ 4,158 $ 3,920 $ 238