Seagate 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

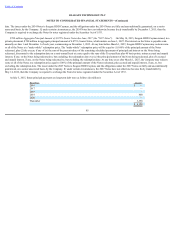

U.S.federalandstatetaxcreditcarryforwardsof$387millionand$89million,respectively,whichwillexpireatvariousdatesbeginninginfiscalyear2016,ifnot

utilized.

AsofJuly3,2015,approximately$422millionand$90millionoftheCompany'stotalU.S.netoperatinglossandtaxcreditcarryforwards,respectively,are

subjecttoanaggregateannuallimitationof$46millionpursuanttoU.S.taxlaw.

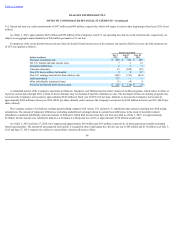

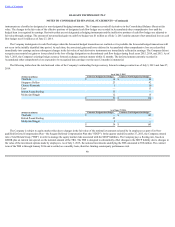

Forpurposesofthereconciliationbetweentheprovisionfor(benefitfrom)incometaxesatthestatutoryrateandtheeffectivetaxrate,theIrishstatutoryrate

of25%wasappliedasfollows:

AsubstantialportionoftheCompany'soperationsinMalaysia,Singapore,andThailandoperateundervarioustaxholidayprograms,whichexpireinwholeor

inpartatvariousdatesthrough2022.Certainofthetaxholidaysmaybeextendedifspecificconditionsaremet.Thenetimpactofthesetaxholidayprogramswas

toincreasetheCompany'snetincomebyapproximately$349millioninfiscalyear2015($1.05pershare,diluted),toincreasetheCompany'snetincomeby

approximately$289millioninfiscalyear2014($0.83pershare,diluted),andtoincreasetheCompany'snetincomeby$338millioninfiscalyear2013($0.89per

share,diluted).

TheCompanyconsistsofanIrishtaxresidentparentholdingcompanywithvariousU.S.andnon-U.S.subsidiariesthatoperateinmultiplenon-Irishtaxing

jurisdictions.Theamountoftemporarydifferences(includingundistributedearnings)relatedtooutsidebasisdifferencesinthestockofnon-Irishresident

subsidiariesconsideredindefinitelyreinvestedoutsideofIrelandforwhichIrishincometaxeshavenotbeenprovidedasofJuly3,2015,wasapproximately

$3billion.IfsuchamountwereremittedtoIrelandasadividend,itislikelythattaxat25%orapproximately$750millionwouldresult.

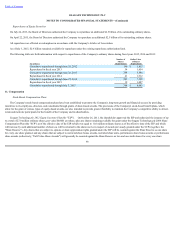

AsofJuly3,2015andJune27,2014,theCompanyhadapproximately$83millionand$115million,respectively,ofunrecognizedtaxbenefitsexcluding

interestandpenalties.Theamountofunrecognizedtaxbenefits,ifrecognized,thatwouldimpacttheeffectivetaxrateis$83millionand$115millionasofJuly3,

2015andJune27,2014,respectively,subjecttocertainfuturevaluationallowanceoffsets.

88

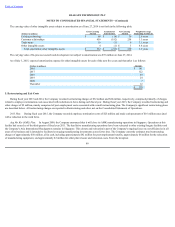

FiscalYearsEnded

(Dollarsinmillions)

July3,

2015

June27,

2014

June28,

2013

Provisionatstatutoryrate $ 493 $ 389 $ 458

NetU.S.federalandstateincometaxes 7 3 12

Permanentdifferences 2 3 3

Valuationallowance 15 (100) (97)

Non-U.S.losseswithnotaxbenefits 2 8 27

Non-U.S.earningstaxedatlessthanstatutoryrate (463) (313) (414)

Auditassessment 173 — —

Otherindividuallyimmaterialitems (1) (4) 4

Provisionfor(benefitfrom)incometaxes $ 228 $ (14) $ (7)