Seagate 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

IncomeTaxes

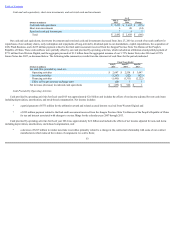

Werecordedanincometaxprovisionof$228millionforfiscalyear2015comparedtoanincometaxbenefitof$14millionforfiscalyear2014.Ourfiscal

year2015incometaxprovisionincludedapproximately$193millionofnetincometaxexpenseduetothefinalauditassessmentreceivedfromtheJiangsu

ProvinceStateTaxBureauofthePeople'sRepublicofChina(Chinaassessment)forcalendaryears2007through2013.Ourfiscalyear2014benefitfromincome

taxesincluded$58millionofincometaxbenefitsrelatedtothereversalofaportionofthevaluationallowancesrecordedinpriorperiodsandanetdecreaseintax

reservesrelatedtoauditsettlementsoffsetbytaxreservesonnon-U.S.taxpositionstakeninpriorfiscalyears.

OurIrishtaxresidentparentholdingcompanyownsvariousU.S.andnon-U.S.subsidiariesthatoperateinmultiplenon-Irishincometaxjurisdictions.Our

worldwideoperatingincomeiseithersubjecttovaryingratesofincometaxorisexemptfromincometaxduetotaxholidayprogramsweoperateunderin

Malaysia,SingaporeandThailand.Thesetaxholidaysarescheduledtoexpireinwholeorinpartatvariousdatesthrough2022.

Ourincometaxprovisionrecordedforfiscalyear2015differedfromtheprovisionforincometaxesthatwouldbederivedbyapplyingtheIrishstatutoryrate

of25%toincomebeforeincometaxes,primarilyduetotheneteffectof(i)taxbenefitsrelatedtonon-U.S.earningsgeneratedinjurisdictionsthataresubjecttotax

holidaysortaxincentiveprogramsandareconsideredindefinitelyreinvestedoutsideofIreland,(ii)taxexpenseassociatedwiththeChinaassessmentrecorded

duringtheDecember2014quarter,and(iii)anincreaseinvaluationallowanceforcertaindeferredtaxassets.TheacquisitionofLSI'sFlashBusinessdidnothave

amaterialimpactonoureffectivetaxrate.Ourincometaxbenefitrecordedforfiscalyear2014differedfromtheprovisionforincometaxesthatwouldbederived

byapplyingtheIrishstatutoryrateof25%toincomebeforeincometaxes,primarilyduetotheneteffectof(i)taxbenefitsrelatedtonon-U.S.earningsgenerated

injurisdictionsthataresubjecttotaxholidaysortaxincentiveprogramsandareconsideredindefinitelyreinvestedoutsideofIreland,and(ii)adecreasein

valuationallowanceforcertaindeferredtaxassets.TheacquisitionofXyratexdidnothaveamaterialimpactonoureffectivetaxrateinfiscalyear2014.Fiscal

year2014includedavaluationallowancereleaseassociatedwithpost-acquisitionrestructuring.

Basedonournon-U.S.ownershipstructureandsubjectto(i)potentialfutureincreasesinourvaluationallowancefordeferredtaxassets;and(ii)afuture

changeinourintentiontoindefinitelyreinvestearningsfromoursubsidiariesoutsideofIreland,weanticipatethatoureffectivetaxrateinfutureperiodswill

generallybelessthantheIrishstatutoryrate.

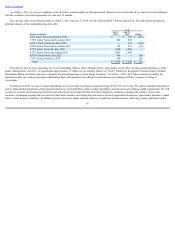

AtJuly3,2015,ourdeferredtaxassetvaluationallowancewasapproximately$929million.

AtJuly3,2015,wehadnetdeferredtaxassetsof$612million.Therealizationofthesedeferredtaxassetsisprimarilydependentonourabilitytogenerate

sufficientU.S.taxableincomeinfutureperiods.Althoughrealizationisnotassured,webelievethatitismorelikelythannotthatthesedeferredtaxassetswillbe

realized.Theamountofdeferredtaxassetsconsideredrealizable,however,mayincreaseordecreaseinsubsequentperiodswhenwere-evaluatetheunderlying

basisforourestimatesoffutureU.S.andcertainnon-U.S.taxableincome.

AsofJuly3,2015,approximately$422millionand$90millionofourtotalU.S.netoperatinglossandtaxcreditcarryforwards,respectively,aresubjectto

anaggregateannuallimitationof$46millionpursuanttoU.S.taxlaw.

49

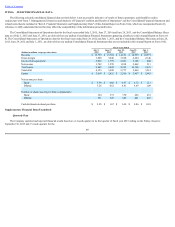

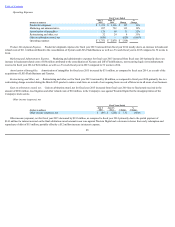

FiscalYearsEnded

(Dollarsinmillions)

July3,

2015

June27,

2014 Change

%

Change

Provisionfor(benefitfrom)incometaxes $ 228 $ (14) $ 242 1,729%