Seagate 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

SummaryofSignificantAccountingPolicies

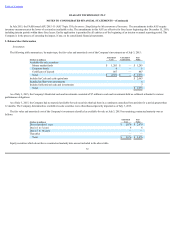

Cash,CashEquivalentsandShort-TermInvestments.TheCompanyconsidersallhighlyliquidinvestmentswitharemainingmaturityof90daysorlessat

thetimeofpurchasetobecashequivalents.Cashequivalentsarecarriedatcost,whichapproximatesfairvalue.TheCompany'sshort-terminvestmentsare

primarilycomprisedofmoneymarketfunds,certificatesofdeposits,andotherinterest-bearingbankdeposits.TheCompanyhasclassifieditsmarketablesecurities

asavailable-for-saleandtheyarestatedatfairvaluewithunrealizedgainsandlossesincludedinAccumulatedothercomprehensiveincome(loss),whichisa

componentofShareholders'Equity.TheCompanyevaluatestheavailable-forsalesecuritiesinanunrealizedlosspositionforother-than-temporaryimpairment.

RealizedgainsandlossesareincludedinOther,net.Thecostofsecuritiessoldisbasedonthespecificidentificationmethod.

RestrictedCashandInvestments.Restrictedcashandinvestmentsrepresentcashandcashequivalentsandinvestmentsthatarerestrictedastowithdrawal

oruseforotherthancurrentoperations.

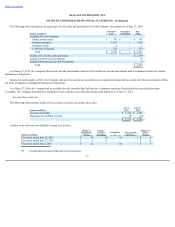

AllowancesforDoubtfulAccounts.TheCompanymaintainsanallowanceforuncollectibleaccountsreceivablebaseduponexpectedcollectability.This

reserveisestablishedbaseduponhistoricaltrends,globalmacroeconomicconditionsandananalysisofspecificexposures.Theprovisionfordoubtfulaccountsis

recordedasachargetoMarketingandadministrativeexpense.

Inventory.Inventoriesarevaluedatthelowerofcost(usingthefirst-in,first-outmethod)ormarket.Marketvalueisbaseduponanestimatedaverage

sellingpricereducedbyestimatedcostofcompletionanddisposal.

Property,EquipmentandLeaseholdImprovements.Property,equipmentandleaseholdimprovementsarestatedatcost.Equipmentandbuildingsare

depreciatedusingthestraight-linemethodovertheestimatedusefullivesoftheassets.Leaseholdimprovementsareamortizedusingthestraight-linemethodover

theshorteroftheestimatedlifeoftheassetortheremainingtermofthelease.Thecostsofadditionsandsubstantialimprovementstoproperty,equipmentand

leaseholdimprovements,whichextendtheeconomiclifeoftheunderlyingassets,arecapitalized.Thecostofmaintenanceandrepairstoproperty,equipmentand

leaseholdimprovementsareexpensedasincurred.

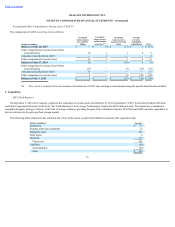

AssessmentofGoodwillandOtherLong-livedAssetsforImpairment.TheCompanyaccountsforgoodwillinaccordancewithAccountingStandards

Codification(ASC)Topic350(ASC350),Intangibles—GoodwillandOther.Duringfiscalyear2012,theCompanyadoptedASUNo.2011-08,Intangibles—

GoodwillandOther(ASCTopic350)—TestingGoodwillforImpairment.TheCompanyperformsaqualitativeassessmentinthefourthquarterofeachyear,or

morefrequentlyifindicatorsofpotentialimpairmentexist,todetermineifanyeventsorcircumstancesexist,suchasanadversechangeinbusinessclimateora

declineintheoverallindustrythatwouldindicatethatitwouldmorelikelythannotreducethefairvalueofareportingunitbelowitscarryingamount,including

goodwill.Ifitisdeterminedinthequalitativeassessmentthatthefairvalueofareportingunitismorelikelythannotbelowitscarryingamount,including

goodwill,thentheCompanyperformsaquantitativetwo-stepimpairmenttest.Thefirststep,identifyingapotentialimpairment,comparesthefairvalueofa

reportingunitwithitscarryingamount,includinggoodwill.Ifthecarryingvalueofthereportingunitexceedsitsfairvalue,thesecondstepwouldneedtobe

conducted.Thesecondstep,measuringtheimpairmentloss,comparestheimpliedfairvalueofthereportingunitgoodwillwiththecarryingamountofthat

goodwill.Anyexcessofthereportingunitgoodwillcarryingvalueoveritsimpliedfairvalueisrecognizedasanimpairmentloss.

TheCompanytestsotherlong-livedassets,includingproperty,equipmentandleaseholdimprovementsandotherintangibleassetssubjecttoamortization,for

recoverabilitywhenevereventsor

68