Seagate 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

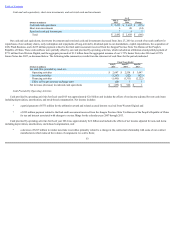

•adecreaseof$190millioninaccountspayableduetoachangeinthecontractualrelationshipwithsomeofourcontractmanufacturerswhich

resultedinareductionindirectmaterialspurchasedandsubsequentlysoldtoourcontractmanufacturers;and

•adecreaseof$104millioninrestrictedcashandinvestmentsprimarilyduetotherestrictedcashandinvestmentsheldinarabbitrustbeingreplaced

withastandbyletterofcredit.

Cashprovidedbyoperatingactivitiesforfiscalyear2013wasapproximately$3.0billionandincludestheeffectsofnetincomeadjustedfornon-cashitems

includingdepreciation,amortization,stock-basedcompensation,and:

•adecreaseof$661millioninaccountsreceivable,net,primarilyduetoadecreaseinrevenueinthefourthquarteroffiscalyear2013comparedto

theprioryearperiod;

•adecreaseof$538millioninaccountspayable,primarilyduetoareductionindirectmaterialspurchasesduetoadecreaseinbuildvolumeinthe

fourthquarteroffiscalyear2013comparedtotheprioryearperiod;

•adecreaseof$272millioninvendornon-tradereceivablesprimarilyduetoadecreaseinbuildvolumesinthefourthquarteroffiscalyear2013

comparedtotheprioryearperiod;

•adecreaseof$170millioninaccruedexpenses,incometaxesandwarranty,primarilyduetodecreasesincostsrelatedtosalesactivitiesresulting

fromlowersalesvolumes;and

•adecreaseof$102millionininventory,duetolowervolumesinthefourthquarteroffiscalyear2013comparedtotheprioryearperiod.

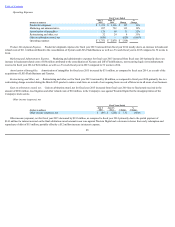

CashUsedinInvestingActivities

Infiscalyear2015,weused$1.3billionfornetcashinvestingactivities,whichwasprimarilyduetopaymentsforproperty,equipmentandleasehold

improvementsofapproximately$747millionandtheacquisitionofLSI'sFlashBusiness,for$450million.

Infiscalyear2014,weused$0.3billionfornetcashinvestingactivities,whichwasprimarilyduetopaymentsforproperty,equipmentandleasehold

improvementsofapproximately$559millionandtheacquisitionofXyratex,for$285million,partiallyoffsetby$508millionofproceedsfromsalesofshort-term

investments.

Infiscalyear2013,weused$0.8billionfornetcashinvestingactivities,whichwasprimarilyduetopaymentsforproperty,equipmentandleasehold

improvements.

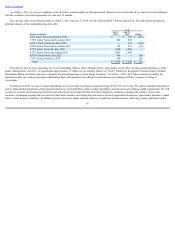

CashUsedinFinancingActivities

Netcashusedinfinancingactivitiesof$1.5billionforfiscalyear2015wasprimarilyattributabletothefollowingactivities:

•$1.1billionpaidtorepurchase19millionofourordinaryshares;

•$1.0billionfortherepurchaseandredemptionoflongtermdebt;

•$0.7billionindividendspaidtoourshareholders;partiallyoffsetby

•proceedsof$1.2billionfromaggregatecashgeneratedfromtheissuanceofour5.75%SeniorNotesdue2034and4.875%SeniorNotesdue2027.

Netcashusedinfinancingactivitiesof$1.3billionforfiscalyear2014wasprimarilyattributabletothefollowingactivities:

•$1.9billionpaidtorepurchase41millionofourordinaryshares;

54